- Rhoda Report

- Posts

- “Ask For That Raise!"

“Ask For That Raise!"

Issue #158

Hi There! I thought staying silent made me humble. It was actually making me underpaid.

For years, I accepted whatever raise landed in my inbox. Zero percent here, one percent there, maybe three percent if I was lucky. I convinced myself it was fine. Be grateful, I thought. At least I have a job. At least I’m getting something.

Well, my gratitude was costing me thousands.

From the start of my engineering career, I knew I was underpaid. I saw it in the numbers. I came up with every excuse to justify staying quiet. I told myself I was too new, that I needed more experience, that I didn’t want to seem pushy or ungrateful. I convinced myself my hard work would speak for itself and that my superiors would “see” my value.

Ha!!!

It took years, and the biggest project of my career, for me to realize that silence doesn’t build wealth. It keeps you stuck, especially when it comes to your self-worth.

It was one of those high-stakes, multi-million-dollar contracts that could define a company’s reputation for years. With that in mind, I worked tirelessly to implement long-lasting systems and squeeze every morsel of potential out of the great team I managed, all so that we could exceed client expectations and deliver cost-effective solutions.

When I finally got that email with my raise letter attached, I expected to see that effort reflected in my raise. Instead, it was the same story, a small bump, just enough to cover the increase in insurance premiums. I took a deep breath and hit reply: “Thank you. I do have a few questions. Could we schedule a meeting to discuss?”

That was my breaking point.

I turned to my black faux-leather notebook, my trusted companion, and started writing. Over the years I recorded every win, every cost I saved the company, revenue I brought in, people I mentored, processes I improved, and profits I exceeded. I wrote them all down. I called it my “brag book,” but really, it was receipts.

I researched salary ranges for my role across multiple platforms like Salary.com, Glassdoor, Payscale, etc., and compared them to what I was earning. I called people in my network who hired for similar positions and asked what someone with my experience and education should be making. I even created a list of the “push backs” I expected to hear and wrote counterarguments for each one. By the time I was done, I had a complete negotiation strategy.

The following week, I sat in that meeting prepared, calm, collected, and confident. I presented my case with zero emotion, just the facts. I tied my impact directly to the company’s goals/values.

The conversation increased my paycheck and changed how I saw myself.

Here are the lessons: most women don’t under-earn because they lack skill. They under-earn because they don’t ask. They convince themselves the timing isn’t right or they haven’t “earned” the right to speak up. However, courage compounds, just like interest.

If that’s you, it’s time to change the story, because closed mouths don’t get fed!

Alright, let’s dig in!

Last week, equities at home and abroad spent the week on the back foot. A hot earnings tape met growing fears that the AI trade has run too far, which knocked risk appetite and pulled major indexes lower last Friday. Mixed labour signals and a sharp drop in consumer confidence added weight. Bonds chopped and finished slightly down. The dollar slipped, oil fell, and gold held steady. By week’s end, the Nasdaq logged its worst week since the April tariff headlines. In single name news, Sweetgreen (SG) slid to a record low as younger diners pulled back and higher priced menu items missed the mark.

U.S. Markets Recap (November 2 - November 8, 2025)

Equities:

The S&P 500 broke a three week winning streak as narrow leadership and AI valuation angst took center stage. Palantir’s strong print late last Friday was not enough to quiet calls from corporate leaders for a pullback in AI spending. The narrative widened the debate on index concentration and overheated technicals. Midweek, Qualcomm sold off after offering a positive outlook, feeding the idea that beats are not being rewarded this season. Risk off tone accelerated into the close as labour signals clashed. ADP showed stabilization, Challenger reported the biggest October jump in layoffs in more than twenty years, and Michigan sentiment sank to a three year low.

Fixed Income:

Core bonds, as tracked by the Bloomberg Aggregate Index, finished lower. New global bond issuance set a full year record at $5.94T, led by financials and larger sovereign needs. Alphabet and Meta priced popular deals that were many times oversubscribed and only modestly above Treasury yields. Despite the flood of supply, the Treasury Index is up more than 6% year to date and the Corporate Index is up more than 7%, a sign that demand has kept pace. The IMF warned that global public debt could top 100% of GDP by 2029. With Treasury yields near the low end of the expected range and tight credit spreads, investors may not be fully paid for taking on extra corporate risk.

Commodities:

The complex ended as little changed after a rangebound chop. WTI crude fell as EIA reported a 5.2 million barrel inventory build and Saudi Arabia cut prices. Oversupply worries pushed crude back toward $60 per barrel even as OPEC plus paused planned output hikes for next quarter. Gold hovered near $4,000 per ounce, cushioned by safe haven bids tied to shutdown uncertainty and a weaker dollar late last week, while fading rate cut hopes capped upside.

Currencies:

The dollar lost ground last Friday after the Michigan sentiment surprise. Its stronger peers helped.

EUR/USD: +0.26%

GBP/USD: +0.05%

USD/JPY: -0.38%

U.S. Economic Recap (November 2 - November 8, 2025)

Shutdown impact deepened. The lapse that began October 1 has halted key data releases and impaired services. The CBO projects a fourth quarter growth hit and a temporary rebound once funding resumes, with a portion of lost output not recovered.

Private payrolls grew by 42,000 in October per ADP, consistent with a cooling labour market. Wage growth was flat. Job changers saw 6.7% gains, job stayers 4.5%.

Layoffs surged. Companies announced 153,074 cuts in October, the most for any October since 2003. Technology and logistics led reductions. Total announced cuts this year moved past 1 million.

Household stress rose. The New York Fed reported 4.5% of household debt at least 30 days delinquent in Q3. Student loan delinquencies hit 14.4%, a record. Total household debt reached $18.59T. Younger borrowers showed the sharpest deterioration, while mortgage delinquencies stayed low.

Confidence weakened. The University of Michigan’s preliminary November index dropped to 50.3, the second lowest since the 1950s. Concerns around the shutdown, job security, and prices weighed across groups.

Spending split widened. The top 10% now accounts for nearly half of consumer spending. The bottom 80% has slipped to 37 percent, with many trading down or delaying purchases.

Global Markets Recap (November 2 - November 8, 2025)

Europe

European stocks posted a second straight weekly decline as the AI pause spilled over. The Bank of England held rates after a close vote, which markets read as laying groundwork for a December cut. Earnings were mixed. Legrand cited softer data center demand, Commerzbank missed on profit due to taxes, and Novo Nordisk confirmed a Washington deal to lower GLP 1 costs.

Asia

Regional indexes mostly fell and logged the worst week since August. Korea cooled after an exchange warning on SK Hynix. Taiwan slipped and Japan led decliners on yen strength and disappointing early week earnings. Greater China outperformed as reports suggested state backed data centers will use domestic chips, lifting Hong Kong and the mainland.

Crypto Recap (November 2 - November 8, 2025)

Broad crypto trailed other risk assets. Bitcoin fell 5.7% week over week and dipped back below $100,000 during an 18% pullback from last month’s $126,251 high. Selling has been driven by spot supply from longer term holders and ETF outflows. The slide under the 365-day moving average near $102,000 is viewed as a bearish signal, with $85,000 flagged by some as a next risk level if $102,000 does not hold. Altcoins underperformed as total market value fell roughly 20% from early October.

Bitcoin closed near $102,600 after a $111,270 high and $99,002 low, last week. Six straight days of U.S. spot ETF outflows were briefly interrupted by a $240 million inflow on November 6 and then a $558.4 million outflow on November 7.

Ethereum fell 11.41% as ETF outflows, a Balancer V2 exploit, and DeFi deleveraging weighed. Stablecoin activity on Ethereum hit records in October, yet flows did not offset price pressure.

Last Week’s Top Gainers: AIA, ICP, FIL, DASH, ZEC.

Here are other key highlights from last week:

Bitcoin miner hashprice near lowest level since September 2024.

Privacy coins are back in the spotlight.

FTSE Russell partners with Chainlink to publish stock indexes on-chain.

Mastercard’s $2B move into crypto could end banking hours as we know them.

CoinGecko data shows the NFT market value has nearly halved in a month.

Institutional-grade quant firm joins forces with Polygon Labs.

This week is packed with high-impact events!!!

Key U.S. Economic Releases this week:

(Subject to delay due to government shutdown)

Tuesday - NFIB Small Business Index

Thursday - CPI, Unemployment Claims, Federal Budget Balance

Friday - PPI, Retail Sales

Fed Speakers:

Tuesday - Barr

Wednesday - Williams, Paulson, Waller, Bostic, Miran

Thursday - Musalem, Hammack

Friday - Bostic, Schmid, Logan

Earnings:

Notable Earnings Releases are shown in the chart below.

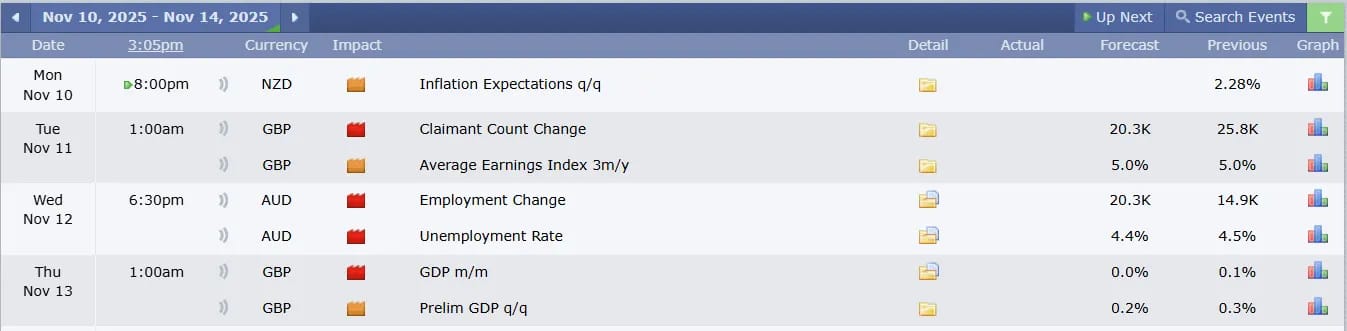

Medium-to-High Impact Global Economic Events This Week:

Tip: Follow the Money!

Keep an eye on the rare earth metals sector. These materials power everything from electric vehicles to data centers, yet the real opportunity may lie behind the scenes. The U.S. is still expanding its refining and processing capacity, creating potential growth in companies that supply critical inputs to tech and energy giants like SMCI and MP.

Week 11/02/25 - 11/08/25 Recap

Special Tools & Strategies - REITS

What if I told you you can own commercial real estate without actually owning the building.

Imagine walking past a shopping mall, a hospital, or even a massive data center and realizing you could own a piece of it, without collecting rent checks, fixing leaks, or worrying about tenants. The idea first grabbed me years ago. I wanted exposure to real estate but not the headaches that came with being a landlord. That’s when I came across Real Estate Investment Trusts or REITs.

What a REIT Is

A REIT is a company that owns, operates, or finances income-producing real estate. You can think of it as a group investment. Instead of one person buying a property outright, a REIT pools money from thousands of investors and spreads it across large buildings like apartment complexes, office towers, hotels, warehouses, and even cell towers.

REITs must pay out at least 90% of their taxable income as dividends, which makes them appealing for investors seeking consistent cash flow. You can buy shares through your regular brokerage account, just like any stock.

Congress created REITs in 1960 to give everyday investors a fair shot at owning parts of the real estate market that were once reserved for the ultra-wealthy. They made it possible for someone with a few hundred dollars to participate in billion-dollar properties.

Different Types of REITs

1. Equity REITs

These are the most common. They own and manage physical properties, earning money from rent. For example, a retail REIT might own dozens of shopping centers and collect rent from the stores inside.

2. Mortgage REITs

These only finance properties, they do not own them. Their profits come from interest on mortgages or mortgage-backed securities. Because they depend on borrowing costs, they’re more sensitive to interest rate swings.

3. Hybrid REITs

These combine both strategies. They own buildings and hold mortgages. While less common today, they give investors exposure to both rent and lending income.

Examples of Top REITs

All three trade on major exchanges, meaning you can invest in them as easily as buying a share of Apple or AMD.

Tips for REIT Investment Beginners

Start with publicly traded REITs. They’re transparent, regulated, and easy to buy or sell.

Research before investing. Look into a REIT’s property portfolio, debt levels, and dividend history.

Diversify. Spread your exposure across sectors like residential, retail, healthcare, and industrial, to balance performance.

Start small. Begin with a modest allocation (around 5% of your portfolio) and grow as you learn how REITs move with market cycles.

Think long-term. REITs reward patience through consistent dividends and gradual price appreciation.

Pros and Cons of REITs

Pros

Easy access to real estate ownership without buying property

Regular dividend income

Portfolio diversification

High liquidity since many REITs trade on public exchanges

Cons

Dividends taxed as ordinary income

Limited reinvestment potential since 90% of profits are paid out

Market risk tied to interest rates and economic cycles

Some carry higher management or transaction fees

REITs quietly bridge the gap between real estate and the stock market. They let you own income-generating properties without the stress of being a landlord. For investors building a portfolio that balances growth and income, REITs can be a valuable tool.

The key is understanding what you’re buying, who manages it, what properties it holds, and how it fits within your broader goals.

Sometimes the smartest investment isn’t another stock pick, it’s learning how to make your money work while you sleep. And for many investors, REITs are the first real step toward that kind of freedom.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.