Hi There!

On my commute home last Saturday, I found myself doing the-all-too-familiar mental rehearsal. You know the one. I was meticulously tallying a "to-do" list that felt longer than the highway itself. By the time I pulled into the driveway, I had already mentally put away the groceries, sorted a mountain of mail, tackled three loads of laundry, cleared out my chest-of-drawers for summer clothes, seasoned the meat, prepped my sea moss, and made a dent in a client proposal.

Every time I thought of another chore, I added it to the list. I was exhausted before I even turned the key in the front door.

But when I stepped into the kitchen and saw the reality of everything waiting for me, something inside just snapped. I looked at the chaos and simply said, "Not tuh-day." I put the perishables away, grabbed a small snack, left my phone on the counter, and retreated to my spare bedroom.

In that sanctuary, for the first time in a long time, I actually listened to the Spirit of Rest when it whispered, "Girllll, stop. Go lay down."

I spent hours just staring at the white ceiling and admiring the artwork on my walls. I practiced gratitude. Whenever a stressful thought or a "should-do" popped up, I scribbled it into my journal to get it out of my head and then went right back to being still. I felt like a Tesla plugged into a high-speed charging station. The longer I stayed there, the more my mind and spirit began to glow.

As women, and especially as nurturers and professionals, we pride ourselves on "doing the most." But as I lay there, I realized that if I want 2026 to be different, I have to burn the rules I never chose. Bury all (according to Lil Kerry). We are often trapped by "subconscious rules", the lie that slowing down equals losing momentum, or that anything less than perfection is a failure. We are tired of "performing productivity" (or whatever corporate calls it). We are ready to systemize our lives so we aren't the constant bottleneck of our own existence.

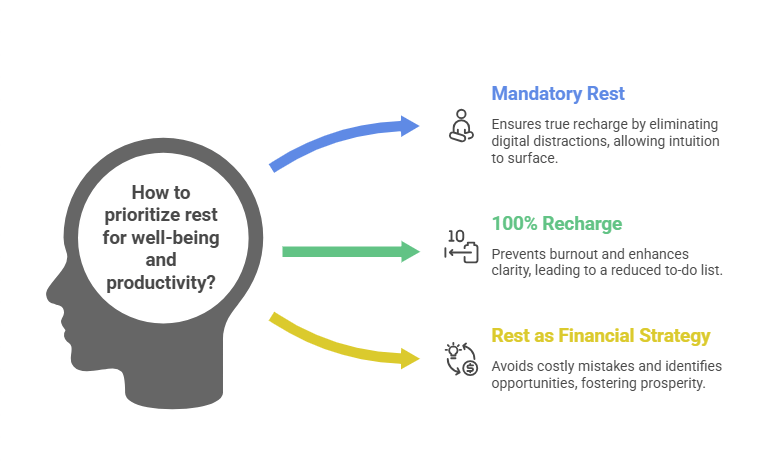

If you are feeling stuck today, here are three things I learnt from my "rebellion" on the bed:

Rest is a Mandatory Assignment: True recharge requires a total "blackout" period. No phones, no TV, no background noise. When you remove the digital noise, you finally hear your own intuition.

The 100% Recharge Principle: We often try to run on 10% battery for weeks, sometimes months. When you allow yourself a full 100% recharge, you don't just feel better, you think clearly and that makes your "to-do" list shrink naturally.

Rest is a Financial Strategy: It sounds counterintuitive, but rest spills over into your finances. A burnt-out brain makes expensive mistakes and misses golden opportunities. A rested mind sees a definitive path to prosperity.

After my rest, I only did two things on my list. And you know what? The world kept spinning, and for once, I was actually in it.

Be kind to yourself. Rest!

Alright, let’s dig in!

Last week, U.S. stocks finished slightly lower as traders worked through a busy mix of early earnings, geopolitics, sector rotation, and central bank headlines. Mega cap tech helped limit the damage late in the week after strong results and upbeat outlooks from key semiconductor names. Outside the U.S., Europe and parts of Asia held up better. Treasuries and oil ended higher but cooled from midweek peaks, while silver stayed hot and the dollar strengthened.

U.S. Markets Recap (January 11, 2026 - January 17, 2026)

Equities:

Major indexes ended last week modestly lower, but the bigger story was rotation. Leadership shifted away from high growth areas and toward value, defensives, and cyclical pockets.

Small caps were a bright spot, extending a rare streak of outperformance versus the S&P 500. This is important as it usually signals broader participation, not just a handful of mega cap names carrying the tape.

Sector performance made the rotation obvious:

Leaders: Real Estate, Consumer Staples, Industrials, Utilities, and Energy

Laggards: Communication Services, Consumer Discretionary, and Financials

Chipmakers managed to grind higher, supported by strong quarterly results and bullish guidance from a major Asian semiconductor powerhouse, plus headlines pointing to deeper U.S. Taiwan cooperation on chip investment.

Market mood improved overall, with sentiment back in “greed,” even as volatility rose. Translation: traders were willing to take risk, but they still demanded a premium for uncertainty.

Fixed Income:

Core bonds edged higher, and the Treasury market kept sending a message that investors are not pricing a serious threat to Fed independence. Instead of the curve steepening and inflation expectations rising, the curve flattened and inflation expectations cooled. Treasury auctions were also well received, especially notable for January, which is often a softer period for demand.

Rate cut expectations shifted lower. Markets are now leaning toward fewer than 2 cuts in 2026, with easing priced later in the year rather than front loaded.

Credit markets remain stretched. Corporate spreads were tight, and issuance has been heavy as companies rush to lock in funding while yields are still attractive relative to the past decade. Demand from pensions and insurers continues to support the market, but valuations remained rich, so this is not the area to get sloppy with risk.

Municipal bonds started the year strong, supported by seasonal reinvestment flows even though reinvestment totals are projected lower than last January.

Commodities:

Commodities finished higher but backed off from their best levels. Metals led. Silver ripped higher again and continued to outshine gold, helped by supply tightness and lingering deficits. Gold and platinum also advanced.

Oil held gains as Iran related headlines kept a risk premium in crude early last week, but prices cooled as the immediate threat of escalation faded.

Currencies:

The dollar strengthened overall, with the dollar index rising as the Euro (€) and yen (¥) weakened. The move was steady and reinforced the same theme seen across markets: investors were still demanding a safety bid while selectively taking risk in pockets like semis and small caps.

EUR/USD -0.34%

GBP/USD -0.15%

USD/JPY +0.15%

U.S. Economic Recap (January 11, 2026 - January 17, 2026)

Inflation data landed in the “good enough” bucket for risk assets, but it did not give the Fed a green light to rush into aggressive easing.

Key takeaways:

Monthly inflation is still running too hot for comfort. The market wants to see repeated 0.1% to 0.2% prints before declaring victory.

Some categories showed clear cooling, especially in pockets of goods inflation such as appliances and used vehicles, which kept the goods vs services split intact.

Super core inflation is trending lower and is expected to soften further in coming months.

Near term, inflation still ran hotter than policymakers preferred, keeping the Fed in pause mode for January and potentially March. The bigger shift is in the balance of risks: attention is tilting toward the labour market. Traders should be prepared for weaker payroll prints and a gradual rise in unemployment, with 4.6% by quarter end as a realistic base case.

Global Markets Recap (January 11, 2026 - January 17, 2026)

Europe:

European stocks were mixed but still extended the winning streak. Energy stocks led as oil stayed supported. The U.K. outperformed, while France lagged due to renewed political budget uncertainty. Germany was close to flat, even as annual growth returned after a long stretch of stagnation.

Asia:

Asia broadly advanced, led by South Korea on tech optimism and potential market structure changes. Japan stole the spotlight with fresh records and strong weekly gains tied to speculation around a snap election and stimulus leaning policy. China slipped modestly as regulators tightened market rules to cool froth, while Taiwan gained with semiconductor strength.

Crypto Recap (January 11, 2026 - January 17, 2026)

Crypto outperformed traditional risk assets during the week.

BTC gained about 5%

ETH gained about 6%

The rally was not purely organic demand. Positioning played a major role, with a sharp squeeze that triggered about $700M in short liquidations, including about $380M in BTC shorts.

Flows were the other big driver:

Spot BTC ETFs took in about $1.42B net

Spot ETH ETFs added about $479M net

One caution flag: some stablecoin liquidity indicators contracted. Data suggested that part of the move was mechanical, meaning the next leg higher will need real follow through buying, not just forced covering.

Top crypto gainers (last week): DASH, XMR, IP, PUMP, ICP, CHZ

Here are other key crypto highlights from last week

Web3 revenue shifted from blockchains to wallets and DeFi apps.

BitMine’s staked Ether reaches 1.5M, equating to 4% of total staked.

Animoca bought Somo as NFT market rebounded early in 2026.

Polygon’s network evolved to move money at scale.

This week is short, but busy in the markets!!

Key U.S. Economic News:

Key U.S. economic releases ahead

Wednesday: Pending Home Sales

Thursday: Core PCE Inflation, Q3 GDP, Jobless Claims

Friday: Services PMI, Manufacturing PMI, Consumer Sentiment

How to think about it:

Core PCE is the Fed’s preferred inflation gauge and can move yields and tech quickly.

GDP plus jobless claims is the cleanest growth plus labour check in one day.

PMIs and sentiment shape the narrative for cyclicals, small caps, and credit spreads.

Fed Speakers:

None. The Fed is in blackout mode ahead of the Jan 28 policy decision.

Earnings:

Early earnings have come in strong so far, with a high beat rate. This week, Netflix is one of the bigger releases to watch, along with other major bellwethers that can shift sentiment around tech spending, AI capex, and consumer demand.

Notable earnings releases are outlined in red below.

Medium-to-High Impact Global Economic Events This Week:

The WEF Annual Meeting in Davos is the dominant global catalyst this week. Watch for policy comments on trade, energy, and rates.

Here are three key takeaways so far from the 2026 WEF Annual Meeting in Davos (as of Jan 20–21, theme: "A Spirit of Dialogue"):

Geoeconomic tensions and "age of competition" lead risks: Global Risks Report 2026 flags geoeconomic confrontation (tariffs, protectionism, strained alliances) as top threat. Trump's tariff threats and Greenland comments spark warnings from Europe (e.g., Macron: "respect over bullies") and calls for middle-power coalitions to avoid a fragmented world.

AI as defining force, but urgent need for responsible scaling: Sessions stress closing the "AI diffusion divide," deploying it for growth/productivity without rules/referees, while addressing job/skills disruption and ethical governance amid rapid change.

Push for new growth, people investment, and planetary limits: Leaders seek fresh growth sources in fragile economies via reskilling, innovation, and nature/water focus (2026 as "Year of Water"). Emphasis on prosperity within boundaries, energy resilience, and inclusive adaptation.

Meeting continues through Jan 23.

Trading Tip:

The January Effect is a well-known seasonal pattern in stock markets where stock prices, especially those of small-cap stocks, tend to rise more strongly in January compared to other months or relative to large-cap stocks.

Week 1/11/26 - 1/17/26 Recap

Special Tools & Strategies - 5 Waves of Opportunity

With the One Big Beautiful Bill Act (OBBBA) tax reforms now in place, it is projected that up to $4.7 trillion in additional capital will flow into the U.S. economy over the course of 2026. This stimulus is expected to arrive in distinct phases, often described as "waves," creating opportunities across different sectors at different times.

Drawing from historical patterns, current projections, and analysts like Felix Prehn, here is an overview of the five waves and the stocks and ETFs worth keeping on your radar.

Wave 1: Immediate Paycheck Boost (February–March 2026)

Updated withholding tables and early refunds put extra cash into consumers’ hands quickly, likely leading to a near-term increase in spending. This phase tends to favour discretionary and retail-oriented names.

Key watches:

XLY (Consumer Discretionary Select Sector SPDR ETF)

AMZN (Amazon)

ULTA (Ulta Beauty)

CVNA (Carvana)

RL (Ralph Lauren)

Wave 2: Peak Refund Season (March–June 2026)

The largest wave of refunds is expected during this period, delivering significant “found money” to households. This can provide a meaningful lift to cyclicals, travel, home-related spending, and small caps.

Key watches:

W (Wayfair)

EXPE (Expedia Group)

IWM (iShares Russell 2000 ETF)

GM (General Motors)

Wave 3: Corporate Repatriation & Capex (Q2–Q3 2026)

Lower corporate rates, repatriation incentives, and extended bonus depreciation encourage business investment, buybacks, and hiring. This phase supports industrials, select tech, and infrastructure-related companies.

Key watches:

INTC (Intel)

MU (Micron Technology)

CAT (Caterpillar)

T (AT&T)

LMT (Lockheed Martin)

Wave 4: Economic Multiplier (Mid–Late 2026)

Stronger consumer spending feeds into higher corporate revenues, employment, and wages, creating a self-reinforcing cycle. This period often sees the broadest participation across equities.

Key watches:

IWM (Russell 2000 ETF)

XLI (Industrial Select Sector SPDR ETF)

MSFT (Microsoft)

AMZN (Amazon)

ORCL (Oracle)

Wave 5: Inflation & Policy Response (Late 2026–2027)

As liquidity builds, inflation pressures may rise, potentially prompting the Federal Reserve to adjust policy. This phase typically favors assets that historically perform well in inflationary or higher-rate environments.

Key watches:

XLE (Energy Select Sector SPDR ETF)

GLD (SPDR Gold Shares ETF)

SLV (iShares Silver Trust)

BTC (Bitcoin exposure via spot ETFs such as IBIT or GBTC)

The OBBBA tax changes represent a meaningful boost for the U.S. economy in 2026, particularly for consumer-facing and cyclical sectors in the earlier waves, followed by a shift toward more defensive or inflation-sensitive assets later on. Timing, diversification, and disciplined position management remain important. These are forward-looking observations based on current projections and historical analogs. Therefore, actual outcomes will depend on execution, economic data, and policy developments.

As always, this is just research for education purposes. Do your own research and consider your personal risk tolerance.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

.png)