- Rhoda Report

- Posts

- “It's Never Too Late!”

“It's Never Too Late!”

Issue #152

Hi There! This past Saturday I celebrated my birthday, and in true Rhoda fashion, I spent some time reflecting, meditating, and simply sitting in gratitude for how far I’ve come. When I look back, I see a life filled with more mountains and hills than valleys. Yet, it was the valleys that taught me the most about life, about patience, and about myself.

I once read that our 40s are the years of laying foundations, of working hard to solidify who we are and what we stand for. Now, at 48, I can say that is absolutely true. These years have been about building competence, sharpening expertise, and shaping values I can stand firmly on. They’ve also been about embracing change (yes, even peri/menopause) with a kind of grounded acceptance I didn’t have in earlier chapters.

What’s different now is the craving of my soul. At this juncture of my life, I find myself seeking balance between the mastery of the skills I’ve worked so hard for and the quiet pull toward spirituality in its purest form. There’s a deeper search happening inside me; a curiosity and a wonder about life itself. While I don’t have all the answers, I feel stronger, more settled, and more attuned to the most authentic parts of who I am.

In reflecting on this new chapter, I want to leave you with three lessons that have anchored me. These lessons may assist you, especially if you feel overwhelmed, stuck, or unsure of how to move forward:

The valleys shape you, not define you. The hardest seasons often carry the wisdom you’ll need for the climb ahead.

Foundations take time. Growth may feel slow, but every small step you take is part of building something lasting.

Being grounded matters more than perfection. You won’t have all the answers. Make the time to listen to what your spirit needs right now.

I step into this new chapter with a silver crown of wisdom on my head and a heart determined to serve. I sense that bigger changes are waiting as fifty approaches, but instead of fearing them, I’m welcoming them. Every twist, every turn, and every valley has prepared me for what’s ahead.

Cheers to Chapter 48. I am wiser, steadier, and ready for what’s next.

As you read this, you can pause and ask yourself: What chapter are you in right now, and what is it teaching you about the truest parts of you?

Alright, let’s dig in!

U.S. equities slipped as valuation concerns overshadowed surprisingly strong macro data. The S&P 500 and other major indexes fell between 0.15% and 0.65% despite Q2 GDP being revised up to its fastest pace in nearly two years, jobless claims at mid-July lows, and durable goods orders beating forecasts. Inflation matched expectations. Investors took profits instead of chasing new highs, with Bank of America (BofA) noting that the S&P trades expensive on 19 of 20 valuation metrics.

Source: Investing.com (9/26/25 after market close)

Globally, ex-U.S. equities mirrored the U.S., dipping 0.4%. Meanwhile, crypto endured its steepest pullback in months, wiping out $237 billion in value as leveraged bets collapsed.

U.S. Markets Recap (September 21 - September 27, 2025)

Equities:

Valuations: Four valuation metrics hit record highs, including market value-to-GDP and P/E ratios. Some warn of bubble risks, but BofA argues today’s index composition (stronger margins, efficiency, and lower leverage) supports higher multiples.

Flows: Foreign investors poured a record $290 billion into U.S. equities in Q2, lifting overseas holdings to nearly 30% of the market. This is the highest share since WWII.

Sector rotation: Six of eleven S&P 500 sectors ended the week lower. The Fear & Greed Index fell back to 53 (“neutral”), down from 64 the week prior.

Fixed Income:

Treasury yields moved higher: the 10-year rose 5 bps to 4.18%, while the 30-year nudged to 4.75%. Markets trimmed easing bets, pricing an 87.7% chance of an October Fed cut (down from 91.9%).

Commodities:

Oil: Brent rose 5.2% to $70 and WTI climbed 4.9% to $66, the largest weekly gains in over three months. Drivers included geopolitical risks (Ukraine-Russia, Iran sanctions), U.S. urging NATO allies to stop buying Russian oil, and expected OPEC+ supply hikes.

Gold: Gained 2.8% to $3,779/oz, close to record highs, marking its sixth straight weekly gain. Silver topped $46 for the first time since 2011.

Currencies:

The dollar index advanced 0.5%, its best week since early August, driven by corporate demand. Yet speculative positioning remains net bearish ($8.6 billion short). Traders remain skeptical about the dollar’s medium-term outlook given Fed easing pressure and tariff-related uncertainty.

EUR/USD: -0.37%

GBP/USD: -0.48%

USD/JPY: +1.04%

U.S. Economic Recap (September 21 - September 27, 2025)

GDP: Q2 revised to 3.8% annualized, up from 3.3%. Consumer spending rose 2.5% (vs 1.6% prior). Business investment jumped 7.3%, with record AI data center spending.

Inflation: Core and Headline PCE inflation (Fed preferred measured of inflation) came in as expected. August core PCE held steady at 2.9% y/y.

Consumer Spending: Personal income rose 0.4% and spending (0.6%) beat expectations in August, but savings rate fell to 4.6%, lowest this year.

Sentiment: University of Michigan index dropped to 55.1, with inflation expectations at 4.7% (1-year) and 3.7% (long-term).

PMI: September composite slipped to 53.6 from 54.6, showing slower growth. Inventories surged at a record pace, raising downside risks.

New US Tariffs: New US tariffs on drugs, furniture and trucks

Global Markets Recap (September 21 - September 27, 2025)

Europe:

The picture across Europe last week was mixed.

France: The French economy has now been shrinking for 13 months in a row. Both factories and services are cutting back, and households remain worried about the future. Confidence is so low that people are saving more and spending less, which holds back growth even further.

Germany: Companies kept cutting jobs, especially in manufacturing, because they don’t expect demand to stay strong. Businesses also complained about high costs and uncertainty.

UK: The UK economy is still expanding, but just barely. Services (like finance and retail) are holding things up, while factories are struggling and exports are falling. Employers are cutting jobs to save money, and confidence about the future is weak.

Asia:

Japan: PMI slipped to 51.1, slowest in 4 months. Services grew, but manufacturing contracted sharply. Tokyo CPI rose 2.5% y/y, showing sticky inflation.

India: PMI eased to 61.9 from 63.2 but remains among the strongest globally. Domestic demand stayed robust, but exports weakened due to U.S. tariffs.

Crypto Recap (September 21 - September 27, 2025)

Selloff: Digital assets lost $237 billion as $3B in long positions were liquidated. Bitcoin (BTC) fell 5% below $109K; Ethereum (ETH) dropped nearly 10% under $4K.

ETFs: Bitcoin and Ethereum ETFs posted $898M and $796M in weekly outflows.

Treasuries: Corporate buyers slowed as Digital-Asset Treasuries (DAT) purchases dropped 76% from July. Many crypto-tied firms now trade below net asset value (NAV), raising solvency concerns.

Outlook: Market cap slipped below $4T, with sentiment cautious and macro factors taking center stage. Analysts framed the move as a “healthy correction.”

Last week’s Top Crypto Gainers: MYX, ASTER, ZEC, QNT, MNT

Caribbean Finance & Crypto Highlight (September 21 - September 27, 2025)

CIBC Caribbean Bank (Bahamas): Q3 net income fell to $24.8M from $33M a year ago, pressured by higher credit loss provisions and taxes. Still, capital ratios are robust at 27.7%. Dividend of $0.09/share approved.

Grenada Green Energy Project: Government signed $18.5M agreements with GRENLEC to build a 10.6 MW battery system, a 15.1 MW solar plant, and grid upgrades. Expected to cut emissions, improve energy security, and support households and businesses.

Here are other key highlights from last week:

Morgan Stanley will enable Bitcoin, Ethereum and Solana trading via E*Trade.

Coinbase, Sony and Samsung back $14.6M round for Stablecoin startup Bastion.

Google dives deeper into Bitcoin mining by backstopping AI hosting deal.

Nansen launched a Claude-based AI assistant.

Trust Wallet launched a Web3 accelerator supported by Polygon, AWS, and others.

This week is packed with U.S. Economic News!

U.S. Government Shutdown Risk (Oct 1, 2025)

Congress has until midnight September 30 to fund the government. With no deal yet, a shutdown looks likely.

Why it matters:

Economic data blackout: Key reports like jobs and inflation may be delayed, leaving the Fed “flying blind” on rate decisions.

Growth hit: Shutdowns can shave 0.1–0.2 percentage points off GDP per week.

Sector impact: Federal workers could be furloughed, air travel may face delays.

Markets: Adds policy uncertainty and could weigh on investor confidence.

Key U.S. Economic Releases this week (September 29 - October 3):

Pending Home Sales (Mon.)

JOLTS Job Openings, Consumer Confidence (Tues.)

ADP Payrolls, ISM Manufacturing PMI (Wed.)

Jobless Claims (Thurs.)

Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings, ISM Services PMI (Fri.)

Fed Watch

Busy week with multiple FOMC members and Fed Vice Chair Jefferson on the docket. Markets will closely parse language around inflation risks vs. labour softness.

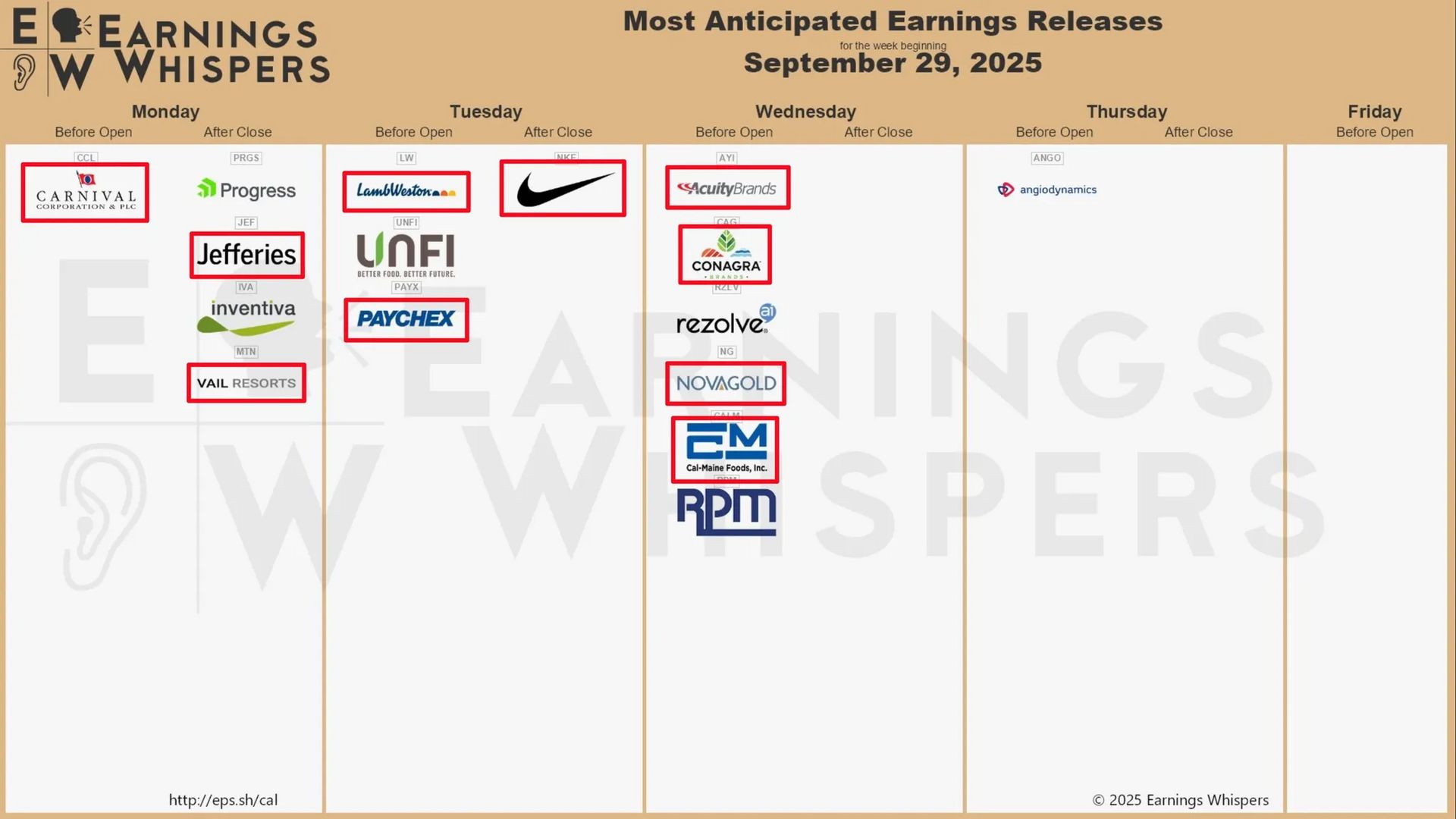

Earnings:

Medium-to-High Impact Global Economic Events This Week:

Tip:

Thursdays are anticipated to be bullish in October 2025

Week 9/21/25 - 9/27/25 Recap

Special Tools & Strategies - “Uptober” is Near!

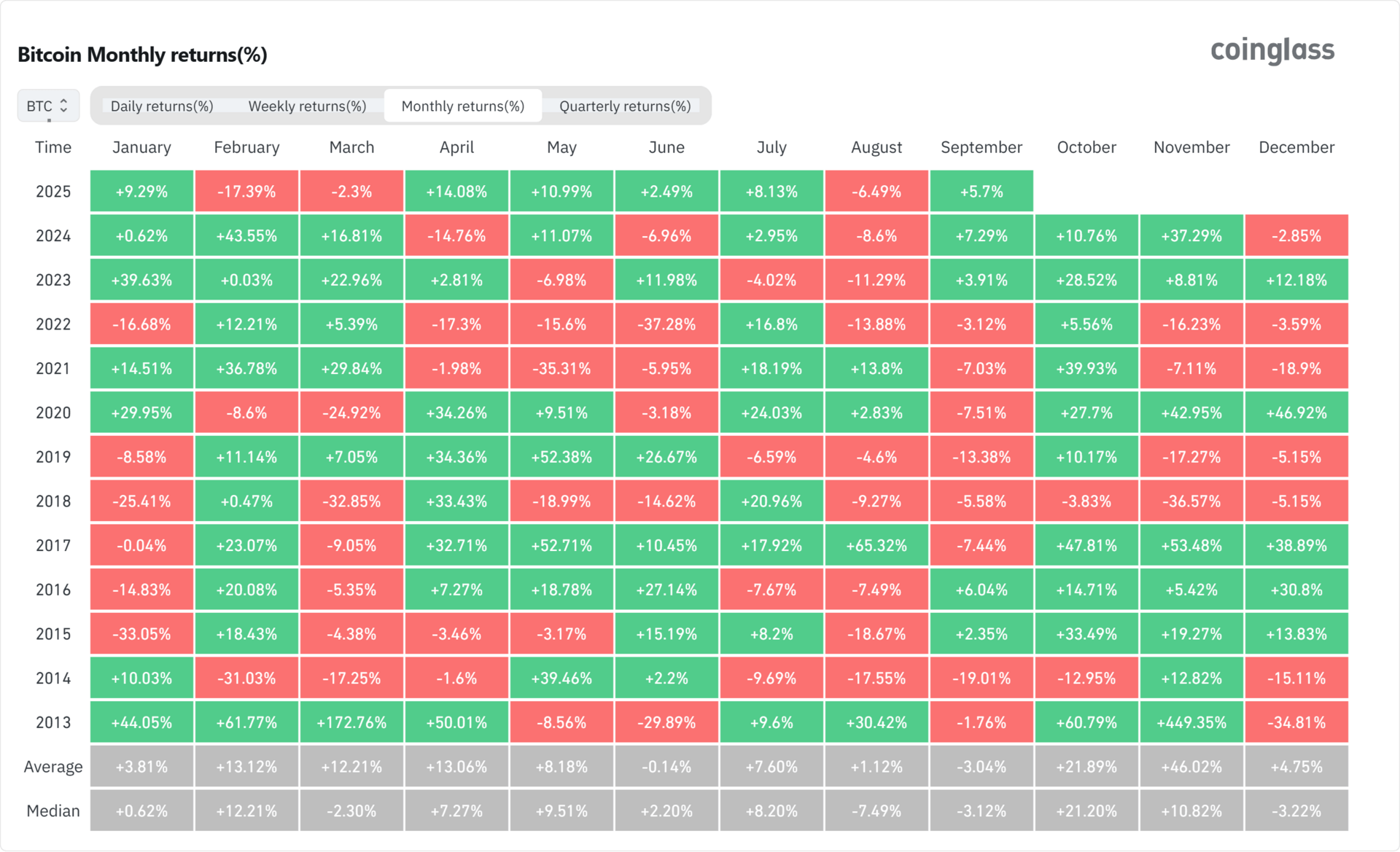

“Uptober” is the playful term used to describe Bitcoin’s tendency to perform well in October. From 2013 to present, Bitcoin has finished October in positive territory in 10 out of 12 years.

The chart below shows Bitcoin Monthly Returns (in%) and why October is one of the most anticipated months on the crypto calendar.

Six out of the 10 green years Bitcoin return was over 25%:

2013: +60.8%

2015: +33.49%

2017: +47.8%

2020: +33.49%

2021: +39.9%

2023: +28.52%

Even moderate rallies in 2016 (+14.71%), 2019 (+10.17%), and 2024 (+10.76%) gave investors healthy momentum heading into year-end.

The only exceptions (to date) were 2014 and 2018, when October followed a “Rektember” (a red September) with small losses.

This year, Bitcoin is set to close September with more than 5% in returns. A green finish matters. By sidestepping the usual September slump, the market enters October with a cleaner slate and a stronger setup for “Uptober.”

October has been the most favourable month for Bitcoin

October has this reputation because:

Seasonal trading flows: Investors often return from the summer lull ready to put money back to work

Portfolio adjustments: Institutions and funds position ahead of year-end

Narrative momentum: When traders expect October to be bullish, that optimism itself can attract more buyers

Of course, the past does not guarantee the future. Therefore, risk management is key.

Bitcoin price heading into October 2025

As of early September 30 2025, Bitcoin trades around $114,381, which is about 8.5% below its all-time high. This means the market is not panicking. If buyers can defend support at $109,000 and push through the strong resistance at $116,000, October could serve as a launchpad for the rest of the year.

Optimists point to history as a guide. Cautious voices remind us that one shock, such as an interest rate shift or global liquidity squeeze, can quickly break seasonal patterns. Both perspectives highlight the importance of flexibility.

The market rewards those who are patient

The lesson from Uptober is simple: patience pays, but preparation matters more. If Bitcoin builds on September’s green close, we could see another strong October rally. If you’ve been waiting for the right moment to learn how to buy crypto safely and confidently, now is the time.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.