- Rhoda Report

- Posts

- “Building Your Bridge to What's Next!”

“Building Your Bridge to What's Next!”

Issue #156

Hi There! Right after I made the biggest decision of my life, I started doubting everything. Then, the sign came.

When my daughter first applied to join the U.S. Air Force, she was told she didn’t meet the weight requirement for her height. The recruiter didn’t offer much beyond the rejection, just a sheet with a chart showing the heights and required weights.

Most teenagers might have given up right there. Not her.

She went home, opened her laptop, and began researching everything she could about the Air Force Basic Military Training fitness test. With the help of a trusted friend, she built her own plan, which included clean eating, weekly meal prep, a gallon of water a day, and lots of running and cardio seven days a week. On top of that, she was still finishing her senior year in high school, juggling homework, exams, and extracurricular activities.

As for me, I had just resigned from my engineering job. For the first time in years, I had the time and presence to be fully there for her. I was able to go all in cooking healthy meals (which was the norm anyway), being the Uber mom, helping her while she studied for the ASVAB exam, and watching her push through every single day determined to get in.

It was at that moment I knew I had made the right decision. It was my bridge moment!

Leaving a career I had built over more than a decade wasn’t easy, but during that time, I saw the reason. I said I needed to focus on her first, and I meant it. Watching her transform her body, her mindset, and her future was a constant reminder of my “why,” and that kept me going.

Plus, seeing her model everything I had been living (discipline, faith, planning, and follow-through) gave me peace in my own leap of faith.

Five years later, I still think about that season often. It taught me something that no project meeting or corporate training ever could. Sometimes the biggest risks bring the deepest peace.

Walking away from my dream project, my position as project manager, and the incredible team I had built was difficult, yes, but necessary. My mother needed more than money sent from a distance. My daughter needed me in her corner. Most importantly, I needed to reconnect with the woman I was before I started defining myself by a title.

The first step of any transition, be it retirement, shifting careers, or rebuilding after divorce, always feels uncertain. It is natural. It means you’re growing into something new.

When I left, I didn’t have a perfect plan, but I had a goal. I wanted peace, flexibility, and to wake up each morning knowing I was living life on my own terms.

I want the same for you.

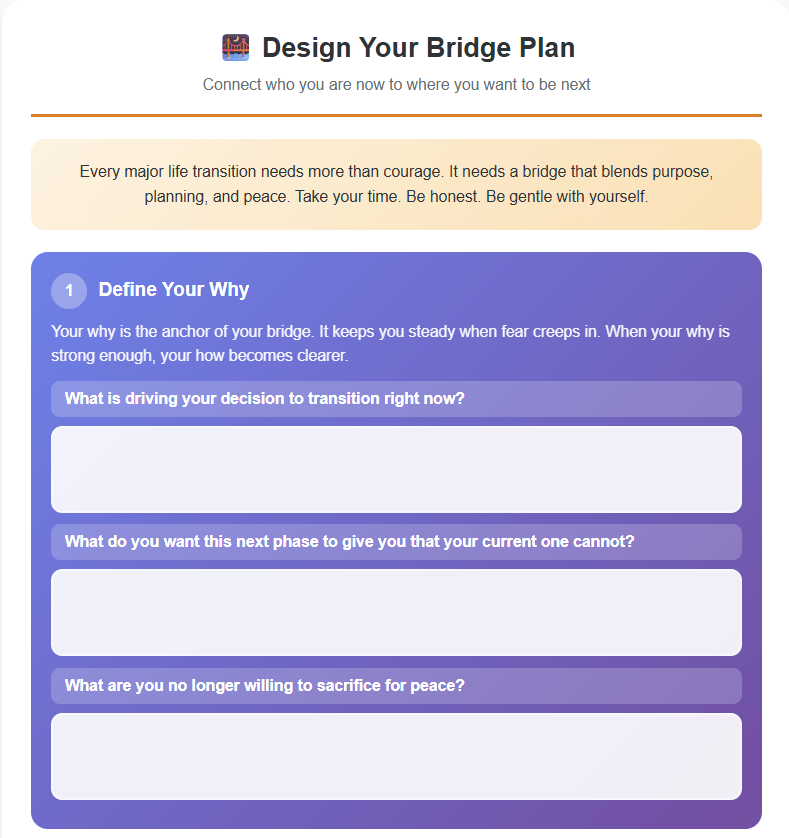

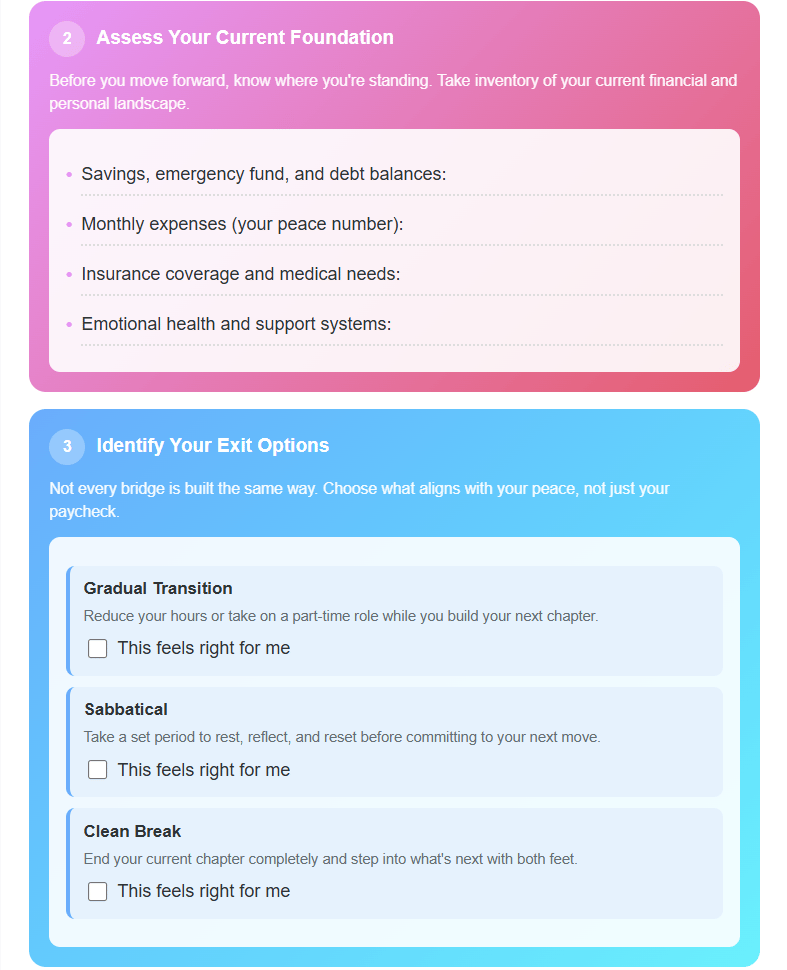

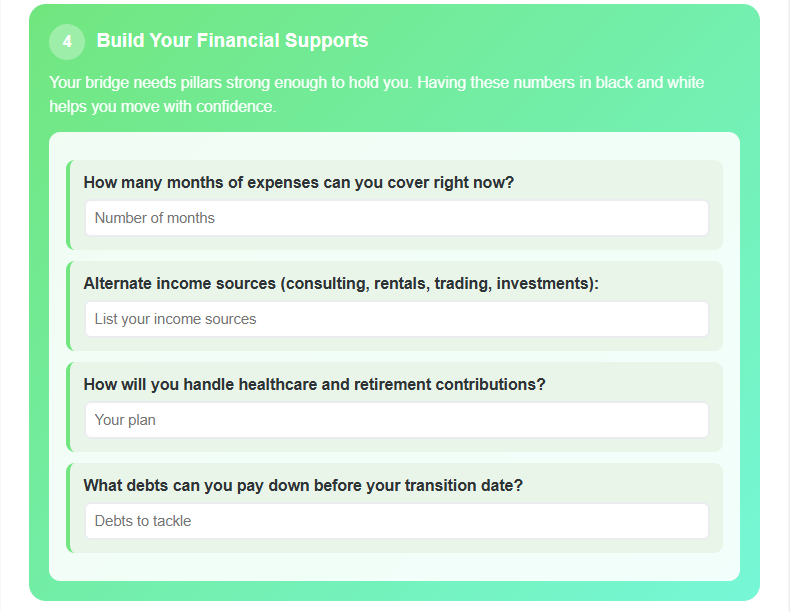

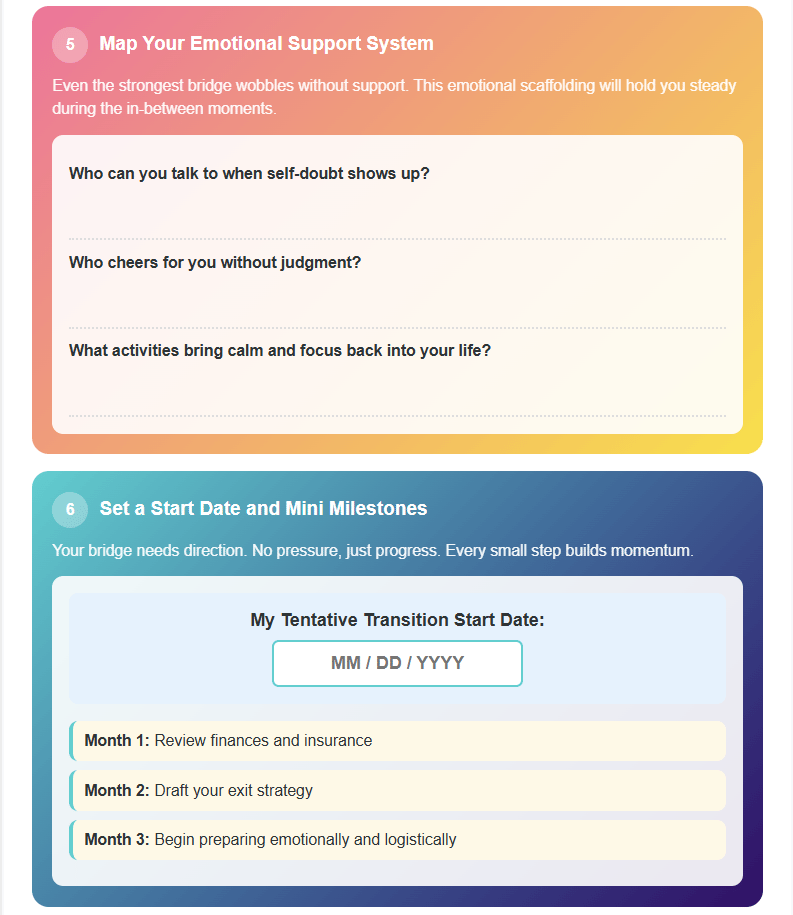

If you’ve been following this series, from “Design Your Next Chapter” to “Your Financial Runway” to “Beyond the Career Title,” then you already have the foundation. Now, it’s time to design your bridge.

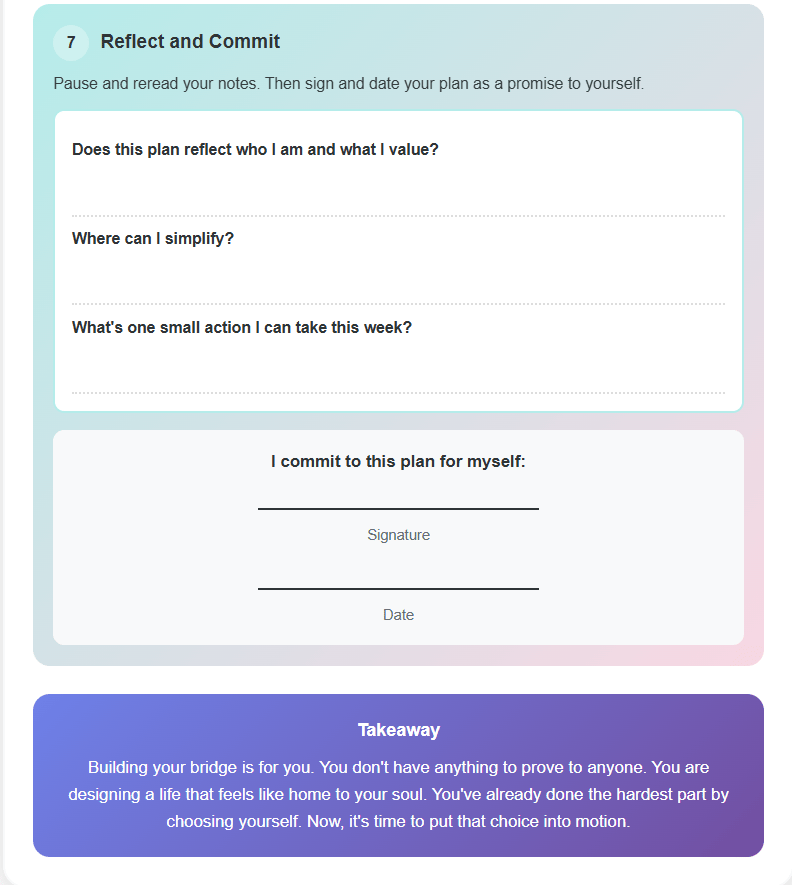

This week’s worksheet in the Special Tools & Strategies section (below) is your guide. It’s called “Design Your Bridge Plan.” The exercise will help you map your next chapter, from reviewing your finances and insurance to setting emotional goals that align with your vision. It’s the same framework I used to make my big move.

I’ll end with this:

You don’t need a perfect plan. You just need to start.

You don’t need everyone to understand your decision. You just need to know your why.

You don’t have to leap in a day or even in a year. Build your bridge one board at a time.

Five years later, my bridge has taken me to a place where peace, productivity, and prosperity collide. I’ve traveled more, written more, taught more, and I’ve been present more.

If I can do it, you can too.

Your next chapter awaits.

Alright, let’s dig in!

U.S. stocks soared to new record highs last week as a cooler September inflation report reinforced confidence that the Federal Reserve will cut interest rates at the next FOMC meeting. A thaw in U.S.–China trade tensions and a strong start to third-quarter earnings season fueled additional optimism. Overseas, Europe and Asia also posted gains amid solid corporate results and political milestones.

However, the positive tone came against a backdrop of a historic U.S. government shutdown, now in its 28th day, threatening to become the longest in American history.

U.S. Markets Recap (October 19 - October 25, 2025)

Equities:

Wall Street bulls were in full control last week.

The S&P 500, Nasdaq, and Dow Jones each ended the week higher after rallying sharply last Friday on the delayed CPI report.

The White House confirmed that President Trump and President Xi will meet this Thursday, easing midweek volatility tied to new potential software export restrictions to China.

Investors welcomed softer inflation data, which strengthened expectations for a rate cut at the next FOMC meeting.

Earnings Highlights from last week:

Tesla (TSLA) rose modestly despite missing profit targets, supported by record sales and strong cash flow.

Netflix (NFLX) declined after missing forecasts.

Intel (INTC) surged on upbeat revenue guidance.

Ford (F) jumped after beating expectations.

IBM (IBM) reversed early weakness tied to slowing cloud growth and finished higher.

Hilton (HLT) and Boston Scientific (BSX) beat estimates, while Texas Instruments (TXN) disappointed with a soft fourth-quarter outlook.

Corporate Spotlight: JPMorganChase’s $1.5 Trillion Security and Resiliency Initiative

Jamie Dimon announced a 10-year plan to finance and invest in industries critical to U.S. economic security. The initiative will:

Support supply chain and advanced manufacturing (critical minerals, robotics, pharmaceuticals)

Strengthen defense and aerospace (autonomous systems, secure communications)

Promote energy resilience (battery storage, grid infrastructure)

Advance frontier technologies (AI, cybersecurity, quantum computing)

Dimon emphasized the need to remove barriers like regulatory red tape and partisan gridlock to restore America’s competitive edge.

Fixed Income:

Bond markets extended their rally for a fifth straight week as yields drifted lower.

The Bloomberg U.S. Aggregate Bond Index advanced amid expectations of slower growth and cooler inflation.

Markets have now priced in a federal funds rate below 3% by 2026, suggesting investors may be at peak dovishness for rate cut forecasts.

Despite improved Treasury supply dynamics, structural concerns about deficits, debt, and inflation risks persist.

Commodities:

Volatility defined the week in commodity markets.

Oil: West Texas Intermediate (WTI) crude jumped from $56 to above $60 per barrel after the U.S. sanctioned Russian state-run oil companies, tightening global supply.

Gold: Snapped a nine-week winning streak, dropping sharply last Tuesday as cooling trade tensions reduced safe-haven demand.

Silver: Followed gold’s lead with a 6.5% weekly decline.

Currencies:

The U.S. dollar index gained 0.5% last week, supported by weakness in the yen, euro, and pound.

EUR/USD: -0.22%

GBP/USD: -0.84%

USD/JPY: +1.48%

Traders favoured the dollar ahead of the Fed meeting, betting that rate cuts may come slower than anticipated if the economy holds steady.

U.S. Economic Recap (October 19 - October 25, 2025)

Inflation and Housing:

The September CPI rose 0.3% month over month, slightly below expectations. Core inflation (excluding food and energy) rose 0.2%, marking its slowest pace in three months. Annual inflation now sits at 3.0%, easing pressure on the Fed.

Housing inflation continues to cool as multifamily supply expands and demand weakens amid slower immigration.

Apparel prices ticked higher due to tariffs, while broader goods and services categories softened.

Government Shutdown Update:

The 28-day government shutdown is the second-longest in U.S. history, centered on expiring healthcare subsidies for 22 million Americans.

Federal workers have missed their first full paycheck.

The White House froze $28 billion in federal projects, while agencies face possible furloughs.

Scope Ratings downgraded the U.S. sovereign credit rating to AA-, citing governance erosion and fiscal deterioration.

Bloomberg Economics estimated that the shutdown could cause a temporary uptick in unemployment, especially in Washington, D.C., before rebounding once operations resume.

Business Activity:

The S&P Global Flash Composite PMI rose to 54.8 in October (from 53.9), signaling solid expansion across manufacturing and services.

Domestic demand strengthened, but exports weakened, reflecting ongoing tariff drag.

Inventories surged at the fastest pace in 18 years, suggesting potential overproduction risks.

Input costs rose due to tariffs and wages, but competition limited price pass-through, slowing output price inflation to the weakest level since April.

Business sentiment fell to a three-year low, reflecting policy uncertainty and export headwinds.

Global Markets Recap (October 19 - October 25, 2025)

Europe

STOXX 600 climbed as financial and energy stocks led gains.

France’s CAC 40 hit a record high despite a credit downgrade by S&P Global to A+.

U.K. inflation came in softer than expected, prompting traders to price in a February rate cut by the Bank of England.

Asia

Markets across the Asia-Pacific rallied as U.S. trade tensions eased.

Japan’s new Prime Minister, Sanae Takaichi, announced a pro-growth coalition plan, igniting optimism.

China’s Fourth Plenum reaffirmed economic stability goals and emphasized technology self-reliance.

South Korea led gains, supported by tech sector strength and optimism over trade progress.

Crypto Recap (October 19 - October 25, 2025)

The crypto market moved in step with traditional markets last week, as investors regained confidence and risk appetite returned. Bitcoin climbed 4.16%, helping to push the total value of all cryptocurrencies to $3.72 trillion. Despite the gains, overall sentiment remains cautious, with the Crypto Fear & Greed Index still showing “Fear” at 37, suggesting many traders remain hesitant. Bitcoin continues to dominate the crypto landscape, now making up nearly 60% of the total market.

Bitcoin (BTC) traded between $106,500 and $113,700, closing out last week near $111,700. The rise was fueled by renewed investor demand, as spot Bitcoin exchange-traded funds (ETFs) saw $446 million in new inflows; a sign that institutions are still buying. However, liquidity in Bitcoin has fallen to its lowest level in seven years, with only about 3.12 million BTC actively circulating. Analysts note that Bitcoin is currently consolidating between $106K and $114K. If the Federal Reserve announces a rate cut, prices could break above this range. On the other hand, a more cautious or “hawkish” Fed tone could send Bitcoin back down toward the $100K–$106K support zone.

Ethereum (ETH) also posted a modest gain of 1.68%, ending last week around $3,945 after swinging between a high of $4,109 and a low of $3,738. Unlike Bitcoin, Ethereum funds saw $244 million in outflows, meaning more investors pulled money out than added in. The price has remained stuck in a narrow range between $3,720 and $4,100, reflecting uncertainty in the market. Traders are watching for a rebound in ETF inflows and stronger macroeconomic conditions before expecting a sustained move higher. Until then, Ethereum is likely to continue moving sideways.

Last Week’s Top Gainers: VIRTUAL, PUMP, HYPE, JUP

Here are other key highlights from last week:

Banks that once shunned crypto custody are racing to tokenize trillions in cash.

Institutions drive CME crypto Options to $9B as ETH, SOL, XRP set records.

Zelle parent pursues crypto for international payments.

AMINA Bank Introduces Regulated Polygon (POL) Staking for Institutions.

This is another busy week in the markets!!!

Key U.S. Economic Releases this week:

(Subject to delay due to government shutdown)

Tue: Richmond Fed Manufacturing Index, CB Consumer Confidence

Wed: Fed Rate Decision & FOMC Statement (2:00 PM ET)

Thurs: Advance GDP

Fri: PCE Price Index, Employment Cost Index, Chicago PMI

Fed Speakers:

Wed: Chair Jerome Powell (2:30 PM ET)

Thurs–Fri: FOMC Members Logan, Bostic, Hammack

Earnings:

172 S&P 500 companies report this week, including:

Wed: Alphabet (GOOGL), Microsoft (MSFT)

Thurs: Amazon (AMZN), Apple (AAPL)

Investors will watch for signals on AI spending, cloud performance, and consumer demand trends.

Other notable Earnings Releases are outlined in red in the cart below.

Medium-to-High Impact Global Economic Events This Week:

Tip: Understanding Deferment Plans

A deferred compensation plan lets you set aside part of your salary or bonus now and receive it later, usually during retirement. Think of it like telling your employer, "Don't pay me this $10,000 bonus today; hold it and pay me $2,000 a year for the next five years after I retire." The benefit: You don't pay taxes on that money until you receive it, which means if you're in a lower tax bracket in retirement, you keep more of it. This creates a steady "paycheck" during your transition years and can help you delay claiming Social Security until age 70 when benefits are highest. The catch: you must commit before the year begins, the money is locked in, and if your company goes bankrupt (for non-qualified plans), you could lose it. It's a smart strategy for high earners planning retirement within 5-10 years who want to bridge the gap between leaving work and tapping into Social Security or retirement accounts.

Week 10/19/25 - 10/25/25 Recap

Special Tools & Strategies - Design Your Bridge Plan

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

.png)