Hi There!

I used to be a worrier. For years, I lived in a state of high-alert where my mind was a runaway train of "what-ifs." It started in my teens, way back in high school. Every exam felt like a life-or-death moment. I worried so hard my body would revolt with full-blown panic attacks. At one point, it got so bad I was prescribed mild Valium just to calm down enough to sit through a test.

I was sated with fear. Half the time, it was not even about the exam. It was this constant overthinking that I was not good enough, or that maybe if I did everything perfectly, I would finally get the approval from my dad that I wanted so badly. Story for another day, because whew...

Years later, when I found out I was pregnant, I immediately decided I had to stop the worrying. I wanted my baby to feel happy and positive around me, so I got better for a while. I kept the panic away because I refused to let that energy sit in my home. But when my divorce came later on, and life started demanding everything at once, the shadows returned. I felt the crushing stress of juggling a career, raising a child, and handling a bruised heart. I went to church every Sunday, I delved into the Word, and I prayed; yet, the panic still consumed me.

I didn’t want to go back to medication, so on the advice of a friend, I started seeing a therapist who gave me simple, practical exercises to manage the noise in my head.

You see, we worry about money, bills, taxes, our jobs, and what people think of us. If you trace those worries to the root, so many of them point back to money and outside influences.

We live in a digital age where we are constantly titillated by the curated, shimmering lives of others on social media. We "scroll, scroll, scroll" and "compare, compare, compare," not realizing we are measuring our behind-the-scenes footage against someone else’s highlight reel. We stretch our finances and our spirits thin to keep up with the Joneses. The same people who aren’t even thinking about us because they’re too busy worrying about the other Joneses.

Meanwhile, worry steals every cubit of our lives, piece by piece, until there’s nothing left for the moment we’re actually standing in.

To those of you who feel "stuck", whether you are rebuilding after a divorce, staring down retirement, or trying to dig out of debt, your financial decisions are only as sound as your mind. When we worry, we make reactive, fear-based choices. To make informed decisions in 2026, you don't necessarily need more information; you need a quieted mind.

The cycle of overthinking stops when we move from worry to actionable steps.

Here is how we reclaim our agency:

Establish a "Worry Window": Give your worries an appointment for only 15 minutes a day. When the fear pops up, write it down, then deal with it only during that appointed time. When the clock stops, the worry stops.

The 5-4-3-2-1 Grounding: When the panic over a bill or a bank statement rises, engage your senses. Five things you see, four you feel, three you hear, two you smell, one you taste. Come back to the now.

Shift to Action: Ask yourself, "Is this a problem I can solve right now?" If you owe debt, don't just stare at the number; call the creditor or automate a payment.

Your worry doesn't need an answer; it needs a boundary. Show up to it consciously, then decide what deserves your action.

Alright, let’s dig in!

The first full week of 2026 delivered no shortage of headlines, from major U.S. labour data and Washington policy signals to geopolitical risk. Markets heard the noise and kept moving anyway. U.S. stocks pushed higher for a solid weekly advance, Europe climbed with tech leading the way, and Asia finished mostly higher. Bonds gained as yields and spreads generally eased. Commodities strengthened, with WTI crude, gold, and silver all higher. The USD also posted a 2nd straight weekly gain.

U.S. Markets Recap (January 4, 2026 - January 10, 2026)

Equities:

U.S. equities opened 2026 with momentum, finishing the first full week in the green and extending the positive tone from the prior Friday. Early last week, markets looked past the capture of Venezuelan President Nicolas Maduro by U.S. forces in Caracas tied to narco terrorism, illegal weapons, and drug importation charges. The usual pattern held. Stocks largely kept their focus on growth, earnings expectations, and liquidity, while energy got a lift from rising crude prices.

The AI theme stayed hot after upbeat CES headlines in Las Vegas and comments pointing to strong demand around NVIDIA (NVDA). But the bigger story was rotation. Cyclical areas attracted fresh buying as investors looked beyond mega cap tech, and small caps joined the party with the Russell 2000 pushing to fresh records.

Defense stocks also caught attention after President Trump signaled an intent to ramp military spending to $1.5T in 2027, while also pressuring contractors through an executive order aimed at preventing defense companies from issuing dividends or launching share buybacks. Even with mixed breadth, Supreme Court tariff ruling jitters, and a mixed jobs report, stocks finished higher.

Homebuilders, including D.R. Horton, climbed after news that President Trump is directing Fannie Mae and Freddie Mac to buy $200B in mortgage bonds. Mortgage rates reportedly fell to the lowest level in almost 3 years, according to CNBC.

Fixed Income:

Core bonds, measured by the Bloomberg Aggregate Index, traded higher as Treasury yields and spreads were generally lower. The mortgage backed securities market took center stage late week after the call for Freddie Mac and Fannie Mae to purchase $200B in mortgage bonds, a move aimed at improving housing affordability through lower mortgage rates.

Agency MBS had a standout 2025, returning more than 8.5%. The setup for 2026 looks different. With spreads now tightened and sitting below longer term averages, the path to returns likely leans more on coupon income than on price gains. In 2025, falling Treasury yields and tightening spreads contributed over 5% of total returns, with coupons making up the rest. The risk to watch in 2026 is prepayment. If mortgage rates fall further, prepayment risk rises and can cap upside. A supportive offset is that Fannie Mae and Freddie Mac have already become large buyers of MBS as the Fed runs off its balance sheet and as the agencies increase retained portfolios ahead of plans to go public again.

Net it out: MBS can still look attractive, but repeating 2025 style returns may be a tall order.

Commodities:

The commodities complex advanced, measured by a rise in the Bloomberg Commodities Index. WTI crude hovered around flat for much of the week, then jumped Friday as protests escalated in Iran, the 4th largest OPEC+ producer, alongside signs of strength in the U.S. economy via a lower unemployment rate. Geopolitical uncertainty supported prices, while Venezuela developments were not expected to materially shift global oil pricing beyond a possible boost if Chinese buyers seek alternatives to discounted Venezuelan barrels.

In metals, gold continued its 2025 tone, supported by geopolitics and China’s central bank extending its monthly buying streak to 14 months. Silver also rose sharply.

Currencies:

The USD posted back to back weekly gains, pressuring major pairs.

EUR/USD - 0.70%

GBP/USD - 0.42%

USD/JPY + 0.67%

For traders, this is a good reminder that forex can quietly confirm the bigger story. A firmer USD can tighten financial conditions and change the feel of risk assets, even when stocks are rising.

U.S. Economic Recap (January 4, 2026 - January 10, 2026)

Jobs data delivered a warning through revisions. December payrolls grew by 50,000 after downward revisions to the prior 2 months. The 3 month average payroll change is now minus 22,000, a sharp slowdown from 232,000 at the start of last year. The unemployment rate dipped to 4.4% from 4.5%, and average hourly earnings rose 3.8% YoY, still running ahead of inflation. Participation and the employment population ratio were little changed, suggesting demand is cooling more than supply is shrinking.

Job openings and hiring cooled without a layoff wave. Job openings fell to 7.15M in November from a revised 7.45M, the lowest in more than a year and below forecasts. Hiring slowed to the weakest pace since mid 2024, while layoffs fell to a 6 month low. The vacancies to unemployed ratio dropped to 0.9, the lowest since March 2021 and far below the 2022 peak.

ADP and payrolls confirmed tepid momentum. ADP showed 41,000 private jobs added in December versus a 50,000 median forecast. The official report showed 50,000 jobs added versus 70,000 expected. Wages rose 0.3% MoM, participation slipped to 62.4%, and long term unemployment rose by nearly 400,000 over the past year.

Consumers are cautious and inflation expectations remain elevated. The New York Fed survey showed 1 year inflation expectations at 3.4% versus 3.2%, with 3 and 5 year expectations at 3%. The perceived probability of finding a job if unemployed fell to 43.1%, the lowest since the survey began in 2013. University of Michigan preliminary sentiment improved to 54 from 52.9, but many still expect unemployment to rise. Inflation expectations were 4.2% for the next year and 3.4% for the next 5 to 10 years.

Productivity is doing important work. Nonfarm productivity surged 4.9% annualized in Q3 after a revised 4.1% in Q2. Output rose 5.4% while hours worked rose 0.5%, pushing unit labour costs down 1.9% after the prior quarter decline. That is the kind of data the Fed can live with.

PMIs were mixed and tariffs kept showing up in the cost story. S&P Global US Composite PMI fell to 52.7 from 54.2, with input costs rising to the highest since May and firms raising selling prices faster. ISM Services PMI rose to 54.4 from 52.6, the strongest since October 2024. Manufacturing looked weaker: S&P Global Manufacturing PMI slipped to 51.8 from 52.2, while ISM Manufacturing stayed in contraction at 47.9 for a 10th straight month below 50.

Global Markets Recap (January 4, 2026 - January 10, 2026)

Europe:

European stocks advanced, with the STOXX 600 topping 600 for the first time and ending at record levels. Tech led the way, helped by ASML strength tied to an analyst upgrade, optimism around a memory chip super cycle, and chatter about a potential memory chip shortage. Defense names also outperformed on potential U.S. military spending increases and raised guidance from Dassault Aviation.

Macro wise, Eurozone inflation remained at the ECB’s 2% target, reinforcing expectations for policy to stay unchanged this year. In corporate news, Rio Tinto and Glencore reportedly entered talks that could create the world’s largest miner.

Asia:

Asian markets ended mostly higher, led by tech and AI. Taiwan Semiconductor helped drive the Taiex to all time highs, while SK Hynix and Samsung supported fresh records in Seoul. Japan led the region late week, helped by yen weakness and a rebound in household spending, with a jump in auto sales.

Hong Kong edged lower as China and Japan’s Taiwan related tensions returned to the surface. Beijing banned exports of civilian military dual use goods and launched an anti dumping probe. Mainland China gained on local tech enthusiasm after authorities laid out AI growth goals for the next 2 years.

Crypto Recap (January 4, 2026 - January 10, 2026)

Crypto was mixed, and Bitcoin spent the week acting like a market that wants to go higher but is not fully committing yet.

BTC weekly performance: +1.18%

BTC hovered around $90,000 and failed to break resistance at $95,000

U.S. spot BTC ETFs saw net outflows of $681.01M

BTC closed around $90.8K after a failed push to about $94.7K (Jan 5) and a drop to about $89.5K (Jan 8)

Liquidations totaled about $449M on Jan 7, accelerating the pullback after rejection above about $94K

Positioning data shows hesitation. Per K33 Research, 86% of total open interest sits in the front month expiry, and longer dated CME futures demand remains weak. Spot volume, volatility, and leverage are near the lows seen before December. Funding rates are also subdued, signaling traders are not piling into aggressive longs.

Top crypto gainers (last week): IP, XMR, MYX, DASH, CHZ, POL

Here are other key crypto highlights from last week

BlackRock added $900M BTC as Bitcoin long-term selling falls to 2017 lows.

Morgan Stanley added Ethereum staking ETF filing to growing crypto lineup.

Grayscale formed trusts tied to potential BNB and HYPE ETFs.

Nike offloaded RTFKT months after investor lawsuit.

Polygon to acquire Coinme + Sequence to offer Regulated Stablecoin Payments.

Another busy week in the markets!!

Key U.S. Economic News:

Key developments so far:

CPI inflation (Tuesday)

Core CPI at 2.6%, the lowest reading since March 2021

Headline inflation held at 2.7%

Markets are pricing 95% odds the Fed holds rates this month

S&P 500 futures surged above 6,990, a new record high

Trump pressured Fed Chair Jerome Powell to cut rates, while market bets pointed to no cut until June

New Home Sales (Tuesday)

October new home sales rose to 737,000 vs 716,000 expected and 711,000 prior

Highest since September 2024

Key U.S. economic releases ahead

PPI inflation (Wednesday)

Retail Sales (Wednesday)

Existing Home Sales (Wednesday)

Jobless Claims (Thursday)

Philly Fed Manufacturing Index (Thursday)

NY Fed Manufacturing Index (Friday)

Industrial Production (Friday)

Fed Speakers:

Barkin (Mon 12:45 PM)

Williams (Mon 6:00 PM)

Musalem (Tue 10:00 AM)

Barkin (Tue 4:00 PM)

Paulson (Wed 9:50 AM)

Miran (Wed 10:00 AM)

Kashkari (Wed 12:00 PM)

Williams (Wed 2:10 PM)

Bostic (Thu 8:35 AM)

Barkin (Thu 12:40 PM)

Vice Chair Jefferson (Fri 3:30 PM)

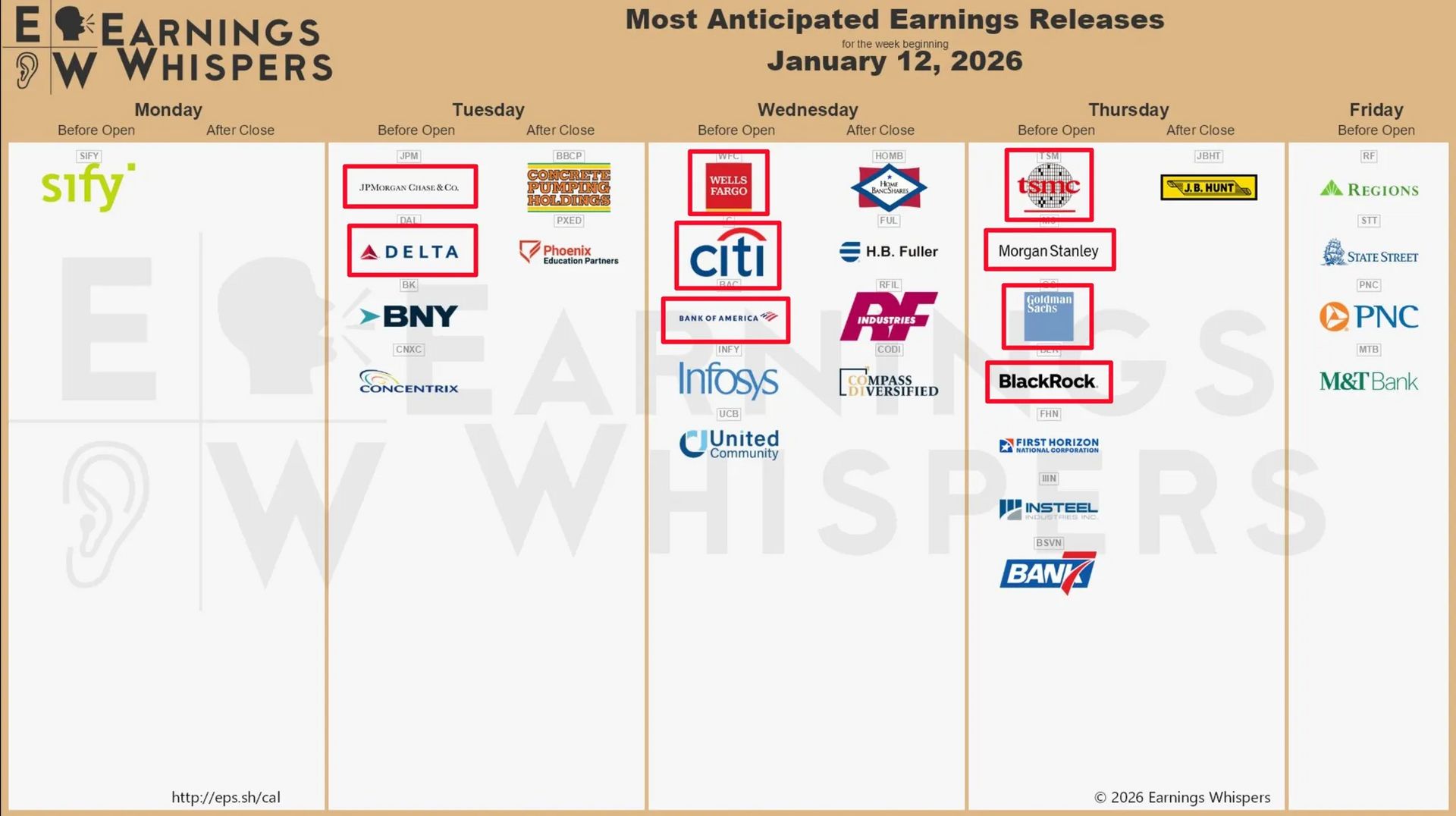

Earnings:

Notable earnings releases are outlined in red below.

Medium-to-High Impact Global Economic Events This Week:

UK GDP m/m (Thursday)

Trading Tip:

When major U.S. economic data releases like CPI, PPI, or Retail Sales are scheduled, don't try to trade everything. Pick 1-2 key market drivers and focus exclusively on them.

For example, if this week's theme is inflation and consumer spending, concentrate on how PPI and Retail Sales might shift Federal Reserve rate expectations. These reports can move markets quickly, so having a clear focus helps you react without getting overwhelmed by noise.

Trying to track too many data points at once leads to scattered attention and poor decisions. Remain disciplined, know what story you're trading, and let everything else be background information.

Week 1/04/26 - 1/10/26 Recap

Special Tools & Strategies - PlayToEarn (P2E)

There are several ways to earn free crypto, and playing games is one of them. I used to laugh when people said that, until I realized how many hours folks, and their kids, spend tapping, battling, farming, and collecting online. If time is money, then gaming time can be money too, if you know where to look and how to avoid the nonsense.

That’s where PlayToEarn comes in.

What PlayToEarn is and its purpose

PlayToEarn is a website that acts like a data hub and news outlet for blockchain gaming. In plain English, it helps you find games that reward players with crypto and NFTs, plus it keeps you updated on what is trending in the space.

It serves:

Curious beginners who want to see what “play to earn” even means

Gamers who want free to play options

Crypto folks looking for new projects, activity, and momentum signals

Key features and what you can learn there

On PlayToEarn, you can:

Browse a big list of blockchain games and filter by chain, genre, and device

Use the site’s P2E Score to gauge community buzz and engagement (helpful when you are deciding what is alive vs. what is quiet)

Read news and updates that explain what is happening in Web3 gaming

Follow community events like their awards coverage

Simple example: how someone might earn

Let’s use Gods Unchained. A player joins competitive weekend matches, earns GODS tokens and card packs, then “forges” duplicate cards into NFT versions. Those NFTs can be listed on a marketplace, sold for crypto, and later transferred to an exchange to convert to cash.

A concrete illustration: imagine you earn 15 GODS tokens in a month plus a couple of tradable NFT cards. If you sell one NFT card and keep the rest, you just turned gameplay into an asset you can manage. Not guaranteed, but that is the basic path.

Popular games you will see listed

You will commonly find games like Axie Infinity, Gods Unchained, The Sandbox, Splinterlands, Illuvium, Hamster Kombat, Big Time, and Sunflower Land on the platform.

Adoption: the good and the not so good

Pros

Web3 gaming still pulls serious activity, around 4.66 million daily unique active wallets in Q3 2025

Big gaming names like Ubisoft, Sega, and FIFA have been exploring blockchain integrations

Cons

Wallet setup and onboarding still make people quit early

Fees and network congestion can eat into small earners

Token prices move fast, and some projects shut down when hype fades

Quick note: crypto and NFTs involve real financial risk. Never spend money you cannot afford to lose, and treat earnings as variable, not a paycheck.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

.jpg)