- Rhoda Report

- Posts

- “Turn Losses Into Gains!!!"

“Turn Losses Into Gains!!!"

Issue #162

Hi There!

I was rejected by every job I applied for, including the one I thought was guaranteed.

Looking back, all I ever wanted to do was to teach. My motto was always ( and still is) to make the complex simple. Naturally, I wanted to teach math because folks always made it more complicated than it really was, and I knew I could break it down so anyone could understand.

I had a solid plan. After graduating community college in Grenada, I was going to return to my high school to teach math. I was good at it, qualified, plus I was close to the principal. I thought for sure I’d get swooped up quick.

Never in a million years I thought my application would be rejected.

When I got that letter, I was shocked. I was upset. Like, how? I didn’t want to teach anywhere else, so I applied to the phone company as a technician, figuring it was the closest thing where my math skills could be used.

Rejected again.

I applied to several companies, and I kept getting rejections. Some letters even told me I was overqualified, which somehow hurt more.

For months, I was unemployed. I laid around my mother’s house after chores were done (of course), watched all the soap operas, and battled that awful whisper that maybe I was not good enough. I had eight subjects, three A levels, an associate degree in science, and teachers who would vouch for me in a heartbeat. Still, they kept saying no.

But, life has a funny way of turning things around.

My statistics teacher tracked me down, said he had been looking for me for months. He offered me his private waitlist of 25 students who needed to take (or retake) the math exams. He didn’t want a cent; I got to pocket all the money. And just like that, my teaching career started.

The very next day, I ran into the Dean of Arts and Sciences who asked where I was working. When I said nowhere, he smiled and said they needed a Lab Technician to prepare and facilitate experiments for A-Level Chemistry, Biology, and Physics. It wasn’t math, but it was teaching complex subjects. I said yes, filled out the paperwork, and started the next week. It worked out perfect because I got access to use the classroom after hours to teach my private math classes. Before long, I had a slew of students from all over.

Those rejections pushed me straight into the work I was made for and taught me a big lesson:

The only heartbreaking part of life is that we don’t have enough lived experience early on to understand that things will eventually work out. It might be 45 years later, it might be 25 minutes later, but it works out.

We were sold this fantasy that life is mostly sweet with a few rough patches sprinkled in. Nope. Life is mostly challenging with moments of goodness that remind us why we keep going. If you can learn to move through the hard without making someone else’s life miserable, you have cracked the code.

So, if rejection is knocking on your door right now, treat it like a redirect. When several doors close, a multitude more are getting ready to swing wide open at the same time. What is divinely ordered for you will not miss you. It may reroute you, slow you down, or confuse you for a season, but it will not pass you by.

Keep going and keep showing up. Something better is already making its way toward you.

Alright, let’s dig in!

Last week, markets opened December with a cautious, but constructive tone. Equities extended the rebound from late November, though momentum stayed measured as traders waited for the final Fed decision of the year and the last wave of tech earnings. The S&P 500 drifted back toward record territory while global equities also finished mostly higher. Softer inflation data added to rate cut optimism, the bond market focused on leadership changes at the Fed, commodities climbed, and the U.S. dollar slipped as rate expectations firmed.

Also, last week Salesforce posted its strongest weekly gain since 2023 after solid earnings, even as investors questioned how quickly AI could encroach on traditional software models.

U.S. Markets Recap (November 30 - December 6, 2025)

Equities:

Last week, the markets delivered steady, quiet gains across the major U.S. benchmarks. With few catalysts on deck, markets moved in tight ranges as traders prepared for a December Fed meeting shaped by expectations for easier policy. Fed cut odds stayed above 90%, supported by a negative ADP print and softer inflation data. Low volume and minimal headlines kept trading muted, but sentiment leaned constructive.

AI remained an active story even without meaningful catalysts. OpenAI signaled another push toward accelerated ChatGPT development, while reports showed Amazon (AMZN) racing to bring its newest AI chip to market, targeting NVIDIA (NVDA) and Alphabet (GOOG/L). Price action across AI-linked names was mixed, highlighting how much the sector now trades on competitive pacing rather than fundamentals.

Earnings pockets offered clearer direction. Marvell Technologies (MRVL) strengthened on repeat chip orders and its acquisition of Celestial AI. MongoDB (MDB) and Credo Technology Group (CRDO) delivered notable beats. The largest headline landed in media as Netflix (NFLX) agreed to acquire Warner Bros. Discovery’s (WBD) studios and streaming business for $72B after a heated bidding process. NFLX eased slightly while WBD gained 2%.

Fixed Income:

Treasuries struggled through their weakest stretch since June as yields moved higher across most of the curve. The market digested reports that President Trump plans to nominate Kevin Hassett as the next Fed Chair. Hassett has historically favoured aggressive rate support for growth and employment, a stance that helped steepen the curve as short-term yields dipped and inflation breakevens widened. Doubts over how far the Fed can cut in 2026 countered some of the dovish interpretation, keeping long yields elevated.

Japanese government bonds continued to exert pressure globally. Rising JGB yields followed the Takaichi administration’s large stimulus package, which raised fresh fiscal concerns. Tension between policymakers and the BoJ added to volatility, though long-dated JGBs found relief from a strong 30-year auction and signals that Tokyo may accept a rate hike. Even with these developments, U.S. 10-year yields held near 19-year highs.

Commodities:

The commodities complex advanced, led by a strong rebound in crude. WTI oil reversed early weakness after Russia-Ukraine peace efforts broke down and attacks on Russian energy infrastructure accelerated. Tankers sourced from the Black Sea are now expected to demand higher rates, offering short-term support for oil even as oversupply concerns linger.

Gold edged slightly lower but stayed above $4,200/oz through Friday. Rate cut expectations and a weaker dollar were supportive, though profit taking and softer safe haven flows kept gains limited.

Currencies:

The U.S. dollar index eased as traders leaned into rate cut expectations. The yen and pound firmed while major FX pairs moved in orderly ranges:

EUR/USD: +0.41%

GBP/USD: +0.70%

USD/JPY: -0.53%

U.S. Economic Recap (November 30 - December 6, 2025)

Labour market data tightened the spotlight on the next Fed meeting. ADP reported a private payroll drop of 32,000 in November, led by a 120,000 job decline in small businesses, the largest one-month loss since May 2020. Professional services, information, and manufacturing saw broad reductions. Wage growth slowed for both job changers and job stayers, indicating cooling momentum. With official BLS data delayed until December 16 due to the shutdown, the ADP report carries unusual importance.

Composite PMI remained firm at 54.2, pointing to steady above-trend GDP growth. Input costs rose across sectors, driven by labor pressure and tariff-related expenses. Business confidence improved as the shutdown lifted and expectations strengthened for increased federal spending in 2026.

Services PMI eased to 54.1 but continued to signal expansion. Domestic demand strengthened, job growth accelerated, and new business rose at the fastest pace since last December. Inflation pressures persisted as input costs climbed and firms raised prices to protect margins.

Manufacturing PMI stayed in expansion at 52.2, though conditions became more uneven. Output improved, but export orders fell for a fifth consecutive month, and finished goods inventories climbed at a record pace, marking the second straight month of unprecedented stock buildup. Metal costs rose sharply and supply chain challenges lingered due to border delays and tariff effects.

Consumer sentiment improved for the first time in five months. The University of Michigan index rose to 53.3 as inflation expectations eased: one-year at 4.1% and long-term at 3.2%. Younger adults led the improved outlook, though high living costs and a softening labor market kept overall sentiment fragile.

Global Markets Recap (November 30 - December 6, 2025)

Europe:

European equities added to recent gains as global rate cut expectations bolstered appetite. Stronger-than-expected retail sales, an upward revision to Q3 GDP, and a sixth consecutive improvement in PMI supported sentiment. However, early November inflation data came in hotter, reducing hopes for an ECB cut this month. In the U.K., equities lagged as investors reacted to the latest budget and scrutiny of public finance disclosures.

Asia:

Most Asian markets finished higher despite a slow start. South Korea and Taiwan extended their leadership on solid tech sentiment and reduced U.S. tariffs on South Korean autos. China gained momentum late last week as tech names rallied, especially after the successful listing of GPU maker Moore Threads Technology. Financials fell after several banks trimmed high-yield deposit products due to margin pressure. Japan traded mixed as BoJ policy uncertainty and fiscal tensions kept markets from finding sustained footing.

Crypto Recap (November 30 - December 6, 2025)

Total crypto market cap slipped to $3.02T while the Fear & Greed Index fell to 23, placing sentiment in extreme fear. Bitcoin lagged risk assets again, falling 1.7% and deepening its unusual divergence from equities. The S&P 500 is up 16.8% YTD while BTC is down 4.5%, marking the first year since 2014 where stocks rise and BTC declines simultaneously. Capital continues to favor AI equities and precious metals over high beta crypto exposure.

Bitcoin:

Dominance: 59.34%

Weekly performance: -1.02%

U.S. spot BTC ETFs: -$87.77M

Range: ~$84.1K to $94K, now consolidating near $89.8K

Supportive developments included Vanguard reversing its crypto ban and Bank of America opening crypto access to adviser clients. Macro liquidity injections (~$13.5B) helped stabilize the market, though crypto absorbed little of it due to ongoing deleveraging and ETF pressure.

Ethereum:

Weekly performance: +0.90%

U.S. spot ETH ETFs: -$65.59M

Price: ~$3,033 (range $2,720 to $3,240)

ETH traded with far more volatility than its weekly gain suggests. A 6.4% drop on Dec 1 was followed by a 7% rebound on Dec 2 and another 6.4% surge on Dec 3 driven by the Fusaka upgrade, which expands DA capacity eightfold, lifts the gas limit to 150M, and sharply reduces rollup costs.

Last Week’s Top Gainers: ZEC, PENGU, SUI, LINK, AAVE

Here are other key highlights from last week

Digital asset treasury boom stalls as flows drop to $1.3B and stocks tumble.

CNBC partners with Kalasi to bring real-time data.

Mugafi brought entertainment IP onchain through new Avalanche.

R25 launched institutional-Grade RWA protocol on Polygon.

All eyes of Fed Interest Rate this week!!!

Key U.S. Economic News:

NFIB Small Business Index (Tue)

ADP Weekly Employment Change (Tue)

JOLTS Job Openings (Tue)

Employment Cost Index (Wed)

Fed Rate Decision (Wed)

Jobless Claims (Thu)

Trade Balance (Thu)

Events to Watch

The December Fed meeting is the main event. Markets are positioned for a rate cut, but policymakers are still weighing cooling labour data against sticky inflation. Expect heightened volatility around the decision, the dot plot, and Chair Powell’s press conference.

Federal Reserve:

Fed Interest Rate Decision (Wed 2:00 PM ET)

FOMC Statement (Wed 2:00 PM ET)

FOMC Dot Plot (Wed 2:00 PM ET)

Chair Powell Press Conference (Wed 2:30 PM ET)

A surprise shift in the dot plot or Powell’s tone could reshape expectations for 2026.

Earnings:

Notable Earnings Releases are shown in the chart below.

Medium-to-High Impact Global Economic Events This Week:

Trading Tip:

Keep an eye on SLV (iShares Silver Trust) this month!

Week 11/30/25 - 12/06/25 Recap

Special Tools & Strategies - Tax Loss Harvesting

I share this story with traders all the time. When I first started trading with real money, I took losses so often it felt routine. I was consistently non profitable and frustrated, but I kept going. When tax season arrived, I sat in my appointment convinced all that red meant a huge tax bill. My accountant, who worked with traders, smiled and said this was actually a perfect year for tax loss harvesting. I had never used the idea before, and it changed how I viewed losses. Many women tell me they avoid investing because they fear losing money, but losses can serve a purpose. They are tools that can lower your taxes and help you reset your portfolio (not financial advice, just educating).

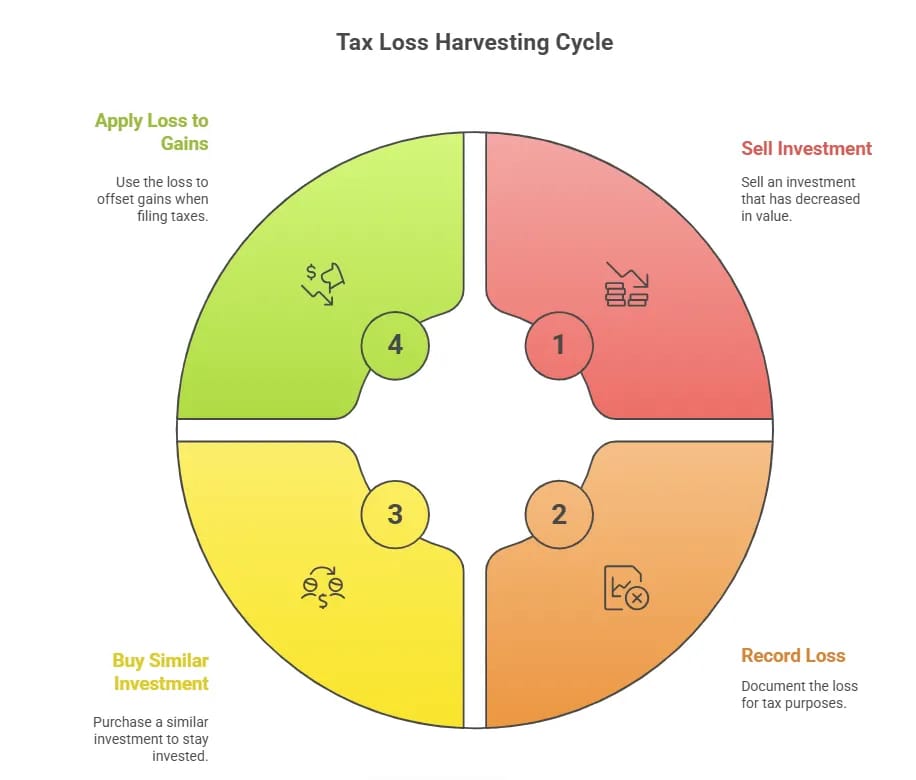

What Is Tax Loss Harvesting

Tax loss harvesting means selling investments that have dropped in value so you can use those losses to reduce the taxes owed on profitable trades. It is compared to using losses from one corner of your portfolio to soften gains somewhere else. If your losses exceed your gains, you can use up to $3000 to reduce regular income and carry the rest forward. It is similar to recycling. You turn something that feels useless into something helpful.

How Tax Loss Harvesting Works

Here is the simple flow:

Tax Loss Harvesting Cycle

The wash sale rule is the main rule to remember. If you buy the same investment within 30 days, you cannot use the loss. This is why investors replace a losing stock or fund with a related option instead of an identical one.

Crypto adds another layer. Crypto has not always been treated the same as stocks under the wash sale rule, giving investors more flexibility. CPAs warn that guidance is changing as regulators adjust rules, so it is important to get professional advice.

Why Tax Loss Harvesting Helps

Several benefits include:

• Lower taxes on profitable trades

• A cleaner and more focused portfolio

• A chance to reset after emotional decisions

• Real savings from losses you already took

Falling crypto prices in recent months created strong opportunities for investors to harvest losses and reduce taxable gains. Many people who bought during rallies are now sitting on pullbacks that can work in their favor if handled correctly.

Losses happen to every trader. The advantage comes from using them wisely.

How This Helps After Recent Drops in Crypto and the Market

With the latest dip in Bitcoin, altcoins, and several stock sectors, many investors now hold positions that are underwater. Instead of letting those losses sit untouched, this may be the moment to turn them into a tax benefit. It does not erase the loss, but it gives you value back from it.

If you haven’t already, be sure to reach out to your accountant or tax professional to discuss how your losses in the stock and/or crypto market or other markets in 2025 can help reduce your taxes.

Don’t be afraid to take losses in your investments. Instead, use your losses to support long term wealth building.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.