- Rhoda Report

- Posts

- “You're Not Behind!"

“You're Not Behind!"

Issue #165

Hi There! If 2025 left you raw, exposed, or exhausted… I wrote this for you.

When January 2025 came around, I walked into it with one mantra on my heart: starve the distractions and stay focused. I wrote about it in Issue #114, “Holding Space!” I truly thought that staying locked in would be the hardest part of the year.

However, the more I sat with myself last week, reflecting on this whole year, I was feeling a kinda way. At first, I figured it was because I did not cross off everything on my annual to-do list. Then I realized it was not disappointment or guilt. It was something else.

I felt lighter. I felt more exposed, like people could see straight into the heart of my soul. It took a minute, then I eventually figured it out. The point was never to complete every task. The point was to shed. How fitting too, because 2025 was the year of the Snake. This was my year of letting go of people, places, and things that did not serve me. In so doing, I shared more of my stories, the highs and the lows, and somehow that helped thousands across various platforms.

So, if you are reading this as the woman who had a rough year, I see you.

If you are exhausted and you have been carrying everybody, I see you.

If you know you need to be consistent in 2026 but you feel like you do not even know where to start, I see you (and read Issue #164)

And to the men reading this who love these women, thank you for being here. The best support is not fixing her. It is understanding what she is holding, and helping her protect her focus (and peace).

This final report for this year closes the loop for me. Life shifted and I adapted.

With that, here are the five of my biggest lessons from 2025 that I want you to carry with you into 2026.

Starve distractions like your future depends on it, because it does.

Not everything deserves access to you.

Shedding will make you feel exposed, and that does not mean you are failing.

Sometimes feeling lighter is the proof that it is working.

Acknowledge how far you have come.

Do not camp out on what you did not get done in 2025. Pay attention to what went right, and how bravely you handled what you did not expect.

Do not drag unfinished business into a new year out of guilt.

Create new for 2026, or build from what you did accomplish. Roll the small wins over and grow them.

You will not have all the answers, and you do not need them to move forward.

Trust that alignment is forming. Believe in what is unfolding. What you are moving toward will feel steady, supportive, and aligned with who you have become.

Thank you for another great year with me. And since we are closing out strong, here are the top two Rhoda Reports you all loved the most this year:

In 2026, I want to grow our Rhoda Report community even more, so please subscribe and encourage your friends and family to subscribe too. The more we grow, the more I can keep providing this content for free.

Finally, if 2025 was humbling, 2026 is going to demand something even bigger from you.

2026 does not need a new version of you. It needs a consistent one!

Alright, let’s dig in!

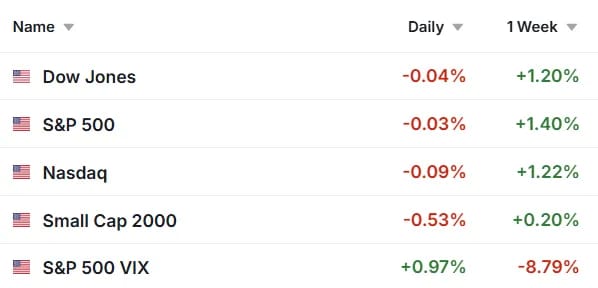

U.S. markets closed out the Christmas holiday shortened week on strong footing, with equities pushing to fresh record highs amid light trading volume. Major indexes advanced roughly 1.20% to 1.40%, supported by evidence that the U.S. economy maintained solid momentum into year end. Strong consumer demand, improving corporate profits, and fading trade policy headwinds reinforced investor confidence. While markets remain constructive heading into 2026, positioning reflected a growing preference for cyclicals and reasonably valued sectors as investors recalibrated expectations around interest rates and growth .

U.S. Markets Recap (December 21 - December 27, 2025)

Last week, U.S. equities rallied broadly. The S&P 500 gained 1.40%, the Nasdaq rose 1.22%, and the Dow Jones Industrial Average advanced 1.20%. The Magnificent 7 outperformed with a 1.70% gain, while volatility continued to compress, with the VIX falling 8.79%. Market leadership was balanced, signaling healthy participation rather than narrow concentration.

Equities:

Last week, sector performance showed strength across 10 of 11 sectors. Communication Services, Consumer Discretionary, Materials, Financials, and Technology each gained more than 1%. Consumer Staples was the lone laggard, declining 0.70%. The Fear and Greed Index climbed to 56 from 45, moving sentiment into the greed zone and reflecting improving risk appetite .

From a technical perspective, SPY maintained its uptrend, holding above key moving averages. Momentum improved with RSI near 61, suggesting strength without excessive speculation. Support remains near the 683 to 677 range, with deeper support closer to 665 if pullbacks emerge.

Fixed Income:

Treasury yields drifted modestly lower over the week. The 1 year yield declined to 3.48%, the 10 year yield eased to 4.13%, and the 30 year yield slipped to 4.81%. The yield curve movement reflected steady demand for duration as expectations for aggressive near term rate cuts softened. Markets now assign only a 17.7% probability to a January rate cut, down from 22.1% the prior week.

Commodities:

Commodities posted strong gains to close out the year. Gold surged 3.8% on the week, breaking above $4,500 for the first time, supported by geopolitical tensions, central bank demand, ETF inflows, and a weaker USD. Silver dramatically outperformed, rallying 14.4%, fueled by speculative flows and lingering supply constraints. Copper climbed 6.0%, driven by dollar weakness and structural demand tied to the global energy transition. On a year to date basis, gold is up roughly 70%, silver over 160%, and copper about 42%.

Currencies:

The dollar index declined 0.6% on the week, giving a boost to commodities and risk assets. Currency trading remained orderly, with no signs of stress despite lighter holiday volume.

Key pairs:

EUR/USD: +0.53%

GBP/USD: +0.90%

USD/JPY: -0.75%

U.S. Economic Recap (December 21 - December 27, 2025)

Economic data reinforced the narrative of sustained growth. The U.S. economy expanded at a 4.3% annualized pace in Q3, the fastest in two years, up from 3.8% previously. Consumer spending rose 3.5%, led by services such as healthcare and travel. Business investment increased 2.8%, with record spending on data centers and computer equipment highlighting continued AI infrastructure demand.

Corporate profits climbed 4.2%, the strongest gain of the year, while final sales to private domestic purchasers rose 3%. Core PCE inflation stood at 2.9% in Q3, still above target but consistent with gradual cooling. Forecasts for 2026 remain mixed, with growth expectations clustering around 2% .

Global Markets Recap (December 21 - December 27, 2025)

Europe:

European markets broadly tracked U.S. strength. France advanced plans to maintain government operations into early 2026 through a temporary rollover budget after lawmakers failed to pass a full fiscal package. Officials emphasized continuity and stability, reducing near term political risk despite ongoing negotiations over the 2026 budget.

Asia:

Japan stood out as a global bright spot. The government unveiled a record ¥122.3T initial budget for fiscal 2026, up 6.3% year over year. Defense spending will exceed ¥9T for the first time, while overall bond issuance will decline. Japan projects a primary budget surplus of ¥1.34T, its first in 28 years. Equity markets responded positively, with the Topix index up roughly 23% for the year, supported by fiscal stimulus, structural reforms, and improved corporate governance expectations.

Crypto Recap (December 21 - December 27, 2025)

Crypto sentiment deteriorated further, with fear dominating market psychology. The Crypto Fear and Greed Index remained stuck in “extreme fear” for the 14th consecutive day, ending Dec 26 at a reading of 20 out of 100. Notably, sentiment levels are now lower than those recorded during the FTX collapse in late 2022, even though Bitcoin is trading at roughly five times its price from that period.

The slide in sentiment has been unfolding since early October, when renewed U.S. China tariff concerns erased nearly $500B from the broader crypto market. More recently, anxiety around monetary policy has added pressure. Growing expectations that the Fed may pause rate cuts in Q1 2026 have weighed on risk appetite, with some market participants warning that Bitcoin could revisit the $70,000 area if rates remain unchanged.

Bitcoin is currently trading near $88,650, about 30% below its Oct 6 all time high of $126,080. Despite the price holding well above prior bear market lows, investor engagement has weakened. Even the search activity across Google, Wikipedia, and crypto focused forums has dropped sharply, signaling declining retail participation and reduced speculative interest.

The Fear and Greed Index reflects a combination of volatility, trading volume, social media sentiment, trend data, and Bitcoin dominance. Taken together, the data suggests crypto markets remain in a prolonged confidence reset rather than a panic driven liquidation phase.

Top crypto gainers (last week): MYX, M, ZEC, PIPPIN, CRV

Here are other key highlights from last week

Wall Street is using Ethereum without talking about Ethereum.

Clarity Act delays led to $952M in crypto fund outflows.

US lawmakers propose tax break for small stablecoin payments, staking rewards.

Pudgy Penguins brings NFT characters to Las Vegas Sphere during Christmas.

Polygon is a leading home for local non-USD Stablecoins.

This is another short, but interesting week!!

Key U.S. Economic News:

Pending Home Sales m/m (Mon)

FOMC Meeting Minutes (Tues)

Unemployment Claims (Wed)

Fed Speakers:

FOMC Member Paulson: Scheduled to participate in a panel titled Lifetime Experiences and Implications for Monetary Policy at the Allied Social Science Associations Annual Meeting in Philadelphia. Any commentary touching on inflation persistence, employment trends, or policy flexibility could influence market expectations despite the holiday backdrop.

Earnings:

No earnings releases this week due to the holidays, keeping the focus squarely on macro developments rather than corporate fundamentals.

Medium-to-High Impact Global Economic Events This Week:

China PMI (Tues)

Tip: The “Set and Forget” Strategy

To kick off 2026, embrace a "Set and Forget" strategy by automating your Dollar-Cost Averaging (DCA) into broad-market index funds to navigate potential market volatility without the stress of timing. Your priority checklist should include rebalancing your portfolio to your target risk level, increasing your contribution rate by at least 1%, and updating your accounts for 2026 IRS limits. Above all, prioritize consistency over timing, remembering that steady "time in the market" is the most reliable path to long-term growth.

Week 12/21/25 - 12/27/25 Recap

Special Tools & Strategies - 2025 Market Recap

Well, this year the markets was certainly full of surprises. I remember a friend asking me about the price of Bitcoin and me saying it was going to hit $125K, and if that held, it would go to $150K. Well, the latter did not hold. I am not complaining. One thing I have learnt over the years in these markets, and what I stress to traders I help, is trade what you see when you open up those charts, not what you think the markets will do, or holding onto a bias while watching the markets move against you. Those who listened are smiling all the way to the bank as they close off the year.

1) Stock market recap for 2025

2025 delivered a third straight year of strong gains, driven by two big forces, namely the AI buildout and the “debasement trade” into hard assets.

Major index performance (2025):

S&P 500: up about 17.4% to 18%, with 39 all time highs. It briefly flirted with bear market territory in April, then rebounded hard.

Nasdaq: up 21.6%, the leader, pulled higher by AI infrastructure and software demand.

Dow Jones: up 13.9%, steady but slower than the tech focused Nasdaq.

Russell 2000: up 13.0%, with small caps participating more as the rally broadened later in the year.

The year’s “mood swings” were real:

April turbulence: Trade policy uncertainty shook confidence and spiked fear fast.

Then a grind higher: Once that air cleared, dip buyers showed up again and again.

Big trends and sector performance:

AI did not stay “just chips.” The market’s attention moved from flashy headlines to the plumbing behind AI, meaning data storage and even nuclear power as an energy source for data centers.

Hard assets dominated the hedge trade. Gold gained about 64% to 70%, broke $4,000 in October, and reached record highs near $4,550.

Oil did the opposite. Crude fell about 22%, sliding from roughly $73 to around $57 to $60 a barrel.

Volatility cooled by year end. The VIX fell about 24%, even after a major April spike, as traders got comfortable buying short lived fear.

Winners and losers (real examples):

Top performers: Data storage names led the tape, including SanDisk up 569.6%, Western Digital up 292.3%, and Micron up 228.7%.

Biggest losers: Retail and healthcare struggled. Fiserv fell 70.3%, The Trade Desk fell 66.8%, and Lululemon fell 51.7%. Even global timber names like West Fraser Timber fell 35%, pressured by new tariffs.

Magnificent Seven reality check:

These giants still accounted for over 40% of the S&P 500’s total returns through Q3, but they did not move as one pack. Nvidia gained 37.8%, Alphabet rose over 65%, while Amazon gained about 5.6% to 6.6%, and others landed in between.

2) Crypto market recap for 2025

If stocks were a steady climb after April, crypto was more like a reset with sharp detours.

A key theme from the year end data: 2025 was not a broad crypto bull run. Bitcoin finished down about 6.3% year to date after tagging a fresh all time high near $126,000, and Ethereum was down about 11.9% year to date after a new high near $4,946.

What moved crypto in 2025:

ETFs and institutions mattered, but did not save everything. US spot crypto ETF inflows were meaningful: BTC +$21.66B, ETH +$9.72B, XRP +$1.14B, SOL +$755.78M.

Regulation tightened, fast. The report highlights a US push that included an executive order to launch a Bitcoin Reserve using 200,000 forfeited BTC, a federal stablecoin framework via the GENIUS Act, and faster ETF approvals with review windows cut to 75 days.

Security and leverage reminded everyone who is boss. The year included a $1.4B ETH hack at Bybit and a major deleveraging event that liquidated over $20B in positions, followed by Binance paying $283M in compensation tied to depegging issues.

Narratives got punished. Several layer 1 and layer 2 tokens finished deep in the red, and “hot” themes like AI tokens saw heavy drawdowns.

Sentiment ended cold. The Fear and Greed Index sat at 23, extreme fear in the year end snapshot.

And NFTs in 2025: the hype phase cooled

NFTs did not get a Santa rally. The sector’s valuation fell to about $2.5B in December, down 72% from $9.2B in January, with fewer buyers, sellers, and transactions as liquidity thinned.

Zooming out, NFT sales in Q1 were $1.5B, down 63% year over year, and November sales dropped to $320M from $629M in October.

The bright spot: NFTs started acting less like lottery tickets and more like membership tools. Examples included FIFA ticket “Right to Buy” tokens priced at $999 selling out, plus real world collectible backed NFT activity where Courtyard processed 230,000+ transactions and about $12.7M in sales in 30 days.

3) Key lessons from 2025

What worked:

Buying quality trends with real demand behind them (AI infrastructure and data storage).

Treating volatility spikes as events, not identities. April fear did not last forever.

In crypto, respecting liquidity and structure. ETFs, regulation, and hacks all shaped the tape.

What did not work:

Chasing headlines without a plan.

Assuming “the whole market” will rally together, especially in crypto.

Ignoring risk controls during leverage flushes.

What to watch going forward:

Whether the AI buildout broadens further beyond big tech.

Whether crypto regulation and ETF expansion brings steadier participation, or just bigger rotations.

Risk note: Markets can move fast and losses are part of trading. Never risk money you cannot afford to lose, and always size positions so one bad week does not wipe out your account.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

.png)