- Rhoda Report

- Posts

- “What to Do When You Feel Stuck!"

“What to Do When You Feel Stuck!"

Issue #169

Hi There! This past week tried me, I am not even going to pretend otherwise. I had writer’s block so bad I was ready to skip this Rhoda Report entirely. The subscribers are not coming in as fast as I want, I was feeling blah, and that snow storm, over the weekend, with minus degree temps came through like it had a personal problem with my mood.

On top of that, I have a shitload of work waiting for me in the house. Plus a challenging request I need to complete by the end of the month, and I do not have a clear blueprint yet. So there I was, feeling lost, trying to hold it together while still keeping up with house work, deadlines, powerlifting training, meal prep, and life.

Needless to say, decision fatigue has been the bane of my existence for the past week.

The thing is, I have been here before. I have felt stuck or lost so many times in my life that I cannot even keep count. The difference now is I can reach for my trusted toolbox.

So wha la. Just like that, I have an opener.

If you’ve been going through the motions, trying to find your footing again, here are a few things that usually pull me out of the funk and help me push through again.

First, change your POV. When everything feels grey, your soul is trying to tell you something. The old way is not working anymore. The stuck feeling is your internal GPS recalculating. So ask yourself, what is one pattern that’s been stalling my progress, and how can I change it today?

Second, tear up the social contract. A lot of our misery comes from invisible deadlines. We tell ourselves we should have the big house by 40, or have life figured out by 35, or have travelled the world and sitting on millions by 50. But, who wrote those rules, eh? Not you, not me, and certainly not God. You have time. The successful people I know most often figured it out after years of trial and error. The real flex is staying in motion and trusting your own timeline.

Third, be a light. When we feel stuck, we turn inward and it gets lonely fast. So look out the window. Check on a friend. Help a neighbour. Being useful to someone else is one of the quickest ways to stop feeling useless yourself.

Fourth, feed the roots. Go back to basics. Are you moving your body? Are you sleeping, or scrolling? Are you learning, or just reacting to whatever the day throws at you? Pray, journal, move, rest, and learn something new. And if you keep reading past this opener, the latter is exactly what the Rhoda Report is here to help with. You will get a market analysis that breaks down what is happening in stocks and crypto, a practical investment or trading tip you can apply without overthinking, and a Special Tools & Strategies section that introduces one new tool, term, or strategy each week so you keep building your financial skill set.

Now, let’s go.

Drop the self pity at the door and take ownership of the next five minutes. Do one small thing today to create momentum. Even a five minute walk or a single journal entry counts. Feeling unmotivated or stuck is temporary, as long as you do not give up on yourself.

Alright, let’s dig in!

Last holiday shortened week delivered enough headlines to keep risk appetite on a short leash. U.S. stocks finished slightly lower after an early risk off jolt tied to tariff threats and geopolitical noise, then stabilized as big tech helped pull markets off the lows. Overseas, the picture was mixed. Europe snapped a 5 week winning streak, while parts of Asia linked to AI demand kept outperforming. Treasuries ended close to flat after markets digested a sharp move in Japanese government bonds, and commodities broadly moved higher.

U.S. Markets Recap (January 18, 2026 - January 24, 2026)

Equities:

Last week, markets came back from the long weekend with a quick gut check. Fresh tariff rhetoric tied to Greenland control talks hit sentiment, and the S&P 500 and Nasdaq fell about 2% early in the week. The tone improved as tensions cooled, and stocks bounced when headlines shifted toward a framework deal via NATO and a dial down in near term tariff threats.

Tech helped steady the markets later in the week after NVIDIA’s CEO highlighted strong demand and framed the AI build out as a multi-trillion dollar investment cycle.

Earnings also mattered. GE and PG slipped on cautious outlooks and consumer commentary, while Intel got hit hard after warning signs around manufacturing issues and softer guidance, a reminder that not every “AI adjacent” name is executing cleanly yet.

Beginner takeaway: in weeks like this, price action follows headlines until it doesn’t, then earnings and positioning take the wheel. Keep position sizes small, because reversals can happen fast.

Fixed Income:

Core bonds changed very little, even after early pressure tied to a surge in Japanese government bond yields that spilled across global rates. While equities whipped around, corporate credit barely flinched.

Credit spreads stayed very tight: IG (Investment Grade) around 0.70% and HY (High-Yield) around 2.47%, near long term lows. Historically, spreads at these levels have often led to weaker excess returns versus Treasuries over the next 12 months, simply because there is more room for spreads to widen than tighten. Goldman Sachs noted that when IG spreads averaged at or below 0.88%, the mean 12-month forward excess return was about -1.3%, and HY at or below 2.95% saw a mean around -4.1%.

Even with that history, the near term setup can still support stable spreads if growth stays above trend, inflation keeps cooling, and the Fed remains in cutting mode later this year. Plus, all in yields are still attractive enough to keep demand steady for many total return investors.

Beginner takeaway: tight spreads usually mean you are not being paid much extra for taking corporate credit risk. It is not “bad,” it just means risk management matters more than chasing yield.

Commodities:

Commodities had a strong week overall. Natural gas stole the spotlight, jumping about 68% as severe winter weather forecasts boosted expected heating demand. Oil also held a solid weekly gain, supported by geopolitical tension and shifting trade headlines. Late last week, support came as threats toward Iran resurfaced and Russia downplayed progress on Ukraine peace talks.

Precious metals acted like classic haven assets, with gold and silver benefiting from the risk off mood.

Beginner takeaway: energy can move on weather fast, and it can move on geopolitics even faster. If you trade these markets, stops are not optional.

Currencies:

The dollar weakened as the euro (€) and Yen (¥) found support during the volatility.

EUR/USD +0.62%

GBP/USD +1.07%

USD/JPY -1.70%

U.S. Economic Recap (January 18, 2026 - January 24, 2026)

The data calendar was fairly light last week, but two things stood out.

First, Q3 growth was revised slightly higher. Second, delayed inflation prints for October and November finally hit after last quarter’s government shutdown. Core services, excluding housing, rose about 0.25% m/m in November, pushing the y/y rate up to about 3.3%.

Bottomline, inflation is still running a bit hot near term, and tariffs add another layer of uncertainty on pass through costs. With that backdrop, the Fed is widely expected to hold rates steady at the Wednesday’s Jan 28th meeting, with the next likely window for cuts pushed toward late Q2.

Global Markets Recap (January 18, 2026 - January 24, 2026)

Europe:

The STOXX 600 snapped a five-week winning streak and logged its biggest weekly drop in about two months as tariff threats rattled confidence. France lagged, with threats of a 200% tariff on French wine weighing on sentiment. The U.K. held up better after comments suggesting the country is positioned to avoid tax hikes, alongside better than expected economic data.

On the corporate side, Volkswagen and Michelin posted stronger than expected cash flow figures, while Ubisoft sank after cutting guidance and canceling six games.

Asia:

Asia was mixed, led by strength in South Korea and Taiwan on continued AI chip optimism and supportive commentary from NVIDIA leadership. Japan finished lower as markets focused on political uncertainty tied to an early February snap election, while bank shares faced pressure alongside the slump in Japanese Government Bonds (JGBs). In the middle of last week, Hong Kong losses were tempered by reports that Alibaba is preparing to list its chipmaking unit, while mainland China dipped as regulators tried to cool the rally.

Crypto Recap (January 18, 2026 - January 24, 2026)

Crypto had a rough week (January 19 to 25, 2026). Total market cap fell by roughly $100B, and volatility stayed elevated as macro risk and geopolitics dominated the narrative.

Bitcoin (BTC) sold off sharply, breaking below $88K and probing the $86K to $87K area in several reports. Spot Bitcoin ETFs saw heavy selling pressure too, with about $1.72B of outflows over a five-day streak. Sentiment sank into “Extreme Fear” territory, with traders also watching government shutdown risk closely, Polymarket odds climbed as high as 77% at points.

Ethereum (ETH) and major alts followed BTC’s weakness. Talk around staking ETFs and yield stayed alive, but risk appetite was clearly muted.

On the policy side, progress continued around US market structure efforts, including the CLARITY Act, with renewed focus on defining SEC and CFTC roles and moving away from regulation by enforcement. Traditional finance interest also kept building, with major players increasingly viewing stablecoins and tokenized assets as competitive threats, not side projects.

Other notable signals included Solana leaning into the “financial infrastructure” narrative, Nifty Gateway shutting down after earlier cycle highs, and token unlocks adding supply pressure into a weak tape.

Top crypto gainers (last week): RIVER, CC, MKR, KAIA, MYX, PAXG.

Here are other key crypto highlights from last week

Solana Mobile launched SKR token airdrop for Seeker phone users.

Grayscale files to convert NEAR Protocol Trust into ETF on NYSE Arca.

Toku launched global stablecoin payroll on Polygon.

This week will be on of the busiest weeks of the year!!

The market will likely swing around two catalysts, namely the Fed decision and big tech earnings.

Key U.S. economic releases ahead

Durable Goods Orders (Mon.)

Consumer Confidence (Tues.)

Richmond Fed Index (Tues.)

Fed Rate Decision (Wed.)

Jobless Claims (Thurs.)

Trade Balance (Thurs.)

PPI Inflation (Fri.)

Events to Watch

On Fed decision day (Wed), watch the reaction in dollar yields, the dollar itself, and mega cap tech. Those usually tell you quickly whether markets heard “steady policy” or “policy risk.”

Fed Speakers:

Fed Chair Powell speaks (Wed. 2:30 PM ET)

Earnings:

Focus stays on four of the Magnificent Seven. These include MSFT, META, TSLA (Wed. after the close) and AAPL (after Thurs. close). Investor attention is likely to center on AI spending, margins, and forward guidance. If these prints surprise, they can drag the entire index with them, especially in a week already loaded with macro risk.

Notable earnings releases are outlined in red below.

Action Plan: Pick 1 to 3 charts to follow, not 30. Write down your risk level before the Fed decision and before earnings. If you cannot explain your stop and your target in 1 sentence, you are probably overtrading.

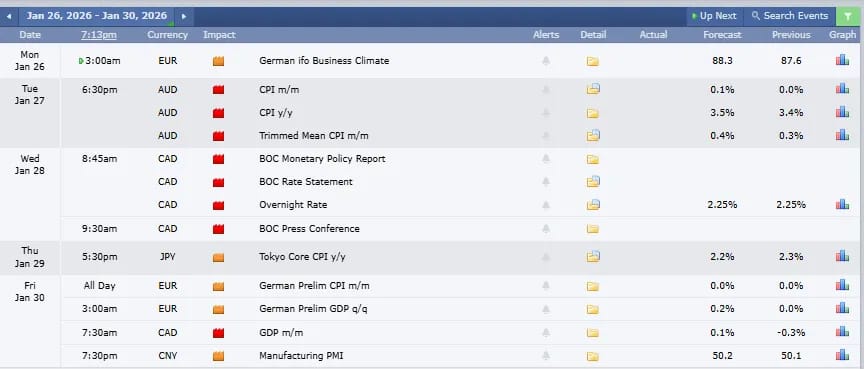

Medium-to-High Impact Global Economic Events This Week:

Tip:

To grow your portfolio without constant out-of-pocket deposits, use the "House Money" strategy: once a position gains 100%, sell exactly half to recover your initial principal. By harvesting your seed capital, you eliminate your downside risk and create a "free ride" on the remaining shares, allowing them to run indefinitely. This recovered cash can then be immediately rotated into a new setup, effectively recycling your capital to compound your wealth through diversification rather than new debt.

Week 1/18/26 - 1/24/26 Recap

Special Tools & Strategies

The State of Crypto in 2026: A Bullish Horizon with Key Trends Ahead

As January 2026 quickly comes to an end, the cryptocurrency landscape is thriving like never before. Imagine crypto as a maturing garden, after years of wild growth and occasional weeds (like market crashes), it's now blooming with institutional support, clearer regulations, and real-world utility. Bitcoin (BTC), the original powerhouse, has shattered previous highs, driven by a macro environment that favoured digital assets over traditional ones like gold. Total market cap hovers around $3 trillion, with inflows into crypto exchange-traded products (ETPs) reaching $34 billion in 2025 alone, signaling that big players like banks and pensions are finally planting roots. For beginners, this means crypto isn't just "internet money" anymore; it's becoming a staple in portfolios, much like stocks or bonds. People who have been in the space a while might note the reduced volatility. Notably, Bitcoin's price swings are taming, making it less of a rollercoaster and more of a steady climb, thanks to tools like spot ETFs.

Yet, challenges still linger. There are regulatory hurdles in some regions and energy concerns for mining. But optimism reigns. Ripple CEO Brad Garlinghouse predicts all-time highs this year, fueled by global adoption. Reports from Grayscale Research echo this, forecasting Bitcoin's new peaks in the first half of 2026 amid bipartisan U.S. policies. Key opinion leaders (KOLs) like @cryptofishx on X foresee an "alt season" in Q1, where smaller coins will surge, but warn of hype cycles fading.

Looking ahead, here are the top three projected trends for 2026.

Trend 1: Tokenization of Real-World Assets (RWAs)

Think of tokenization as turning everyday items like real estate or art into digital shares you can buy, sell, or trade instantly on the blockchain, like slicing a pie into easy-to-grab pieces. This makes investing accessible, so there is no need for big bucks to own a fraction of a luxury property. Expect explosive growth in tokenized stocks, private equity, and credit, potentially 10x-ing from $530 million today. BlackRock's 2026 outlook highlights tokenization as a core theme shaping portfolios, while SVB predicts record mergers and acquisitions (M&A) in this space. Look out for projects like Ondo and BackedFi leading the charge.

Trend 2: Explosive Growth in Stablecoins

Stablecoins are like the reliable anchors in crypto's stormy seas, pegged to stable assets like the U.S. dollar, they offer steady value for payments and savings. In other words, they're digital cash without bank fees, perfect for everyday use or earning yield. Circulation could triple to over $1 trillion by year-end, per Quartz analysts, with "yield wars" heating up as platforms like Ethena (ENA) offer competitive returns. Forbes notes stablecoin infrastructure as a must-watch, integrating into businesses for seamless global transfers. I envision them powering agentic money, enabling automated, machine-to-machine payments.

Trend 3: AI and Crypto Convergence

Picture AI as a smart assistant teaming up with crypto's secure networks to create "agentic" systems that trade, predict, or even run economies autonomously. This means smarter apps, like AI advisors suggesting investments based on your goals. This year, watch for AI-driven DeFi, privacy tools, and decentralized compute slashing costs by 50% versus traditional clouds. Bitwise predicts AI economies forming onchain, while Forbes sees crypto-AI trades mirroring each other. Keep an eye on decentralized ID as a big meta, blending AI with identity verification, but beware of the hype.

In summary, 2026 positions crypto as an empowering tool for financial independence, especially for those navigating wealth-building. Start small, diversify, and stay informed. Educating yourselves about the space before you invest is key. With these trends, the future looks inclusive and innovative.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

.jpg)