- Rhoda Report

- Posts

- “This Ain't Texas!”

“This Ain't Texas!”

Issue #143

Hi There! These days, my head, heart, and hips are all in the thick of Spicemas 2025, Grenada’s carnival (the best mas by far). If you catch me now, chances are I’m mid-chip, dancing to one of the new soca anthems of the season, letting the riddim (as we say) carry me “down in Greenz”.

Grenada soca is legacy! It is born from the heartbeat of our ancestors, built on the drumbeat of resistance, and shaped by a people who know how to turn hardship into harmony. Every chune (tune) comes laced with joy, power, and freedom. When that bassline drop, my whole spirit elevates.

Lately, all I’m hearing in my head is riddim. Sweet, sweet riddim. Truth be told, it’s been hard to focus on much else. July hit, and like clockwork, my mind is back to my island. Right now, Grenada is bubbling. The streets are alive, the music loud, and the people are full of extra energy. The music this year is pure fyah.

I have been blasting my soca playlist every chance I get. Soca music keeps me grounded and lifted at the same time. It’s hard to explain, unless you’ve felt it for yourself. The music just moves you. It grabs you by the waist and calls you into motion. It doesn’t ask permission, it just commands joy that reminds me of all the best things: the smell of oil down over fire wood, the sound of neighbours calling my mom out, barefoot memories on the beach, a nice, cool breeze in my face and not a care in the world. I may be away for a stretch, but soca finds me, fuels me, and wraps me up in that Grenadian warmth.

Every song has a message tucked inside: a history lesson, a present-day truth, or a word to carry me forward. The drums is the heartbeat. The beat of the Jab Jab (described in Issue #41) is what sets our sound apart from the rest of the region. It’s heavy. It’s deep. It’s ancestral. It’s the beat of liberation, of sacred mischief, of a people who refuse to be silent. It’s the power that echoes through our bones and says, “keep going.”

Sometimes I sit and listen for focus. The music drowns out the noise in my head and makes space for simplicity. When the instruments align, when the lyrics connect, when the beat takes hold, it’s like I’m plugged back in. I have the energy to get through what’s in front of me.

Soca music is my medicine. It’s my culture. It’s my connection. It reminds me that no matter what season I’m in, joy is available. Power is available. I just have to press play.

Alright, let’s dig in!

Last week, the S&P 500 wrapped up with its fifth consecutive record close, gaining every single day and solidifying its bullish July performance. The Nasdaq and Dow joined the rally, due to a mix of upbeat corporate earnings, favourable trade developments, and strength in AI-driven sectors. International equities followed suit as Washington struck several trade deals in Asia and hinted at a forthcoming pact with the European Union. Meanwhile, global bond markets saw some disruption, the dollar weakened, and commodities cooled off.

Despite the gains, some market watchers are flashing caution signals. The return of meme stock frenzies and aggressive dip-buying behavior has led to warnings of speculative froth reminiscent of early 2021. Beneath the surface, Intel’s restructuring plans and Tesla’s revenue miss reminded investors that this bull run isn’t without its risks.

U.S. Markets Recap (July 20 - July 26, 2025)

Equities:

Wall Street was all gas, no brakes last week. The S&P 500 hit a new high every trading day, powered by continued strength in tech. Alphabet (GOOGL) surged after strong AI-related results and bullish spending plans, while Tesla (TSLA) slid after reporting its steepest revenue decline in nearly 10 years.

Trade optimism played a big role in lifting sentiment. The White House announced new deals including a major pact with Japan, slashing tariffs on autos to 15%, opening Tokyo’s markets to U.S. cars and rice, and a $550 billion investment commitment into the U.S. economy. These headlines helped suppress the VIX, which slid further below 16, and kept the broader risk-on mood intact.

Still, undercurrents of caution were visible. A rotation into lower-quality names and another burst of meme-stock momentum hinted that not all participation was institutional. With a potentially hawkish Fed meeting ahead, markets may need to recalibrate expectations soon.

Fixed Income:

Bond markets experienced a week of contrast. While the Bloomberg U.S. Aggregate Index posted gains, short-term rates ticked higher. The 2-year yield rose by four basis points, while the 10-year yield slipped three points.

Globally, bond yields climbed, especially in Japan. The Bank of Japan (BoJ) appeared to be stepping back from artificially propping up its government bond market. The result? Japan’s 10-year yield hit its highest level since 2008, and the 30-year JGB yield flirted with all-time highs. This shift pushed Japanese investors to reconsider their large holdings of U.S. Treasuries, which could pressure the long end of the U.S. yield curve in the months ahead.

Commodities:

Commodities lost ground last week, with the Bloomberg Commodities Index declining. Crude oil led the slide, pressured by the U.S. signaling a soft reopening of Venezuelan exports and Iraq potentially restarting flows through the Turkey pipeline. Traders remained cautious ahead of the OPEC+ meeting, which is not expected to introduce any fresh supply caps.

Gold faded after mid-week gains, dragged down by trade-related risk appetite. Silver held steady, while copper rose slightly.

Currencies:

The U.S. dollar broke its two-week winning streak, falling 0.8% against major currencies. The euro led the charge higher after ECB President Christine Lagarde signaled that rate cuts are unlikely in the near term. Meanwhile, market fears around Fed independence cooled after President Trump clarified he has no intention to fire Chair Jerome Powell.

EUR/USD: +1.00%

GBP/USD: +0.22%

USD/JPY: -0.78%

U.S. Economic Recap (July 20 - July 26, 2025)

Last week’s data releases were relatively light, but not without substance. July’s preliminary PMI readings showed services activity accelerating, helping push the composite index to a new 2025 high. However, manufacturing slipped back into contraction territory for the first time since December 2024.

On the inflation front, both prices paid and received ticked up, hinting that some firms are successfully passing increased input costs on to consumers. Weekly jobless claims dipped slightly, and preliminary data showed a drop in durable goods orders, consistent with a slowdown in business investment.

Global Markets Recap (July 20 - July 26, 2025)

Europe:

The STOXX 600 posted modest gains, as investors juggled earnings and trade talks. Highlights included disappointing results from SAP and Stellantis, and strong beats from BNP Paribas and Deutsche Bank. The ECB held interest rates steady, as expected, while trade negotiations with the U.S. approached the finish line.

Asia:

Asian markets gained ground, with Japan leading the way following confirmation of a new trade deal with the U.S. Even with political gridlock at home, Tokyo stocks rallied mid-week. Hong Kong’s Hang Seng surged to multi-year highs, and China’s Shanghai Composite crossed the 3,600-point mark. Taiwan and South Korea finished flat, while India slipped slightly.

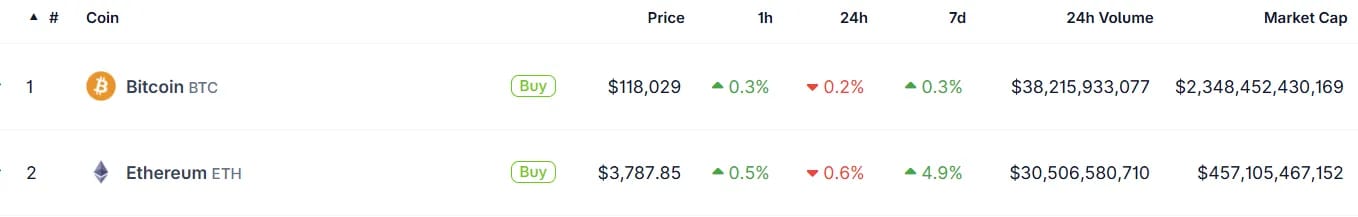

Crypto Recap (July 20 - July 26, 2025)

Bitcoin (BTC) consolidated below record levels, ending the week down 0.3% around $118,000. It remains about 4% off its all-time high of $123,000 from earlier this month. Notably, BTC Dominance rose above 61%, signaling renewed Bitcoin strength relative to altcoins.

Markets are watching a significant liquidity zone at $117K. If BTC holds above that level, bulls may retest the $120K-$125K region. A break below opens the door for a retracement to the $114K CME gap or lower.

Institutional moves raised eyebrows. A trader bet $5 million in options premiums that Bitcoin would drop below $110K by August 8, which is a huge single-leg bearish bet totaling $600 million in notional value. Combined with $400 million in liquidated long positions, the near-term picture looks cautious. Still, long-term sentiment remains bullish. Citigroup reiterated its $135K year-end target, and spot Bitcoin ETF inflows, though slowing to $72 million last week, show continued institutional confidence.

Last Week’s Top Altcoin Gainers: Ethena (ENA), Cronos (CRO), Flare (FLR), Story (IP)

Here are other key highlights from last week:

Dogecoin could soon verify ZK Proofs natively.

Western Union CEO viewed stablecoins as an opportunity.

PNC taps Coinbase to bring crypto trading into client accounts.

Ozzy Osbourne’s death sparks 400% surge in CryptoBatz NFTs.

BeToken deployed on Polygon, Spain’s first regulated and on-chain security token.

This week is jam packed with high impact news!

Key U.S. Economic Releases remaining this week:

Tuesday: JOLTS Job Openings, Consumer Confidence

Wednesday: ADP Employment, Q1 GDP, Pending Home Sales, Fed Rate Decision

Thursday: Core PCE Inflation, Jobless Claims, Employment Cost Index

Friday: Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings, ISM Manufacturing PMI, Consumer Sentiment

This is one of the most consequential data weeks of the quarter, with interest rate decision, inflation, labour market strength, and GDP all on the docket.

Fed Watch

Fed Chair Jerome Powell Speaks Wednesday at 2:30 PM ET

Markets are currently pricing in no rate hike, but investors will listen closely for signals on timing for the first rate cut and Powell’s read on sticky inflation and wage pressures.

Earnings:

t’s a blockbuster week for Q2 earnings. Big tech highlights:

Wednesday (after close): Meta (META), Microsoft (MSFT)

Thursday (after close): Apple (AAPL), Amazon (AMZN)

Also on watch: Crypto-related names like Coinbase, Riot, PayPal, HOOD, SOFI, and Strategy, which could provide clues about sentiment in the digital asset space.

Other key names on outlined in red in the chart below.

Medium-to-High Impact Global Economic Events This Week:

Trading Tip:

The 2% Position Size Rule: Never risk more than 2% of your total account on any single trade. This isn't just about money management—it's about trading psychology. When you're not risking your financial wellbeing on one trade, you make clearer, more objective decisions.

Week 7/20/25 - 7/26/25 Recap

Special Tools and Strategies - Ethereum (ETH)

Lately, Ethereum has been getting a lot of buzz in the media. I've been getting questions like “What is Ethereum and how is it different from Bitcoin?” and “Which is better, Bitcoin or Ethereum?” These are great questions. While both are top players in the crypto space, they serve very different purposes.

Purpose and Functionality: Digital Gold vs Digital Silver

Think of Bitcoin as digital gold. Its main job is to be a store of value. It doesn’t try to do too much. It’s simple, secure, and scarce. Bitcoin is like a digital vault where people park their wealth, especially during times of economic uncertainty or inflation.

Ethereum, in contrast, is more like digital silver, with a slight twist. It is a programmable blockchain. This means developers can build things on top of it like decentralized apps (dApps), smart contracts, and token systems.

Here’s a quick example:

Paying a friend back with Bitcoin is like handing them $20. Fast and simple.

Using Ethereum, though, would let you build a smart contract that splits a dinner bill five ways, calculates the tip, and sends a portion to charity, all done automatically. Ethereum is the infrastructure that powers a decentralized internet.

Consensus Mechanisms: The way they validate transactions

Bitcoin uses Proof of Work (PoW). It’s like a giant race where computers around the world compete to solve complex math puzzles. The winner gets to add the next “block” of transactions and earns Bitcoin. This system is secure but uses a lot of energy.

Ethereum used to use Proof of Work too, but in 2022 it upgraded to Proof of Stake (PoS) through a major shift called The Merge. Instead of mining, validators are chosen to confirm blocks based on how much ETH they staked, or locked up, as collateral. If they cheat, they lose part of their stake. This new system uses far less energy and makes Ethereum greener and more scalable.

Transaction Speed

Imagine you’re at a coffee shop. With Bitcoin, your payment is confirmed in about 10 minutes. Not terrible, but not ideal if you’re rushing to work.

Ethereum is more like a grab-and-go kiosk. Transactions are usually confirmed in 15 seconds or less. That speed makes it ideal for platforms that need fast interaction, like NFT marketplaces, tokenization, decentralized exchanges, or blockchain games.

Supply and Monetary Policy: Fixed vs Flexible

Bitcoin is capped at 21 million coins. That’s it. No more will ever be created. That hard limit is part of what gives Bitcoin its scarcity appeal. it really is digital gold by design.

Ethereum doesn’t have a fixed supply, but since The Merge, its issuance rate has dropped. Plus, part of every transaction fee is now burned (permanently removed from circulation). This means Ethereum could become deflationary, especially during high network activity.

Think of it this way:

Bitcoin = scarcity is hard-coded

Ethereum = supply flexes with use, but still trends toward scarcity

Wall Street’s Changing Focus

Institutional investors used to focus almost entirely on Bitcoin. It was simple, regulated in many countries, and seen as a hedge. Recently though, Ethereum is catching serious attention.

As Tom Lee from Bitmine (BMNR) puts it:

“I like Ethereum because it is a programmable smart contract blockchain. But to be frank, the real reason I choose Ethereum is that stablecoins are exploding. Circle is one of the best IPOs in the last five years, with a 100x EBITDA ratio... Stablecoins are the ChatGPT of the crypto world... evidence of Wall Street attempting to 'equity-ize' tokens. Meanwhile, the crypto space is working on 'tokenizing' equity.”

Let’s unpack that. Ethereum is the base layer for stablecoins, which are digital dollars. Stablecoins like USDC (created by Circle) mostly run on Ethereum. As Wall Street explores ways to blend tradfi (traditional finance) with blockchain, Ethereum’s infrastructure makes it the go-to platform.

While Bitcoin is viewed like a savings account with a fixed amount of gold, Ethereum is the underlying tech behind the financial tools of the future.

They Play Different Roles in a Portfolio

So, which is better? The truth is: it depends on your goals.

If you’re looking for a long-term store of value, something you can tuck away like digital gold, Bitcoin is a solid option.

If you’re more interested in the technology, innovation, and future potential of blockchain-based apps, or you want exposure to the booming world of decentralized finance and digital assets, then Ethereum is a strong candidate.

They’re not competitors. They’re complements.

Think of it like this:

Bitcoin is your long-term savings.

Ethereum is your innovation and growth bet.

Understanding how each works and what role they play can help you build a crypto portfolio that’s balanced, diversified, and positioned for what’s next.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.