- Rhoda Report

- Posts

- “Joyful Giving, Smart Spending!"

“Joyful Giving, Smart Spending!"

Issue #160

Hi There! I used to dread the holidays, because I couldn’t afford to celebrate them. The season would roll in with its lights and music, and instead of feeling joy, I felt anxious. Back then, debt sat on my shoulders like a wet blanket. I was already stretched thin as a single mother, trying to rebuild after divorce, pay bills on time, and trying to hold myself together. Adding holiday expectations on top of that was too much.

I remember turning down invitations because I could not afford to contribute a dish or buy a small gift. People would say, “Just come, don’t bring anything,” but that didn’t quiet the voice in my head reminding me I couldn’t even put ten dollars toward the potluck. I would show up empty-handed and smile, but deep down I felt like I was failing.

When you are filled with that kind of shame it grows silently, and it grows fast.

But one year, something shifted. I stopped trying to pretend. I went back to the way I was raised in Grenada, where generosity wasn’t measured in price tags but in presence. I remembered the holidays of my childhood were filled with laughter, storytelling, visiting friends, parang, and sharing what we had. My mother didn’t have much, but she loved to cook and she had a gift for making people feel welcomed, seen, and valued. Reminiscing on those moments softened me.

My view of the holidays while paying off debt changed. I stopped attaching my worth to what I could buy and started focusing on the pieces of myself I could give like my time, warmth, help, listening ear, and of course, my stories. When I finally had that “come-to-Jesus” moment, I showed up when I can with no pressure and no expectations. Just love.

From that moment, I made the decision that I was going to reclaim the season on my own terms. I started creating a holiday budget early in the year, putting aside tiny amounts every month. I explained to my daughter that her list had to be short. She understood, and honestly, she taught me that children don’t need grand gifts to feel loved. They need you.

Over time, I learnt to:

Shop throughout the year, especially at clearance sales at the end of each season.

Be creative.

Stay grounded in joy, peace, and connection, because these mattered the most.

You might be sitting with similar feelings this holiday season. Maybe you’re rebuilding after divorce. Maybe the bills have piled up. Maybe you’re behind on retirement and doing mental gymnastics trying to figure out how to stretch your paycheck. Or, maybe you’re just overwhelmed by the pressure to give when you can barely breathe.

Know this:

The best gift you can give your family and friends this year is a peaceful you!

You don’t have to impress anyone. You don’t have to drain your bank account. You don’t have to buy your way into the holiday cheer. What you can do is create a plan that’s within your budget and use it to make this season light again. You deserve that!

Choose joy that does not cost you your peace!

Alright, let’s dig in!

Last week, global equities finished lower as volatility resurfaced. Investors approached NVIDIA’s earnings with caution, and the weakness in United States tech spilled into Asia and Europe. Core bonds rose, commodities slipped, and the United States dollar strengthened again.

Even with NVIDIA posting strong results, AI bubble concerns kept pressure on markets. Fed rate cut odds for December stayed uncertain. Stocks managed a late bounce last Friday, but all three major United States benchmarks still posted weekly losses. Bitcoin slid deeper throughout last week.

U.S. Markets Recap (November 16 - November 22, 2025)

Equities:

Major United States averages ended lower after a shaky stretch driven by selling in AI linked names. Early in the week the S&P 500 dropped below its 50-day moving average for the first time in 138 sessions. An analyst downgrade on MSFT and AMZN added to the tension.

NVIDIA’s earnings last Wednesday night showed firm chip demand and solid guidance. Still, markets hesitated. Last Thursday delivered the largest intraday swing since April as traders stepped away from big tech and semiconductor stocks. Retail commentary from WMT, TGT, and HD reinforced consumer caution.

Rate cut odds rose after New York Fed Governor John Williams suggested the central bank may cut rates next month. That helped lift equities from weekly lows.

Gap jumped after reporting same store sales up 5% last quarter, helped by its viral Katseye campaign.

Fixed Income:

Core bonds, tracked by the Bloomberg Aggregate Index, traded higher. The Fed’s October meeting minutes showed limited support for a December rate cut, but markets focused on future balance sheet plans.

The Fed intends to shift more of its $4.2T Treasury holdings into shorter maturities. Today the portfolio is overweight longer term bonds, which has helped suppress long term yields. If the Fed reallocates toward shorter maturities, demand for 10 year and longer Treasuries may drop, keeping volatility elevated.

Despite the discussion, traders still expect the Fed to cut rates 3 more times by the end of 2026. Bond market reaction to the minutes was muted.

Commodities:

The commodities complex moved lower. WTI crude fell early in the week, then extended losses after reports that President Zelensky agreed to work on a United States backed peace plan that could allow more Russian fuel exports.

Gold was mostly unchanged as rising rate cut expectations offset weak demand from Asian buyers.

Currencies:

The United States dollar index rose +0.9% last week as traders moved into cash during the equity pullback.

Last week moves:

EUR/USD: -0.93%

GBP/USD: -0.57%

USD/JPY: +1.19%

U.S. Economic Recap (November 16 - November 22, 2025)

A backlog of delayed data arrived as agencies reopened.

September payrolls increased more than expected, with the unemployment rate stable but slightly higher. Previous months saw downward revisions, including a 4,000 job contraction in August. Continuing jobless claims reached the highest level since November 2021, signaling growing difficulty for workers seeking new roles.

Job growth remained concentrated. Health care and leisure and hospitality added 690,000 new positions in 2025, while the rest of the economy shed about 6,000 jobs. High rates and policy uncertainty kept many companies cautious.

The Bureau of Labour Statistics (BLS) confirmed that October employment and October CPI data will not be released. That leaves the Fed’s December 9 to 10 meeting dependent on older September data.

Consumer sentiment dropped sharply. The University of Michigan Index fell to 51 from 53.6 in October. One year inflation expectations came in at 4.5%, and long term expectations dipped slightly. Job loss fears reached the highest level since mid 2020.

S&P Global Flash United States Composite PMI rose to 54.8 from 54.6. Services rose to 55.0. Manufacturing eased to 51.9. Growth estimates point to about 2.5% annualized for Q4. Rising input costs, driven by wages and tariffs, signaled renewed inflation pressure. Business confidence improved on expectations of possible future rate cuts.

Government data still reflected a fragile backdrop. September payrolls rose 119,000 versus forecasts of 51,000, but gains were concentrated in health care and hospitality. Manufacturing and transportation cut jobs. Unemployment rose to 4.4%. Wage growth slowed to 0.2% month over month.

Global Markets Recap (November 16 - November 22, 2025)

Europe

European equities moved lower. AI related volatility spilled over from the United States, and attention turned to reports that the United Kingdom may increase bank levies in the 2026 budget. Germany saw slightly firmer producer inflation. Eurozone PMI data showed services improving and manufacturing softening. Corporate headlines featured buyback plans from BNP Paribas and Siemens Energy.

Asia

Asia Pacific markets declined. Taiwan and South Korea dropped more than 3.5%. Hong Kong fell 5%. Tension increased after Beijing issued travel warnings and paused Japanese seafood imports following remarks from Japan’s prime minister about defending Taiwan.

Japan approved its largest stimulus package since the pandemic, funded partly through increased bond issuance. China’s property support rumors failed to lift confidence. Both Japan and mainland China finished lower.

Crypto Recap (November 16 - November 22, 2025)

Bitcoin:

Risk off sentiment pushed crypto sharply lower. Bitcoin fell 10% Friday over Friday. It briefly broke below $81,000 before closing above $85,000. BTC is down 22% so far in November, the steepest monthly slide since the 2022 collapses.

A $19B liquidation wave on October 10 wiped out about $1.4T in asset value, followed by another $2B in liquidations last week. Spot Bitcoin ETFs posted more than $1B in outflows for a third straight week. Futures open interest fell 35% from October highs. A dormant wallet labeled Owen Gunden sold $1.3B in BTC over the past month.

Sentiment hit extreme fear. Bitcoin printed 11 consecutive lower lows, the longest stretch since 2010. Companies that mirrored corporate Bitcoin accumulation strategies began selling reserves to support share buybacks.

Options positioning added pressure. BTC fell below the heavily traded $85,000 strike, where dealers were short gamma. This forced additional selling as prices declined. Models point to possible stabilization near $80,000 where dealers turn long gamma, although thin liquidity limits confidence.

Ethereum:

ETH fell 13.88% for the week.

U.S. spot ETH ETFs saw $500.25M in outflows.

ETH slid from about $3,250 to about $2,650. ETF outflows acted as forced supply. Derivatives liquidations added another $400M to $430M in ETH long unwinds.

Short term targets adjusted into the $2,850 to $2,950 range. Long term projections remain near $4,200 to $4,500 within 12 to 18 months.

Last Week’s Top Gainers: BCH, MYX, RAIN, WLFI, PI

Here are other key highlights from last week:

Senator Tim Scott pushed for December vote on crypto market bill.

Crypto treasuries faced “High Hurdle,” premiums unlikely to hold.

Visa tested stablecoin payouts to speed payments for creators, gig workers.

Creator economy shifted focus from attention to fan ownership.

Yuga Labs unveiled Koda Nexus in The Otherside Metaverse.

Revolut integrated Polygon for payments, trading and staking, processing $690M.

It’s a short week in the markets!!!

Upcoming U.S. Economic News:

All scheduled for Tuesday and Wednesday:

PPI inflation

Retail sales

House price index

Pending home sales

Richmond Fed manufacturing index

Jobless claims

Durable goods orders

Chicago PMI

Core PCE inflation

Markets are closed for Thanksgiving.

Fed Speakers:

None scheduled.

Earnings:

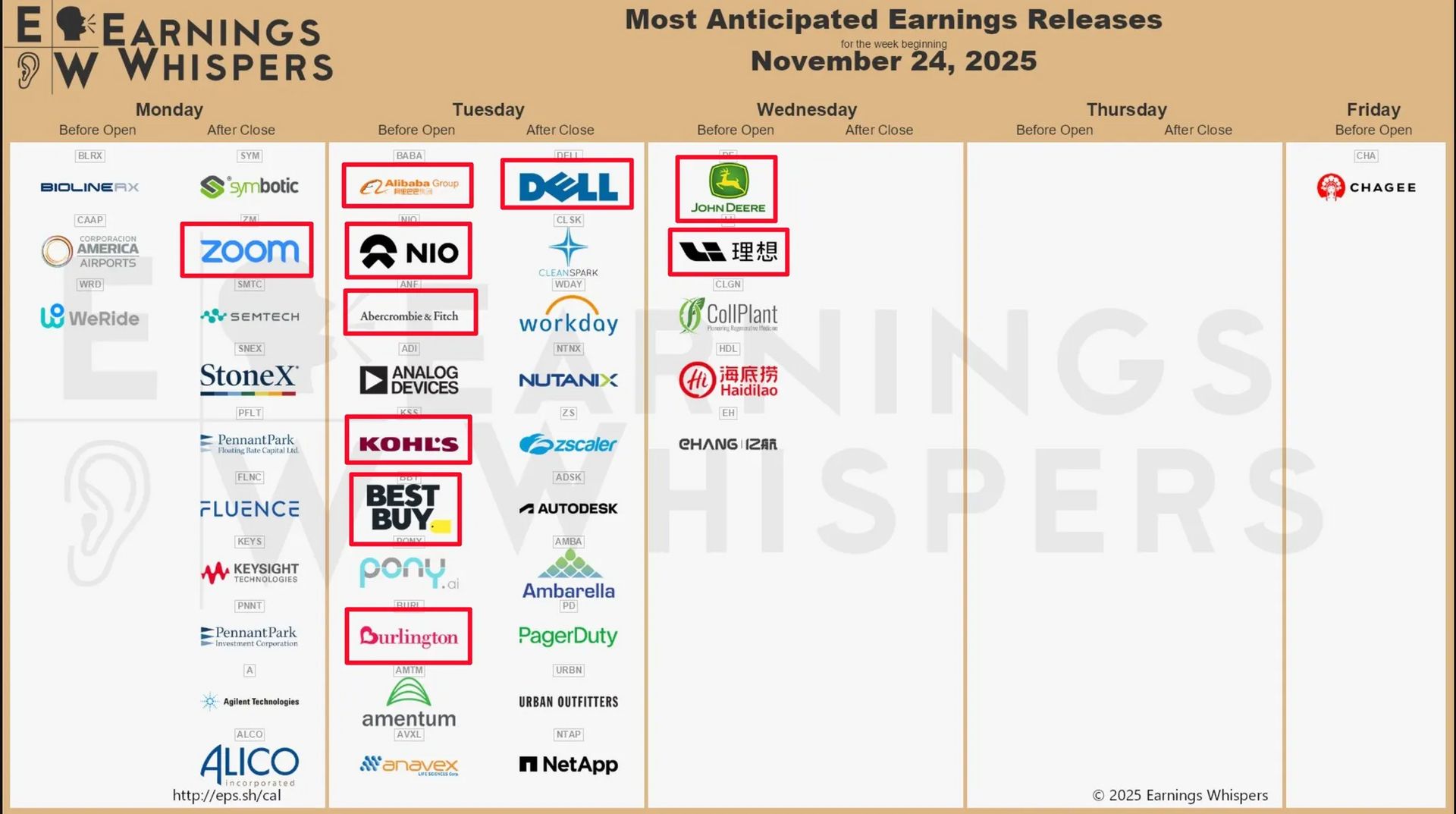

Notable Earnings Releases are shown in the chart below.

Medium-to-High Impact Global Economic Events This Week:

Trading Tip: 3 Keys to Picking Tradable Assets

Day traders exploit small price movements using leverage, and they focus on three essential factors when selecting assets. First, they need liquidity for easy entry and exit at fair prices with minimal slippage. Second, they look for volatility because larger price swings create more profit potential, though with added risk. Finally, high trading volume confirms market interest, and volume spikes often signal incoming price moves. Without strong liquidity, volatility, and volume, you're trading at a significant disadvantage.

Week 11/16/25 - 11/22/25 Recap

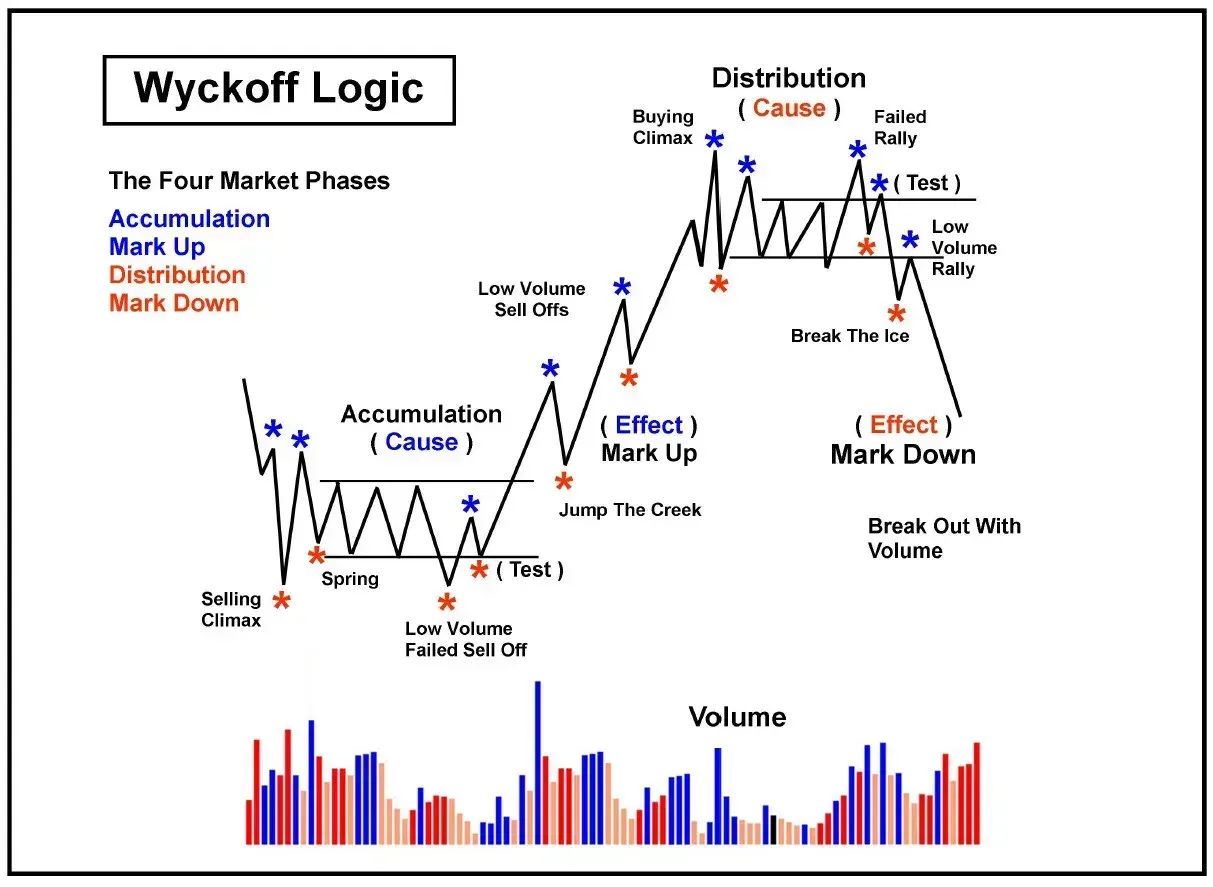

Special Tools & Strategies - Wyckoff Logic Explained

I remember the first time I stumbled into a choppy market thinking I was about to catch the perfect breakout. The chart looked strong, volume looked healthy, and social media was screaming “buy.” Ten minutes later, that breakout turned into a trap and the price sank right back into the range. I was frustrated, confused, and felt played.

When I discovered Wyckoff Logic, the light bulbs went on. I finally understood how smart money moved and stopped trading emotionally.

The Core Wyckoff Concepts

Wyckoff teaches traders to imagine one powerful market player controlling price. She buys when the public is fearful, and she sells when the public finally feels confident.

She leaves footprints on the chart that you can learn to spot.

Once traders start thinking about the market in terms of what she is doing, their confusion drops and timing improves.

The Three Fundamental Laws

1. Law of Supply and Demand

Prices rise when demand exceeds supply, fall when supply exceeds demand, and move sideways when they’re balanced.

2. Law of Cause and Effect

Sideways ranges (accumulation or distribution) create the “cause.” The breakout afterward is the “effect.”

Longer cause, bigger effect.

3. Law of Effort vs. Result

Volume is the effort. Price is the result.

If the effort increases but the result is weak, something is off.

This imbalance often signals reversals.

The Four Market Phases

1. Accumulation

After a downtrend, smart money quietly buys at low prices. Retail is scared. Price moves sideways. Key signs include:

Selling Climax

Automatic Rally

Secondary Tests

Spring and Test

This is the “cause.” It’s the foundation for the next uptrend.

2. Markup

Once accumulation ends, demand exceeds supply. Price begins a clean uptrend. You see:

Strong breakouts

Higher highs and higher lows

Pullbacks on low volume

Retail traders start chasing here.

You, if you understand Wyckoff, already got in early.

3. Distribution

At the top, smart money lets go of their positions while retail traders eagerly buy. Price moves sideways again. Signs include:

Buying Climax

Upthrusts

Weak rallies

Fake breakouts

This is another “cause” building, but this time it leads downward.

4. Markdown

Distribution finishes, and selling pressure dominates.

Price drops consistently. Weak rallies fail. Volume confirms the trend.

Retail panics.

The cycle prepares to repeat.

How a Beginner Trader Can Start Using Wyckoff Today

1. Identify the Market Trend

Zoom out. Is the S&P 500 trending up, down, or flat?

Trade with the market, not against it.

2. Choose Assets Aligned With the Trend

In a bull market, look for assets showing accumulation.

In a bear market, look for assets showing distribution.

3. Spot Accumulation or Distribution Ranges

These sideways ranges are the clues that smart money is positioning.

Watch price and volume behavior closely.

4. Identify Key Wyckoff Events

For example:

A Spring in accumulation

A UTAD (Upthrust) in distribution

These events can be the turning points.

5. Enter With Structure and Manage Risk

Enter after confirmation (like a Spring Test or a Sign of Strength).

Place stops outside the range to avoid noise.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.