- Rhoda Report

- Posts

- “Design Your Next Chapter: Walk Away With a Plan!”

“Design Your Next Chapter: Walk Away With a Plan!”

Issue #153

Hi There! October always feels special to me. Maybe because it marks the month I decided to stop running on the treadmill of “doing everything right.” October 30th will be five (5) years since I handed in my resignation letter and walked away from my engineering career. People still ask me how I did it, like it was one grand moment of courage. The truth is, it was not a single leap. It was a thousand quiet steps, taken in faith, over time.

I didn’t just up and quit. I had been building toward that day for years, even before I even realized it. My daughter was in high school then, preparing for her next steps, and my mom was back home in Grenada. Between managing projects, mentoring staff, traveling for work, and balancing family life, I found myself asking a simple, but agonizing, question:

When do I actually get to live?

If you’ve ever found yourself staring at the clock at work, wondering if this is really all there is, then you already know the feeling. You love being good at what you do, however you’re tired of the constant grind. You want time to breathe. You want to feel full again. Maybe you’re thinking about walking away too, but the fear of what’s next is louder than the dream of what could be.

I’ve been there. If no one has told you this yet, you’re not crazy for wanting more.

For me, peace of mind became the new measure of my success. I knew I wanted flexibility to visit my mom in Grenada for months at a time, to be present for my daughter, and to create work that didn’t drain me but gave me energy. What I didn’t want was to live out the same ole, same ole for another decade, waiting on “someday.”

Chileeee….. let’s be honest, walking away from a steady paycheck and a comfortable career is not easy. It takes planning, preparation, and a deep understanding of why you want to do it in the first place. The “why” is what keeps you steady when everyone else thinks you’ve lost your mind.

Before I took that step, I spent months writing, thinking, praying, talking, learning, and dreaming on paper. I asked myself questions I had avoided for years:

What does my ideal day look like?

How do I want to spend my mornings?

Who do I want to share my time with?

Those answers became my foundation and that’s where I want you to start this week. Don’t jump to the “how.” Start with the “why.” Cause if your only motivation is to get away from something, you’ll end up building another version of the same thing ( yep same sh*t, different toilet). If you’re moving toward something like peace, purpose, rest, or family, you’re already on the right path.

What most people don’t tell you is that early retirement or a career pivot is all about design first. It’s about envisioning a life that makes sense for you. For some, that means part-time consulting. For others, it means a small business or even taking a long pause to heal before deciding what’s next. There’s no single right path, but there is one right starting point, your vision (and yours alone).

I’ll share more of my steps in the coming weeks. As you read this issue, I want you to give yourself permission to dream without limits. If money, age, or fear weren’t factors, what would your life look like one year from now? Five years from now? Ten years from now? What would you do if you trusted yourself fully?

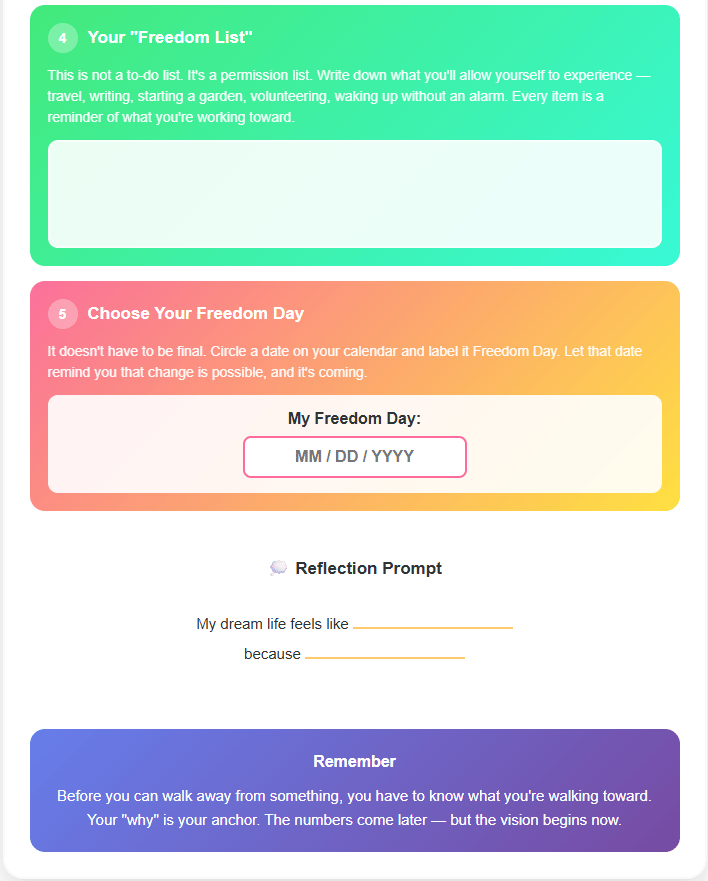

Take thirty minutes this week to free-write your answer. No filters, no overthinking. Just write. You don’t need to know all the numbers yet. You just need to remember what you want your life to feel like. Use the worksheet in the Special Tools & Strategies below.

In my journey I learnt that when you honour your vision, the steps to make it happen start to reveal themselves. That’s how I built my plan. Piece by piece. Day by day.

Next week, I’ll discuss the financial side of my story. I’ll share the part where I learnt how to build a runway that supported my leap. For now, just start where I did, with a pen, a blank page, and the courage to imagine something more.

You may not be ready to quit today. You don't have to be.

Start preparing for the day when peace, purpose, and possibility become your full-time focus.

Alright, let’s dig in!

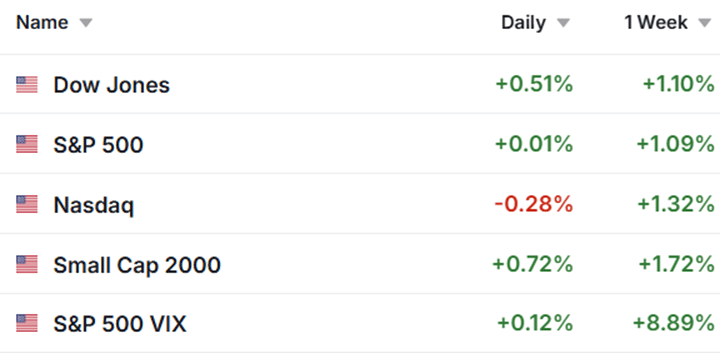

Despite the government shutdown in Washington, markets ended the first week of October in an upbeat fashion. The major U.S. indexes continued their rally from September, closing out a strong third quarter and beginning the final stretch of 2025 on solid footing. Healthcare and technology shares powered gains in the U.S., while overseas, Asia-Pacific and European markets climbed on renewed tech enthusiasm.

Treasury yields edged lower, the U.S. dollar weakened slightly, gold prices surged for a seventh straight week, and crude oil tumbled to its lowest level since June. While the absence of government data releases (including the monthly jobs report) left traders without the usual economic cues, optimism about rate cuts and artificial intelligence (AI) kept the momentum alive.

U.S. Markets Recap (September 28 - October 04, 2025)

Equities:

The S&P 500 advanced 1.09% for the week, sealing a 3.64% gain for September and 8.11% total return for Q3. Despite the government shutdown halting key data releases, investors leaned into the familiar “bad news is good news” narrative, betting that weaker labour data would encourage the Fed to ease policy later this month.

Source: Investing.com (10/4/2025)

AI enthusiasm dominated headlines once again after OpenAI’s $500 billion valuation deal, reinforcing bullish sentiment in tech. Meanwhile, healthcare names led weekly gains as Pfizer (PFE) surged on news of a favourable pricing agreement with the White House, lifting hopes that other pharmaceutical firms might follow suit.

Nike (NKE) also made headlines, posting an upbeat earnings report that drove shares higher and helped offset losses in Palantir (PLTR), which fell after reports of security flaws in its defense software systems.

Fixed Income:

Bonds ticked higher as the Bloomberg Aggregate Index rose modestly on expectations that the Fed will cut rates soon.

However, attention is shifting to the Fed’s balance sheet reduction (quantitative tightening). The Fed’s overnight reverse repo facility (tool Fed use to manage liquidity in the financial system) has now fallen to just $8 billion, the lowest since 2021. Analysts warn that as this facility nears zero, liquidity could tighten and short-term funding markets could turn volatile.

If the Fed ends QT earlier than expected to maintain adequate reserves, that pivot could support bond prices into year-end.

Commodities:

Energy markets struggled this week as WTI crude oil plunged below $61 per barrel, its biggest weekly drop since June. The decline came amid higher OPEC+ production, refinery maintenance, and lower seasonal demand.

Meanwhile, gold extended its winning streak to seven weeks, approaching $3,900 per ounce as investors sought safety during the political impasse. Silver and copper also advanced.

Currencies:

The U.S. dollar softened slightly amid shutdown concerns and weaker-than-expected ADP payrolls data.

EUR/USD: +0.35%

GBP/USD: +0.56%

USD/JPY: -1.38%

U.S. Economic Recap (September 28 - October 04, 2025)

The government shutdown has suspended publication of several key economic reports, including non-farm payrolls and the weekly unemployment claims. Unlike the 2018–2019 shutdown, the Bureau of Labour Statistics (BLS) did not receive advance funding this time, halting regular releases.

Private sector data helped fill the gap:

ADP employment came in weaker than expected last Wednesday, showing slowing labour demand.

The data blackout has left the Federal Reserve “flying blind” into its October policy meeting. Despite this, markets appear over 90% confident that softer data will push the Fed toward easing.

Global Markets Recap (September 28 - October 04, 2025)

Europe:

European stocks wrapped up their best September since 2019, supported by strength in healthcare and technology. Investors cheered hopes that European drugmakers might secure favourable tariff deals similar to Pfizer’s U.S. breakthrough. Inflation data aligned with expectations, while unemployment ticked slightly higher; a sign of cooling but not yet contraction.

Asia:

Asia had a stellar week, led by South Korea’s nearly 5% gain, driven by tech optimism following OpenAI’s new partnerships with Samsung and SK Hynix. Hong Kong’s Hang Seng Index climbed 4%, and Taiwan’s Taiex hit record highs.

Trading volumes were thinner due to China’s Golden Week holiday, but optimism remained strong. Japan’s Nikkei wobbled on domestic political jitters before rebounding late in the week on a new OpenAI–Hitachi collaboration announcement.

Crypto Recap (September 28 - October 04, 2025)

Crypto markets rallied sharply despite Washington’s shutdown. Bitcoin surged 11.5% last week, closing near $122,400, its second-best ETF inflow week ever with $3.2 billion added to spot ETFs.

Seasonality and macro tailwinds combined to ignite what traders now call “clean leverage, real inflows.” Bitcoin’s strong October track record (positive in nine of the past ten years) added confidence to the rally. During the time of writing (Oct 6, 2025), BTC hit a new all-time high at $126,080. JP Morgan maintains its $165K end-of-2025 target.

Ethereum (ETH) also surged to $4,714, lifted by $1.3 billion in spot ETF inflows and heavy short liquidations. Analysts noted that future momentum for ETH depends on whether its ETF demand holds up as traders position for the October Fed meeting.

Stablecoin supply crossed $300 billion, showing ample liquidity for continued risk-taking.

Last week’s Top five (5) Crypto Gainers:

Zcash (ZEC), SPX 6900 (SPX), PancakeSwap (CAKE), Floki (FLOKI), Aptos (APT)

Here are other key highlights from last week:

Walmart-Backed OnePay to add Bitcoin and Ethereum trading to finance App.

Samsung expands Coinbase integration w direct crypto purchases in Galaxy wallet.

Base NFTs overtake rivals in sales count led by AI trading game.

Immutable and Polygon Labs launched gaming on Polygon inside Immutable Play.

Uptober in Full Swing this week!!!

Key Developments to note:

U.S. government shutdown continues into its second week.

Private payrolls data remain the only insight into labour market health.

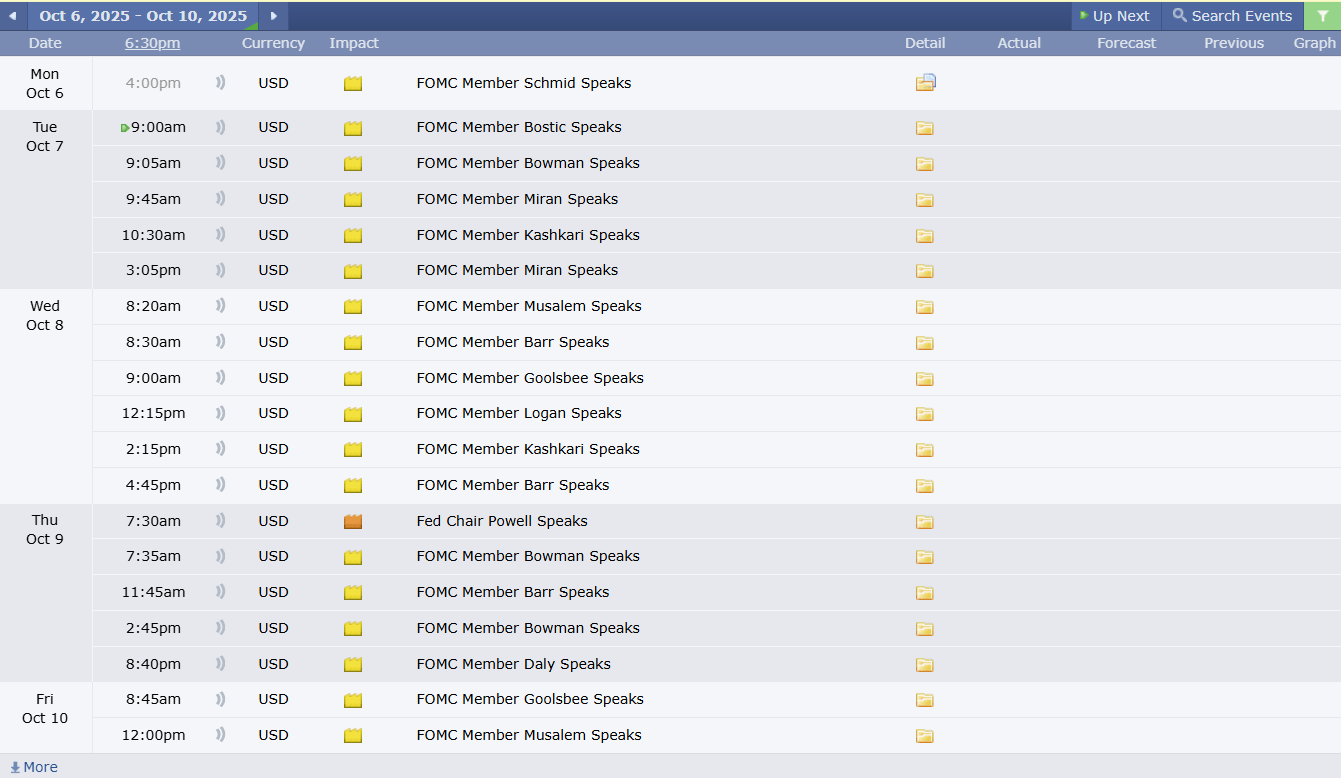

Market sentiment stays risk-on ahead of the FOMC minutes (Wednesday).

Key U.S. Economic Releases this week (Subject to delay due to shutdown):

Date | Event | Impact |

|---|---|---|

Wed 10/8/2025 | FOMC Meeting Minutes | High |

Thurs 10/9/2025 | Jobless Claims (Tentative) | High |

Fri 10/10/2025 | Non-Farm Payrolls (Tentative) | High |

Fri 10/10/2025 | U. of Michigan Consumer Sentiment | High |

Fri 10/10/2025 | Inflation Expectations | High |

Fed Speakers

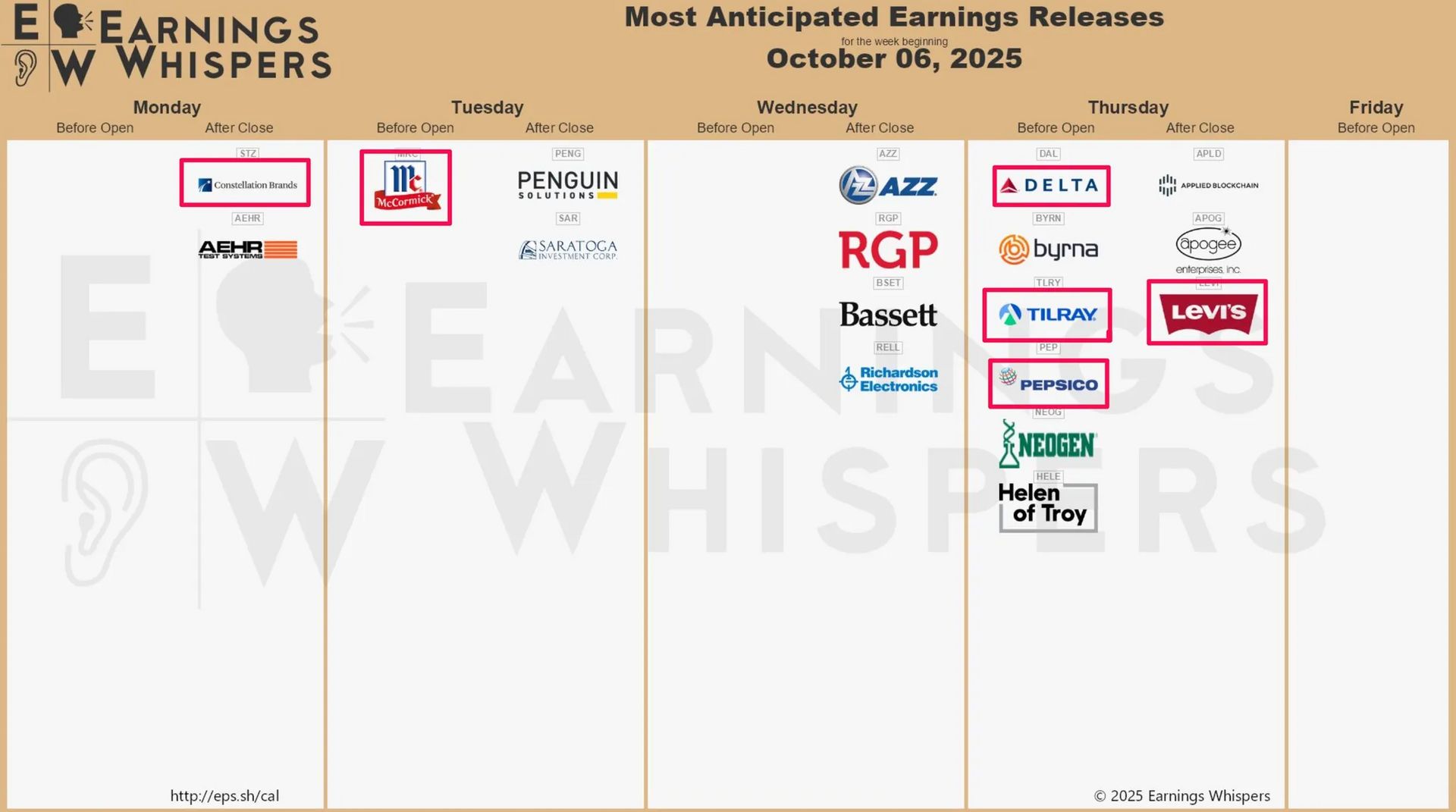

Earnings:

Notable Earnings Releases are outlined in red in the cart below.

Medium-to-High Impact Global Economic Events This Week:

Tip: You're Not Starting From Zero!

You are not starting from scratch. Know that every skill, every hard season survived, and every sacrifice made has built the foundation you're standing on right now. Your past isn't wasted; it's the wisdom and strength that will carry you into what's next. Freedom isn't for the fearless. It belongs to those brave enough to be afraid and move forward anyway.

Week 9/28/25 - 10/04/25 Recap

Special Tools & Strategies - Exit Plan Basics

Created by Rhoda Report

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.