- Rhoda Report

- Posts

- “Welcome to Rally Season!”

“Welcome to Rally Season!”

Issue #142

Hi There! For years I had a good laugh watching my girlfriends (40 and up) fumble through their purses for those “emergency” readers. Some would be squinting, others pulling out bifocals or cute, little magnifiers just to read a menu or sign a receipt. I'd sit there feeling mighty proud with my 20/20 vision, teasing them like, "Y’all sure y’all don’t want me to read it for you?"

Well…Karma always has a way of humbling you.

A few weeks ago, I rolled outta bed and couldn’t even read the time on my nightstand clock. Thought it was the perimenopause acting up again or maybe I just needed a little more sleep. I didn’t think anything else about it, until I sat in front my computer and the charts looked like a Monet painting.

The stock market was a blur!

I grabbed my old glasses. No help. Then I remembered a dusty pair of Walgreens +1.25 Peepers I bought umpteen years ago for my mom. I slid them on and bam! Crisp letters, clean charts, and no squinting. A whole revelation in aisle three.

After struggling through menus, receipts, my journal pages, books, and every screen I own, I finally went to the eye doctor. Five years overdue. Turns out my eye health is still strong, thank goodness. However, I needed stronger reading specs.

Needless to say, I am now in the club.

Next time we are out for brunch and I reach into my purse to pull out my glasses, don’t even say a word. Just know I’ve earned my seat at the table, right next to the other beautiful, wise, squint-free women flipping through pages, peering at fine print, and seeing life (and the markets) a whole lot clearer.

Cheers to clear vision and honest aging!

Alright, let’s dig in!

Last week brought a mixed bag for global markets as traders digested a range of headlines spanning earnings, inflation, Fed independence, and tariff tensions. While the Nasdaq and S&P 500 hovered near record highs, buoyed by tech strength, the Dow slipped slightly. Across the globe, equity performance split as economic and political developments diverged. Oil prices dipped, the dollar climbed, and U.S. Treasuries steadied after increased volatility. Meanwhile, a game-changing regulatory win sent cryptocurrencies soaring, led by altcoins outpacing Bitcoin for the second week in a row.

U.S. Markets Recap (July 13 - July 19, 2025)

Equities:

The S&P 500 and Nasdaq capped the week with fresh all-time highs last Thursday before pulling back slightly. Tech shares once again led the charge, thanks to Nvidia receiving a long-awaited export license to ship AI chips to China. The broader market remained range-bound as investors weighed strong corporate earnings against fresh political drama. Rumours of Fed Chair Powell’s removal rattled markets midweek, only to be quickly denied by the President himself.

Key earnings beats from Citi, JPMorgan, Bank of America, and Goldman Sachs set a strong tone for Q2 season. However, even with positive surprises from Netflix, American Express, and Johnson & Johnson, market reactions were negative. Many stocks appear priced for perfection.

Fixed Income:

Bond markets remained in focus as investors parsed the Fed’s next move. Treasury yields were little changed, with the 10-year ending just two basis points higher. Despite political calls for rate cuts, inflation data remained elevated, complicating the Fed’s path.

Behind the scenes, bond markets face rising global pressure. Selling in Japanese and UK government bonds spilled over into the U.S., raising Treasury term premiums. While rate cuts could offer short-term relief, they may ultimately backfire by boosting inflation expectations and mortgage rates. The bond market isn’t buying into political pressure just yet.

Commodities:

The Bloomberg Commodities Index rose modestly. Crude oil fell back last Friday despite a midweek bounce driven by geopolitical tensions and EU sanctions on Russian oil. The price cap announcement tempered gains. Gold continued its sideways movement, stalled by mixed signals on inflation and Fed rate cuts. Unless a decisive macro catalyst emerges, gold could remain stuck in neutral.

Currencies:

The dollar strengthened again last week, rising 0.6% against major currencies. Safe-haven flows and political uncertainty in Japan helped the greenback, while the yen slipped amid pre-election volatility. The pound declined slightly.

EUR/USD: +0.26%

GBP/USD: -0.05%

USD/JPY: +0.14%

With the dollar now logging back-to-back weekly gains, emerging market currencies could feel pressure if this trend continues.

U.S. Economic Recap (July 13 - July 19, 2025)

Last week’s economic focus centered on inflation.

Annual CPI accelerated to 2.7% in June, up from 2.4% in May

Core CPI climbed to 2.9%, putting continued pressure on the Fed

Month-over-month inflation rose 0.3%, the fastest pace in 5 months

Medical care costs and household furnishings led the uptick, but used and new car prices declined, offering a glimmer of relief. Retail sales data remained strong, suggesting consumers haven’t closed their wallets just yet. Inflationary pressure is expected to remain through the summer, especially as new tariffs trickle into pricing models.

The Fed appeared committed to holding rates steady until data meaningfully cools, despite political pressure to ease. Market watchers expect inflation to settle back near 2.7% by year-end, assuming trade tensions don’t escalate further.

Global Markets Recap (July 13 - July 19, 2025)

Europe:

European equities remained mixed. Positive earnings helped offset macro headwinds. The STOXX 600 hovered near unchanged levels. UK inflation surprised to the upside, while Germany’s fiscal plan received approval from the EU Commission. On the trade front, Brussels proposed simplifying talks with the U.S., even hinting at lowering auto tariffs even though retaliatory measures are in motion if negotiations stall.

Asia:

Asian markets rallied broadly. China and Taiwan outperformed last Friday following additional stimulus from the People’s Bank of China and strong Taiwan Semiconductor earnings. Japan moved modestly higher amid election-related caution, while South Korea unveiled a new market initiative aimed at pushing the Kospi index to 5,000. Australia hit a new record high, while India lagged.

Crypto Recap (July 13 - July 19, 2025)

It was another historic week for crypto.

While Bitcoin rose only 0.3%, altcoins like Floki, Conflux, Tezos, and Ethena surged, with some gaining over 30%. The total crypto market cap pushed above $4 trillion for the first time, driven by regulatory clarity from Washington.

GENIUS Act Signed into Law

President Trump signed the GENIUS Act into law on July 19, cementing the first U.S. regulatory framework for stablecoins. It mandates 1:1 dollar backing and offers dual licensing paths for issuers. The Act also:

Grants Federal Reserve oversight over cross-state stablecoin activity

Carves out exemptions for tokenized money market funds

Includes transparency requirements (CLARITY Act) and an explicit ban on a U.S. CBDC (Anti-CBDC Act)

This legislation could reshape how digital dollars are issued, with implications for banks, fintechs, and crypto-native firms alike.

Institutional Crypto Adoption Accelerates

Citigroup, JPMorgan, and Schwab all unveiled stablecoin and tokenization plans

Tether launched a new compliant version of USDT for institutions

KuCoin launched xStocks, tokenized U.S. equities tradable on Solana

Kamino introduced tokenized stocks as DeFi collateral

Ondo Finance partnered with BNB Chain to offer 100+ tokenized U.S. assets

PayPal expanded PYUSD to Arbitrum for lower-cost transactions

Real estate is also being tokenized, with Dubai attracting a wave of first-time investors into digital property shares. Meanwhile, the SEC declared stablecoins under banking regulation, adding pressure on issuers to comply with stricter standards.

Last Week’s Top Altcoin Gainers: Conflux (CFX), Floki (FLOKI), Tezos (XTZ), Ethena (ENA)

Here are other key highlights from last week:

SharpLink overtook Ethereum Foundation as largest corporate holder of ETH.

BlackRock sought staking option for iShares Ethereum Trust in new filing.

Core introduced first revenue-sharing model for stablecoin issuers, devs.

Blistering NFT ‘sweep’ underway as CryptoPunks, Penguins surge.

This week is packed with notable earnings releases!

Key Developments so far:

Fed Chair Powell emphasized the need for big banks to remain well-capitalized and competitive but avoided commenting on interest rates.

Markets remain cautious as earnings season picks up steam and economic data rolls in.

Key U.S. Economic Releases remaining this week:

Tues: Richmond Fed Manufacturing Index

Wed: Existing Home Sales

Thurs: Jobless Claims, Services PMI, Manufacturing PMI, New Home Sales

Fri: Durable Goods Orders

Earnings:

Eyes are locked on Tesla (TSLA) and Alphabet (GOOG) earnings this week. Other key names on outlined in red in the chart below.

Medium-to-High Impact Global Economic Events This Week:

Trading Tip:

Exit Strategy: The 50% Rule. When a trade moves significantly in your favor, consider taking profits on half your position when you've captured 50% of the expected move to your target. This locks in gains while letting the remainder run for bigger profits. It's a psychological game-changer that removes the "all or nothing" pressure.

Week 7/13/25 - 7/19/25 Recap

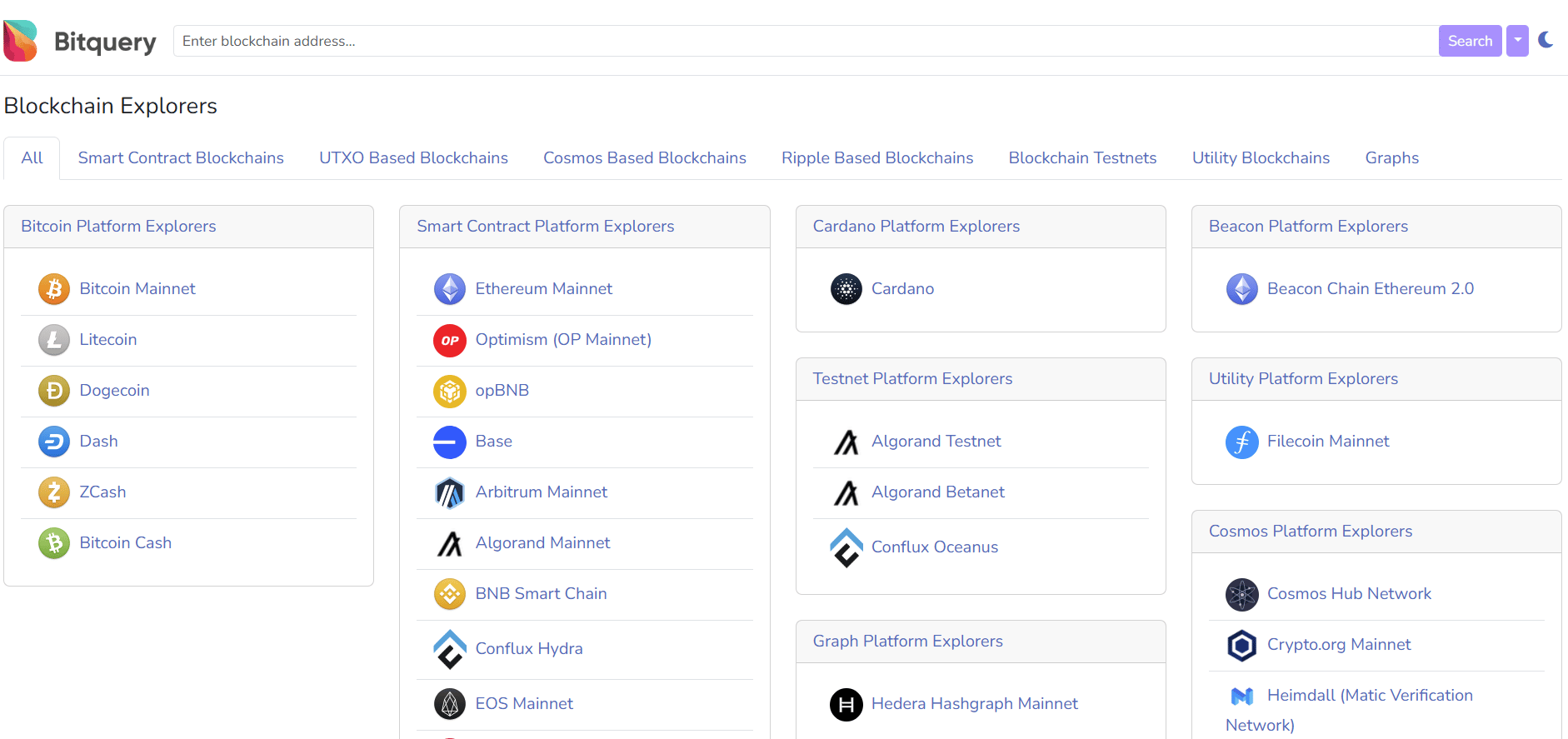

Special Tools and Strategies - Bitquery

If you have ever scrolled through crypto Twitter (CT) and seen posts showing a whale wallet moving millions, a breakdown of DeFi token flows, or detailed NFT stats, you’ve probably asked yourself: “Where are they getting this info?” The answer, more often than not, is a tool like Bitquery.

What Is Bitquery?

Bitquery is a blockchain data platform that makes it easier to access, understand, and use on-chain information across 40+ blockchains, including Ethereum, Solana, and Binance Smart Chain. Bitquery offers historical and real-time data via GraphQL APIs, Websockets, cloud storage, and an in-browser data explorer.

It’s like a Google Search for blockchain, but tailored for crypto analysts, builders, and even casual observers who want to to follow the money on-chain or understand what’s really happening behind the headlines.

Who Can Use Bitquery?

Beginners

Visual Learning: The Bitquery Explorer offers a visual, point-and-click experience that helps you see transactions and wallet activity in plain English.

Ready-to-Use Queries: You don’t need to be a coder to get started. There are plenty of sample queries you can tweak and test to learn how blockchain data is structured.

No Infrastructure Worries: Bitquery does the hard stuff (like indexing blockchains and running nodes), so you don’t have to.

Intermediate Users

Unified Data Access: Use one consistent GraphQL interface to pull data from multiple blockchains, so there is no need to learn each chain’s quirks.

API-Friendly: Easily plug Bitquery’s APIs into your apps, dashboards, or scripts.

Real-Time Streaming: WebSocket support means you can build live bots or alerts that react instantly to transactions or liquidity changes.

Advanced Users

Forensics and Compliance: Use the Coinpath tool to trace fund flows across wallets and chains. Great for security teams or serious crypto investigators.

Custom Integrations: Bitquery supports AWS, Google BigQuery, Snowflake, and other cloud platforms for enterprise-scale data analysis.

Machine Learning & Research: Export large datasets to train ML models, detect wash trading, or analyze NFT holding behavior.

Key Features and What They Do

GraphQL IDE

A powerful in-browser tool where you can build and test queries.

Example: Want to track all ERC20 token transfers from one wallet over the last 30 days? Build that query and save it in minutes.

A beginner-friendly platform to explore live data visually across 40+ chains.

Use it to find smart contract interactions, NFT mints, or DEX trades.

Bitquery’s forensic engine that maps how money moves across wallets and chains.

Used by compliance teams to spot illicit activity or recover stolen funds.

WebSocket APIs

Enables real-time alerts and integrations.

Example: Get notified the moment a certain wallet interacts with a contract.

Cloud Data Access

Enterprise users can integrate Bitquery data directly into cloud storage solutions like AWS S3 or Azure.

Ideal for projects needing large-scale historical data.

Pricing

Free Tier: Includes access to core APIs and limited query volume—perfect for hobbyists or early testing.

Premium & Enterprise Plans: Custom pricing for higher limits, more support, SQL access, and cloud integrations.

While pricing isn't fully transparent on the homepage, many users find the free tier generous enough to start building meaningful projects.

Pros and Cons

Pros:

Covers over 40 blockchains with real-time and historical data

GraphQL interface is precise and flexible

Ideal for everything from dashboards to trading bots to AML reports

Plug-and-play Explorer helps beginners get started fast

Coinpath is a standout for forensic and compliance use cases

Cloud compatibility makes it scalable for businesses

Cons:

Steeper learning curve if you’re new to GraphQL

Complex queries can take time to master

Some users report occasional gaps in less-popular data sets

Pricing for enterprise features can be higher than simpler alternatives

What Users Are Saying

Developers love the flexibility: “One query, any chain. It’s like magic.”

Analysts value the speed: “I can get whale wallet data in seconds.”

Builders appreciate the time saved: “Bitquery eliminated the need to build our own indexer.”

Bitquery helps turn raw blockchain activity into usable, insightful information fast. If you're curious about the inner workings of crypto such as the flows, the contracts, the wallets, it is a tool consider.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.