- Rhoda Report

- Posts

- “Love, Legacy, and Money: The Financial Wellness Audit!"

“Love, Legacy, and Money: The Financial Wellness Audit!"

Issue #170

Hi There! I don't know about you, but I feel like the month of January flew by like Usain Bolt in a 100m dash. One minute I’m ringing in 2026 to the sounds of sweet soca near the beach, and the next, I’m staring at the calendar like it ate the last 31 days while I wasn't looking. If you’re feeling a little breathless trying to keep up with your resolutions, don’t worry, you are right where you need to be.

Happy February! We are officially in the month of Love (Valentine’s Day is looming!) and Legacy (Black History Month). There is no better time to fall back in love with your future, and this month is all about honouring the past by securing that future.

I know the financial world can feel like a private club. They talk in acronyms, sprinkle in fancy terms, and somehow you’re expected to nod like you grew up reading balance sheets for bedtime stories. Between the jargon and the blatant gatekeeping, it’s easy to feel overwhelmed or like you’re already behind. This is exactly why I created the Rhoda Report. I wanted to tear down those walls and build a space where we can learn out loud, ask “basic” questions without shame, and grow together (each one, teach one). In this house, I believe in making the complex simple. So, if you’re getting value here, don’t keep the wealth to yourself, subscribe and share this with somebody you want to see win.

Legacy is built in community, not isolation. As I pondered on this, I realized there is a question we don’t ask enough:

Do you love yourself enough to build a legacy?

I’ve said it in previous issues and I will say it again: building wealth is light on the math and heavy on the mindset. As we honour the giants whose shoulders we stand on this month, Maggie Lena Walker from Richmond, Virginia, is a powerful example of how self-love can lead to legacy. In 1903, at the age of 39, she became the first African-American woman to charter a bank in the U.S. Her mission was simple yet revolutionary: "turning pennies into dollars." She didn’t just talk about empowerment; she lived it. She founded and served as the president of the St. Luke Penny Savings Bank to provide loans to Black community members who were routinely denied by white banks.

Maggie didn't just open a bank; she taught herself finance first. History tells us she spent hours studying accounting and business management, often late at night, because she knew that financial literacy was her armor. By 1920, her bank had helped over 600 families buy homes, and by the time of her death, the bank had assets of over $1 million, all built on the "pennies" of her community.

Maggie Lena Walker’s success shows us that self-love is the foundation of wealth. Loving yourself enough to learn the “boring” stuff is the first step toward breaking generational cycles. While the world prepares to spend a projected $25.9 billion ($200 per person) on Valentine’s Day this year (according to the National Retail Federation), I want to challenge you to invest some of that "love" into your own future.

Your Money Move: The Financial Wellness Audit

Maggie started with small deposits (nickels and pennies). You don't need millions to start; you just need to start. This week, perform your own financial wellness check:

Log into every single account you have (bank, credit cards, retirement, brokerage, and crypto).

Write down the totals. Yes, even the negative ones. You can't fix what you won't face.

Calculate your Net Worth. (Assets minus Liabilities).

Forgive yourself. Let go of any past financial "mistakes." They were just tuition payments for the lessons you're using now.

Maggie L. Walker faced a world that told her she "couldn't." She did it anyway. If she could turn pennies into a banking empire in 1903, imagine what you can do in 2026 with the tools in your pocket.

Love yourself! Learn the numbers! Build the legacy!

Alright, let’s dig in!

Capital markets had a lot to digest in the final full week of January: big earnings, fresh Fed messaging, swirling headlines out of Washington, and sharp moves in commodities and Forex. U.S. stocks finished mostly lower after giving back early week gains as AI spending scrutiny reappeared and investors processed the nomination of Kevin Warsh to succeed Jerome Powell as Fed Chair. Europe stayed steadier, extending a strong monthly run, while Asia closed mixed as yen strength pressured Japan’s exporters. In currencies, the story of the week was a softer dollar and a stronger Yen, even though both reversed part of their moves by Friday. Plus Crypto saw a decline as Bitcoin dropped below $80K.

U.S. Markets Recap (January 25, 2026 - January 31, 2026)

Equities:

Stocks ended the final week of January mostly lower, but the bigger picture is that major indexes still managed to bank January gains. Last week started with strength. The S&P 500 pushed to a fresh all time high after a rotation back toward index heavyweights. However, the rotation had a cost, small caps got dented as money flowed back into the big names.

Then the tone shifted. The Fed held rates steady, and the statement changes did not meaningfully move rate cut expectations. The volatility arrived last Thursday with a tech driven sell off as investors started interrogating AI spending again. Microsoft (MSFT) was among the hardest hit after spending guidance moved higher while Azure growth came in slightly short. The combination triggered the question markets hate most: how long can the AI fueled rally stay this expensive?

Not all big tech was treated the same. Meta (META) surged on the back of AI monetization tailwinds, which helped cushion broader sentiment. Apple (AAPL) beat estimates but flagged rising storage costs, and shares ended moderately lower Friday. SanDisk (SNDK) extended its strong start to 2026 after an upbeat revenue and earnings outlook. The final Friday of January also brought a curveball: video game stocks sold off after Google released an AI world building tool that stoked fears about disruption in game development workflows.

Fixed Income:

Core bonds, measured by the Bloomberg Aggregate Index, changed very little last week. The Fed held short-term rates steady at the January FOMC meeting and framed growth and inflation risks as more balanced. Translation: the hurdle for additional cuts looks high, and the bond market reaction suggested the decision was already priced. Going into the meeting, the probability of a cut was barely above 0%.

The Treasury curve had been flattening this year as rate cut expectations were priced out, which made the front end more compelling because shorter yields stayed attractive. Then the Fed Chair nomination hit. After President Trump nominated Kevin Warsh, the curve steepened, with shorter maturities falling while longer yields ticked slightly higher as markets started pricing in more cuts this year.

Warsh served as a Fed governor during the 2008 financial crisis and is known for a more disciplined posture on monetary policy, with concerns about long run balance sheet expansion and “groupthink” at central banks. If confirmed, he steps into a divided Fed and could push for faster cuts even with inflation still somewhat elevated.

Commodities:

Commodities edged higher overall, and the complex quickly became one of last week’s hottest topics. Precious metals were a perfect example of how fast sentiment can flip. Gold and silver erased strong weekly gains late week as the dollar strength accelerated their pullback. Gold briefly surpassed $5,500 per oz and silver touched $120 per oz earlier last week before reversing.

In energy, WTI crude traded higher as talk of potential U.S. military action against Iran kept traders on edge. Natural gas rose again on another round of winter weather forecasts for the U.S. East Coast.

Currencies:

Forex (FX) delivered real movement, with the dollar facing outsized pressure as the yen (¥) strengthened on speculation that Japan could intervene to prevent further weakness. Reports that Washington may support those efforts added fuel to the volatility. By the end of last week, the dollar posted its best day, since last July, on the Fed Chair nomination news, while the yen gave back nearly 1% of its weekly advance.

U.S. Dollar Index -0.62%

EUR/USD +0.19%

GBP/USD +0.32%

USD/JPY -0.61%

U.S. Economic Recap (January 25, 2026 - January 31, 2026)

The Fed delivered something markets have been craving: slightly more consensus. The FOMC voted 10 to 2 to keep rates unchanged, with Waller and Miran dissenting in favour of a cut. The statement itself carried important tone shifts:

Labour markets are now framed as stabilizing, a contrast from the December read of ongoing weakness.

The Fed removed language about “downside risks to employment,” which lines up with mixed signals: low unemployment claims but also low hiring rates.

The “shifting balance of risks” language was removed, which matters because it affects how the market builds expectations for future meetings.

With inflation and employment risks framed as more balanced, a March policy change looks unlikely. March will include an updated summary of Economic Projections, and the expectation is that the first cut comes later in 2026 as housing pressures ease and businesses move past tariff passthrough dynamics.

Global Markets Recap (January 25, 2026 - January 31, 2026)

Europe:

The STOXX 600 posted a moderate gain and extended its longest monthly win streak since August 2021. A major macro highlight was the EU and India concluding a free trade agreement after roughly 20 years of negotiations, which helped sentiment.

Corporate stories drove the tape:

ASML gained after strong orders and a €12B buyback plan.

Swatch jumped as investors looked past a sizable EBIT miss and leaned into 2026 growth guidance.

Adidas and Electrolux posted profits that came in better than expected.

On the downside, consumer discretionary was pressured after LVMH reported a larger than expected decline in leather goods and fashion sales, cooling hopes of a luxury rebound.

Asia:

Asian equities finished mixed, with Japan in the spotlight for the wrong reasons. The Nikkei and Topix fell sharply as exporters were hit by the stronger yen and rising intervention chatter. South Korea moved the other way, powered by tech strength after SK Hynix posted strong results and was identified as the sole high bandwidth memory provider for Microsoft’s AI chips. In greater China, mainland markets were mixed to little changed as property stocks cooled after an earlier lift tied to easing developer regulations, while Hong Kong rallied amid chatter about inflows linked to the dollar weakness.

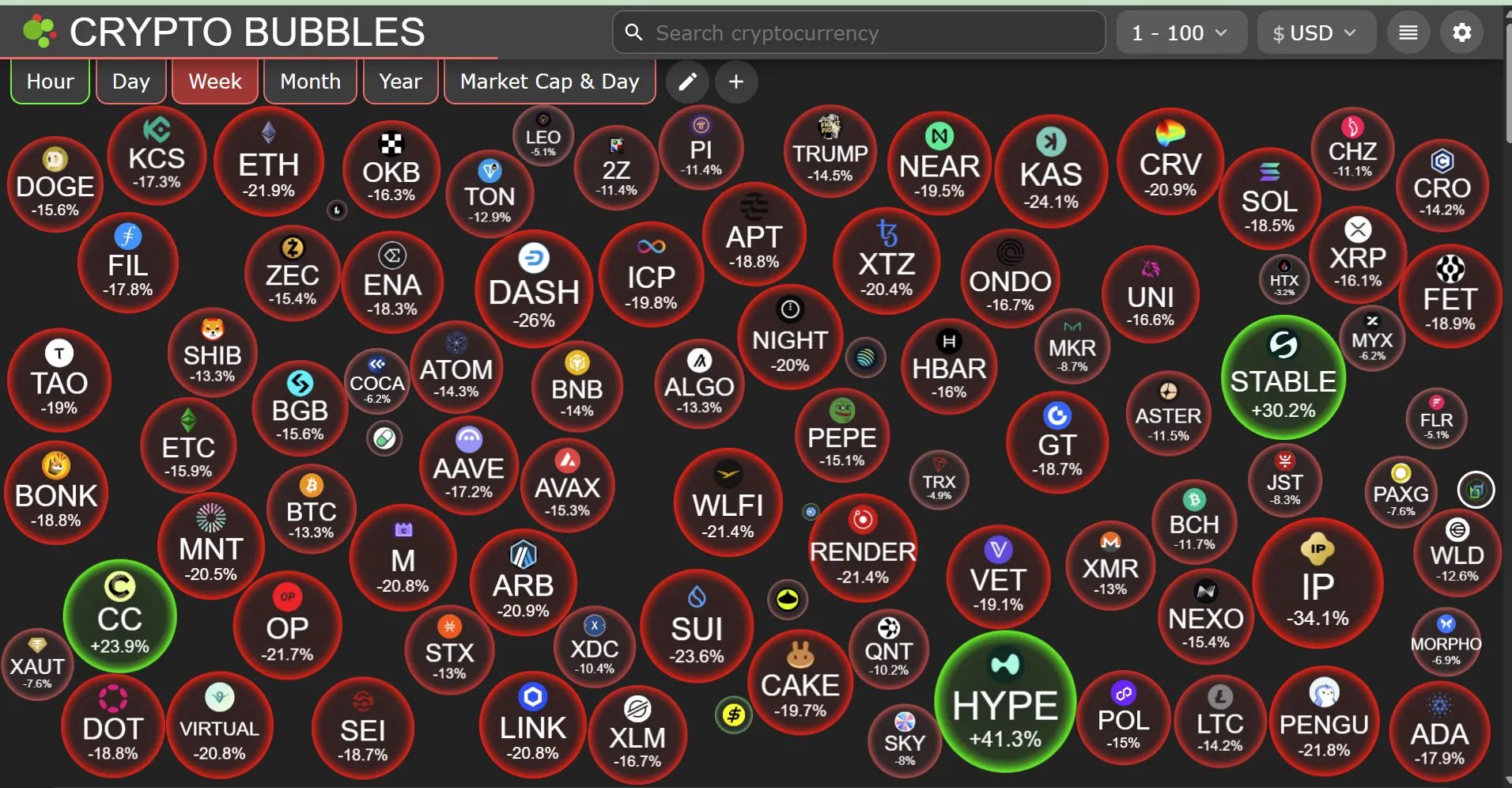

Crypto Recap (January 25, 2026 - January 31, 2026)

Last week, the crypto markets extend their downturn, with the total market cap dipping to around $2.77T amid extreme fear (Fear & Greed Index at 20). Bitcoin slid about 11% to test $76K-$83K levels, Ethereum dropped about 17% below $2.8K, and other altcoins like Solana followed suit, driven by heavy liquidations exceeding $1B on peak days and a broader risk-off sentiment.

Major events included:

Regulatory progress on the Digital Asset Market Clarity Act, with Senate committee advancements and White House meetings between banks and crypto firms to resolve stablecoin reward disputes, though no agreement was reached, highlighting ongoing tensions.

VC funding hit $244M across 14 deals, led by Mesh's $75M Series C for crypto infrastructure.

Tether froze $182M in USDT linked to illicit activity.

OpenAI eyed a Q4 2026 IPO amid AI-crypto hype.

Corporate moves: GameStop speculated on selling BTC holdings; El Salvador added $50M in gold (diverging from crypto); Binance converted $1B SAFU fund to BTC.

Token launches/unlocks: Infinex TGE, Plasma unlock adding supply pressure; Hyperliquid's trade volume hit $2B ATH.

Closures: Nifty Gateway NFT platform shut down.

Top crypto gainers (last week): STABLE, HYPE, CC

Here are other key crypto highlights from last week

Circle targets ‘durable’ infrastructure to drive institutional stablecoin adoption.

VanEck expanded crypto ETF lineup with spot Avalanche product.

Sony doubled down on Soneium after first year of mainnet activity.

Polygon is building an open, interoperable payments stack that works end to end.

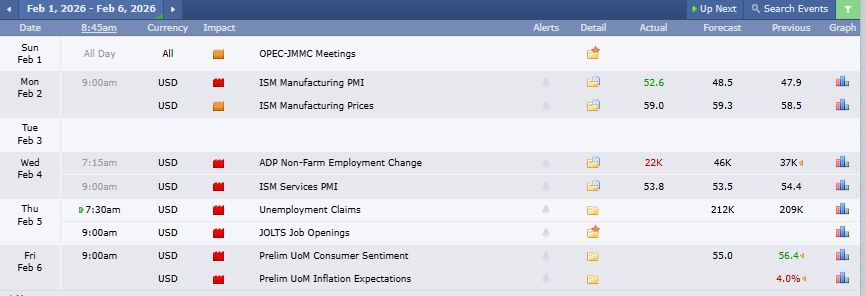

This week is labour-heavy!!

If the labour data comes in hot, hopes of a rate cut can get shoved out again. If it comes in soft, risk can bounce, but watch whether the market trusts the “softness” or labels it noise.

Key U.S. economic releases, with their projected and actual data, are shown below in the table below.

Events to Watch

Ongoing market digestion of the Kevin Warsh Fed Chair nomination and what it implies for cuts, balance sheet policy, and internal Fed dynamics.

Shutdown related volatility and any signs of resolution or escalation.

Any Iran related headlines that can spill into oil and broader risk sentiment.

Fed Speakers:

Monday: Bostic

Tuesday: Barkin, Bowman

Wednesday: Cook

Thursday: Bostic, Musalem

Friday: Jefferson

Earnings:

There are 128 S&P 500 companies reporting earnings this week, including Alphabet on Wednesday and Amazon on Thursday, with attention on the high profile names listed in your chart. Pay attention to guidance and margins, especially any language about AI-related spending discipline and monetization timelines. This is the pressure point markets exposed last week.

Notable earnings releases are outlined in red below.

Medium-to-High Impact Global Economic Events This Week:

Tip for the Week:

Keep your focus tight this week by tracking just two (2) drivers instead of chasing every headline: labour data and big tech earnings. If you are trading, set your max loss for the week before the heavy news days on Wednesday and Friday so volatility does not catch you unprepared. If you are investing, separate short-term headline fear from real fundamental change, and use risk off weakness as a moment for patience and a staged entry plan rather than impulsive buys or panic selling.

Week 1/25/26 - 1/31/26 Recap

Special Tools & Strategies

Advance/Decline Index: How to Tell if the Market Move is Real

I still remember the first time I heard a TV anchor say, “The market is ripping higher,” and I looked down at my watchlist and thought, “So why do my stocks look red?” Back then, I assumed I was doing something wrong. Later I learnt something that saves traders a lot of stress: an index can be pushed around by a handful of huge stocks while most of the market is doing the opposite.

This is why the Advance/Decline ne Index matters. It is a simple way to check whether the whole market is participating, or whether a few big names are doing all the lifting.

What are advances and declines in the stock market?

Every trading day, stocks on an exchange either close higher than the prior close, or lower.

Advances: the number of stocks that finish up on the day

Declines: the number of stocks that finish down on the day

This is called market breadth, meaning: “How broad is this move?” The advance/decline line can be described as a sentiment indicator that compares the number of advancing stocks to declining stocks and helps confirm trends or signal possible reversals.

Two common tools come from this data:

Advance/Decline Ratio: advances divided by declines help you see whether most stocks are rising or falling.

Advance/Decline Line: a running total of net advances (advances minus declines) that rises when breadth is positive and falls when breadth is negative.

How beginners can use advances and declines to enter and exit trades or investments

Think of the market like a parade.

If the band, the dancers, and the crowd are all moving in the same direction, the move has support.

If only the lead truck is rolling forward and everyone else is backing up, the “parade” can reverse fast.

Here is how to use that idea with SPY (the S&P 500 ETF):

For entries (buying):

If SPY is pushing up and advancers clearly beat decliners, you are getting confirmation that the move has participation.

If SPY pulls back a bit but breadth stays strong, that often becomes a cleaner entry than chasing a headline candle.

For exits (selling or tightening risk):

If SPY keeps making new highs while breadth weakens, you stop adding risk and start protecting profits.

If decliners dominate repeatedly, it tells you selling pressure is widespread, even if the index has not fully rolled over yet.

What to look for: key patterns, red flags, and indicators

Use this like a TV-friendly checklist. You can follow it on CNBC or Fox Business when they mention “market internals,” or on many brokerage dashboards that show advancers and decliners. If your platform has charting, you can also pull up advance decline lines like the NYSE A/D Line on StockCharts.

What to look for | Bullish interpretation (Enter or Hold) | Bearish interpretation (Exit or Sell) | Tips for beginners |

|---|---|---|---|

Advancing issues vs Declining issues | Advancers clearly lead decliners, meaning broad participation | Decliners lead, meaning selling pressure is broad | On TV, this is often shown as “advancers vs decliners.” You are looking for a clear win, not a photo finish. |

Advance/Decline Ratio | Ratio above 1 suggests more stocks rising than falling | Ratio below 1 suggests more stocks falling than rising | Traders compare this to index moves to see if a minority is driving the rally. |

Advance/Decline Line trend | A/D Line rising along with SPY is healthy confirmation | A/D Line flattening or falling while SPY rises is a warning | The A/D Line is built from net advances and is cumulative, so it is great for trend confirmation. |

Divergence | SPY and A/D Line both make higher highs | SPY makes new highs but A/D Line does not | Divergence is described as a key way the A/D line signals weakening participation. |

Exchange check | NYSE breadth supports broad market strength for SPY | Nasdaq breadth weak while SPY holds up can warn of tech drag | Use NYSE breadth as your general “market health” gauge and Nasdaq breadth as your “big tech weather report.” |

A specific example you can picture in real time

Let’s say SPY is green and pushing toward the high of day. On a business news segment, you see market internals flash up:

Advancers: 2,700

Decliners: 1,000

This indicates broad participation. It suggests the move is not just one or two mega caps doing the work. This is when “buying a pullback” in SPY or holding a good AAPL or AMZN swing tends to make more sense than panicking.

Now flip it:

SPY hits a fresh high, but advancers and decliners are about even, or decliners are winning.

This is an indication of a trap zone. Price looks strong, but the market’s “supporting cast” is not showing up. In that environment, you do not chase. If you are already in, you tighten your stop or take partial profits.

Key Takeaway

The Advance Decline tools keep you from getting hypnotized by a green headline. SPY can be up because a few mega cap names are pulling the index higher, but advancers vs decliners tells you whether the broader market is actually participating. When breadth confirms the move, you can hold with more confidence and look for pullback entries instead of chasing. When breadth diverges and weakens while price pushes higher, that is your warning to tighten risk, take partial profits, or stop adding new exposure. Used this way, the Advance Decline Line and Ratio act like a market health check, helping you separate real strength from a rally that is being propped up.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.