- Rhoda Report

- Posts

- “Rebuilding From Rock Bottom!"

“Rebuilding From Rock Bottom!"

Issue #159

Hi There! When I was deep in debt, saving even $5 felt like a luxury. I was paying off what felt like a mountain: the credit cards, car repairs, loans I'd co-signed, and the lingering costs of a divorce that had shaken every corner of my life. Each payday, I'd watch my salary appear in my account and disappear almost instantly. By the time the dust settled, I was staring at a negative balance with a deep sense of shame.

Back then, the idea of saving was almost laughable. I'd see advice about having three to six months of emergency savings and think, "With what money?" My mind was focused on survival, not security. I was robbing Peter to pay Paul. Every dollar I made already had a name attached to it, and it wasn't mine.

I didn't realize it at the time, but my mindset of constantly reacting and feeling behind was a bigger burden than the debt itself. I was broke financially and emotionally. I was always afraid that one unexpected expense could unravel everything (again). It's a hard space to live in, and I know many women find themselves there, holding it all together while silently wondering how long they can keep juggling.

The shift came when I stopped seeing saving as punishment and started seeing it as protection. I realized I could do both: pay down my debt and save. I started setting aside $5 from each paycheck. At the time, it was all I could manage, but it was something. It gave me a sense of control in a season when everything else felt uncertain.

I remember opening my online, high-yield savings account with Ally Bank. Before I did anything with my paycheck, a small amount was automatically transferred to that account. At first, it was $5, then $10, then $25, then more. Over time, it became a routine. I created my own formula for rebuilding. Eventually, that account grew into months of expenses. When unplanned expenses hit, I didn't crumble. I handled it.

The small decision gave me breathing room. It taught me that saving is all about momentum. It's the discipline of paying yourself first, no matter how small the number looks. The little deposits added up and gave me reassurance.

You might be in that same place right now, feeling stretched thin, telling yourself there's nothing left to save. I understand. I promise you, something shifts when you start putting a little aside for your future self, even if it's just $1 or $5. The act in itself is really you saying, "I believe there's a future worth protecting."

The more I think about it, the phrase "emergency fund" insinuates that you are surviving the next crisis. So, change the name. Call it your "Peace Fund," meaning a savings fund that will help you reclaim your peace of mind. It's the foundation for every other financial move you'll make.

So, if you're reading this and already have a "Peace Fund," congrats! If you're nodding along and stressed that you don't, it's not too late. Here is your assignment:

Open a separate account.

Call it your "Peace Fund."

Automate your transfer.

Start small, be consistent, and watch how it changes not just your finances, but your entire being.

Alright, let’s dig in!

Last week, markets closed mixed after tech sentiment swung back and forth, dragging major indexes with it. The end of the government shutdown should have been a relief, but it barely moved the needle since so much of the economic data pipeline remains jammed. With several reports delayed and some likely never published, investors were left trading without the usual signals. Treasury yields pushed higher in an abbreviated week and commodities strengthened as metals found support again.

The Nasdaq had a dramatic comeback last Friday, rising from deep morning losses to finish in the green. Not every name enjoyed the rebound. StubHub slid sharply after reporting a quarterly loss and refusing to offer guidance for the next quarter.

U.S. Markets Recap (November 9 - November 15, 2025)

Equities:

Stocks ended last week with little change, despite strong early momentum. Hopes around the shutdown ending helped lift confidence early on after the Senate advanced a Continuing Resolution and President Trump signed the stopgap bill. The reaction was muted though since markets had already priced in the reopening.

The bigger challenge came from the week’s swift shifts in artificial intelligence enthusiasm. The S&P 500 held gains through last Wednesday but met another wave of selling as hawkish comments from Fed officials and fading expectations for near term rate cuts unsettled investors. With no government data to anchor expectations, uncertainty grew around the Fed’s path into December.

Last Thursday saw a sharp unwind in momentum trades. Large tech names, retail favourites, short interest clusters, and high beta stocks were all hit. Last Friday opened with more volatility, but buyers stepped back in and the S&P 500 managed to climb above the weekly flatline thanks to a selective tech rebound.

Fixed Income:

Core bonds drifted lower as Treasury yields moved higher across the curve. The Treasury Quarterly Refunding Announcement came mostly as expected. Auction sizes for nominal coupons and floating rate notes will stay the same this quarter, but officials signaled that future coupon increases are likely. Markets now expect the next round of coupon hikes in February 2027.

The Treasury Borrowing Advisory Committee (TBAC) voiced support for higher front end coupons and slightly smaller bill sizes. Treasury buybacks will continue at the same size and frequency, which is important because more than 90 percent of outstanding Treasury issuance is off the run. These buybacks have helped improve liquidity and calm rate volatility over the last six months.

Auction activity was mixed. Last Monday’s $58B 3 year auction was the strongest of the year with a bid to cover ratio of 2.85 and indirect bidders taking 63%. The 10 year and 30 year auctions later in the week tailed slightly by 0.6 and 1.0 basis points, showing demand that was steady but not impressive.

Commodities:

The commodities sector finished broadly higher. Crude oil slipped sharply midweek as inventories rose for the second straight week and the curve approached contango (market condition where the price of a futures contract for a future delivery date is higher than the current spot price), but prices still posted a weekly gain after a reported Ukrainian drone strike on Russia’s Novorossiysk export hub raised supply concerns.

Silver and copper strengthened, and gold found support from a weaker dollar, renewed speculation around a Fed rate cut, and steady demand from investors nervous about European fiscal risks.

Currencies:

The dollar weakened as traders reassessed the economic outlook and waited for clearer analysis on delayed data releases. Losses were limited by continued fiscal concerns in the United Kingdom.

EUR/USD: -0.10%

GBP/USD: -0.14%

USD/JPY: -0.01%

U.S. Economic Recap (November 9 - November 15, 2025)

The shutdown continued to disrupt the economic calendar. Inflation data, retail sales, and other core releases were missing, leaving a notable void. Even though the funding bill passed, the White House confirmed that October inflation and employment data are still unlikely to be published. This complicates the Fed’s preparation for the December meeting. They are not entirely in the dark, but visibility is limited.

ADP and other private data sources suggest the labour market is cooling. When smoothed out, both ADP and BLS trends point to a weakening job market. This puts pressure on the Fed to keep the rate cutting cycle moving.

The government officially reopened after President Trump signed the bill ending the 43 day shutdown. The closure halted food assistance, disrupted air travel, furloughed hundreds of thousands of workers, and created significant economic drag. The Congressional Budget Office estimated a hit of roughly 1.5 percentage points to Q4 real GDP growth. About half may be recovered in early 2026, but the rest is permanently lost.

Congress passed the short term measure with a 222 to 209 vote. Funding runs through January 30 for most agencies and through September 30 for key social programs. The package did not include the ACA premium subsidy extensions sought by Democrats. With the government open again, agencies have begun returning to normal operations and workers will receive back pay starting Saturday.

The data blackout remains a major issue. The Bureau of Labour Statistics (BLS) will release an incomplete October jobs report without the unemployment rate because the household survey was never conducted. Some datasets, including the October CPI, may never be released. The BLS may have to combine two months of data into a single future report.

Global Markets Recap (November 9 - November 15, 2025)

Europe

European stocks posted solid weekly gains as optimism around the U.S. shutdown ending supported early buying. France outperformed after lawmakers put pension reform on hold, reducing the risk of political upheaval. The Bank of France nudged fourth quarter growth expectations higher. Germany also improved thanks to cooler inflation data and strong results from Infineon and Bayer. Switzerland rallied on news of progress toward a U.S. trade agreement. The United Kingdom lagged due to weak economic data and growing pushback against the upcoming budget.

Asia

Asian markets ended mixed after tech stocks saw their largest single day drop since April on Friday. South Korea absorbed the biggest hit but still managed a weekly gain despite record foreign investor outflows. Taiwan fell after earlier advances. China erased weekly gains after a Friday selloff driven by weak industrial production and retail sales numbers. Early week enthusiasm around Alibaba’s planned app overhaul supported Hong Kong. Japan led gainers on yen weakness and improved sentiment among manufacturers.

Crypto Recap (November 9 - November 15, 2025)

Total market cap: $3.21T

Crypto Fear and Greed Index: 10 (Extreme Fear)

Bitcoin dominance: 59.56%

Bitcoin:

Last week, Bitcoin fell 8.5% Friday over Friday and dropped below $95,000. Spot Bitcoin ETFs saw nearly $900M in outflows last Thursday. Leverage wiped out aggressively as long liquidations climbed throughout the week. Liquidity has thinned and market depth is down about 30% from yearly highs. As of today, Wednesday November 19, Bitcoin fell to $88,630.70, its lowest level since April.

Derivatives traders shifted into defensive positioning. Put open interest at $85,000 and $90,000 now exceeds call open interest at $120,000 and $140,000, the opposite of earlier in the year.

Last Week’s Top Gainers: TEL, AB, STRK, ZEC, DASH, ASTER

Here are other key highlights from last week:

Square Bitcoin Payments is Live, bringing Bitcoin to millions of merchants.

Chainlink said it finally solved crypto’s $3.4 trillion problem.

Nationally chartered bank SoFi rolled out crypto trading for US customers.

NFT and memecoin markets recovered after month-long crypto slump.

The world’s largest funds network (>£250B txns/month) integrated with Polygon.

All markets are riding on Nvidia (NVDA) this week!!!

Key U.S. Economic Releases this week:

So far:

The November Empire State Manufacturing Index surged to 18.7, well above expectations of 6.1 and the highest reading since November 2024. This points to firm activity in New York State.

The Fed minutes showed a split committee. Many officials believe a December rate cut is not appropriate, while several think it could be justified if the data weakens. December is now a coin flip for markets.

So far:

Nonfarm Payrolls on Thursday

Philly Fed Manufacturing Index on Thursday

Existing Home Sales on Thursday

Services PMI on Friday

Manufacturing PMI on Friday

Consumer Sentiment on Friday

Inflation Expectations on Friday

Fed Speakers:

Williams, Jefferson, Waller, Barr, Hammack, Cook, Goolsbee, Paulson, Logan.

Markets will watch closely for any clues around the December meeting.

Earnings:

Thirteen S&P 500 companies report this week. Nvidia (NVDA) is the centerpiece after posting Q3 earnings per share of 1.30 dollars and quarterly revenue of 57.0 billion dollars, beating expectations across the board. AI demand remains the engine behind its growth story. Additional earnings releases were provided in your chart.

Other notable Earnings Releases are shown in the chart below.

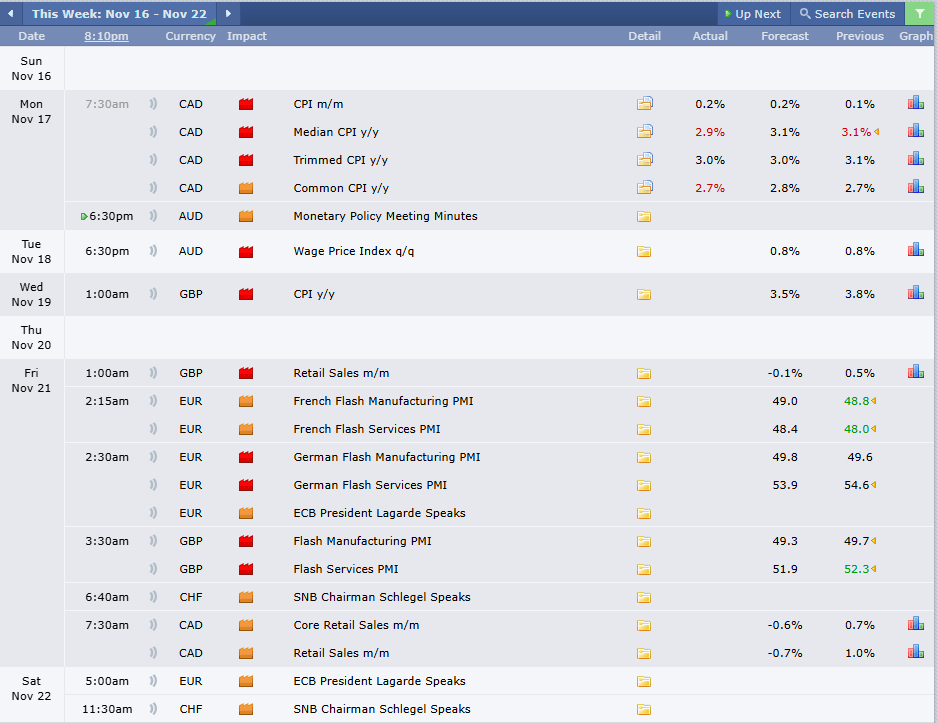

Medium-to-High Impact Global Economic Events This Week:

Trading Tip: Wait for Multi-Timeframe Confirmation

Before entering a trade, ensure your 4-hour and 1-hour charts align with your daily bias. When all three timeframes point in the same direction, you're trading with momentum, not against it.

This simple filter helps you avoid costly counter-trend trades and improves your win rate. Be patient and wait for alignment, even if it means passing on setups. The best opportunities are worth the wait.

Week 11/09/25 - 11/15/25 Recap

Special Tools & Strategies - Crypto Bear Market

I remember the crypto winter of 2022. Bitcoin hit nearly $69,000 in November 2021, and everyone swore it was heading to $100K by the end of 2021. I watched the whole market cycle play out as people became comfortable, piling in cash at high prices. Meanwhile, seasoned investors spotted the signs and started taking profits. When the bear market arrived in early 2022 and dragged itself through, we all had to adjust. Some people refined their systems, tightened their risk rules, and used the red days to deepen their education. Others packed up their profits and disappeared. The contrast taught me that a bear market tests your discipline and patience more than your wallet.

What is a crypto bear market?

A crypto bear market happens when prices decline for an extended period and the entire market mood shifts. Most people use a 20% plus drop in major assets like Bitcoin or Ethereum as a signal, but the numbers only tell part of the story. You know you are in a bear market when confidence dries up, fear spreads, and even strong projects get pulled down 60% or more by overall selling pressure. Trading activity slows, the news cycle turns negative, and weaker projects collapse under the weight of poor planning or scam behaviour. A bear market feels heavy because every bounce seems short-lived, but that does not mean investors cannot succeed inside it.

What causes bear markets and how long they last?

Bear markets do not appear out of nowhere. They usually build up slowly as risks pile on top of each other. Excessive leverage is a common culprit. When investors borrow too much and prices dip, the forced liquidations can trigger a chain reaction. Broader economic factors matter too. Rising interest rates, inflation concerns, or shrinking liquidity can pull capital out of riskier assets. Regulatory uncertainty can freeze investor confidence. Then there are major failures like Terra or FTX, which send shock waves through the entire ecosystem.

As for duration, the average crypto bear market lasts around ten months, although some stretch longer than a year. If you are new to the crypto space a bear market can feel like an eternity, but understanding market cycles helps you stay grounded.

Manage risk and emotions.

This is where most beginners stumble. When prices fall fast, panic selling feels like the only way to protect yourself, but it often locks in losses and removes your chance to recover. Instead, decide ahead of time how much you can afford to invest and stick to that limit. Avoid leverage completely until you have several years of experience because borrowed money magnifies mistakes.

Use dollar cost averaging (DCA).

DCA means investing small amounts at regular intervals no matter what the market does. Think of it like planting seeds each week instead of trying to guess the perfect day to plant all of them at once. In bear markets, DCA lowers your average cost over time and smooths out emotional swings.

Manage your portfolio wisely.

A bear market is the perfect time to clean things up. Diversify across strong projects instead of chasing whatever is trending. Many investors keep a portion of their portfolio in stablecoins so they have buying power ready when prices drop. Some lock assets into passive income tools like staking or lending platforms, but this requires research. Only use platforms with long track records, transparent teams, and audited code.

Focus on security and research.

When the market gets rough, scams multiply. Protect your assets with hardware wallets, strong passwords, and two factor authentication. Study a project’s fundamentals such as its use case, leadership, token design, and financial health. Treat research like learning the ingredients before you buy the meal.

Metrics that show real project strength

You do not need to be a blockchain expert to evaluate a project. A few simple metrics can guide you.

Look at on-chain activity. Are active addresses growing? Is transaction volume steady? Strong networks continue to move even during downturns.

Look at development activity. Are developers still committing updates? Is the team still communicating? Good teams do not vanish when prices fall.

Look at financial health. Does the project have enough liquidity? Are the token mechanics designed for long term sustainability? These clues help you separate solid projects from those that shine only in bull markets.

Know this

If you are new to crypto, the biggest lesson is this. Do not panic when the chart turns red. Bear markets are uncomfortable but they are also where long term wealth is built. The lower prices go, the more room there is for future growth. Think of it as buying winter coats in the summer when they are half price. Study the market, build your skills, and pace yourself with a plan you can follow. The next bull market rewards the people who prepared during the quiet season.

If you want help building your plan and understanding which tools fit your goals, this is the perfect time to sit down together and map it out.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.