- Rhoda Report

- Posts

- “Your Financial Runway: The Key to Retirement!”

“Your Financial Runway: The Key to Retirement!”

Issue #154

Hi There! I remember the exact afternoon when early retirement stopped being a fantasy and started to feel real. It wasn’t during a big trip or a financial seminar. Rather, it was right at my kitchen table, staring at a spreadsheet that refused to balance. For years I thought freedom meant hitting a certain number in my savings account. On that day, however, I realized the number meant nothing if I didn’t understand how my lifestyle fit into it.

Maybe you’ve had that same moment. You start thinking about stepping away from your career or building a slower life, but then your mind jumps to one question:

How will I afford it?

That’s where I began too.

Before I left my cushy engineering job, I had to get very honest about the kind of life I wanted. I was chasing peace (and flexibility). I wanted time to travel, to be with family, to train for my powerlifting meets, tor analyze the charts, and to not have to deal with long commutes and traffic. I also had to face the realities: gym memberships, equipment, flights, groceries, health insurance, and my usual bills; all these things added up.

So, the first step was simple: I wrote down everything that defined my version of a calm and meaningful life. This list eventually became the basis for what I refer to as my “Financial Runway.”

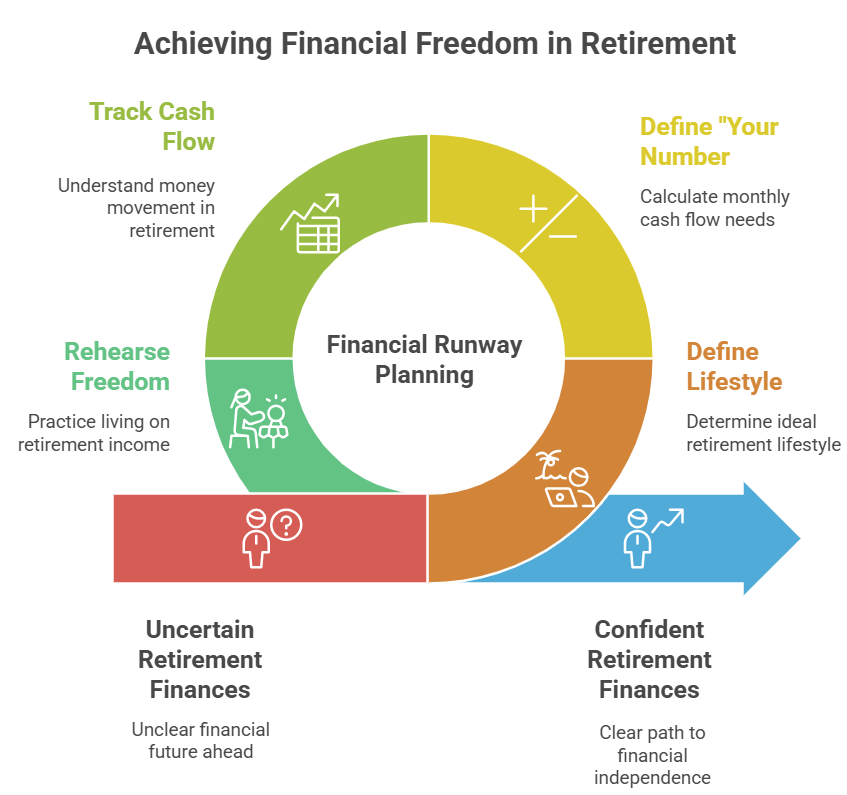

Step 1: Know Your Lifestyle

Start by asking yourself, What does my ideal day look like? A life that feels fulfilling.

Do you want to work part-time? Travel twice a year? Move closer to family?

Your answers shape your budget far more than any retirement calculator ever will.

Once I realized I was designing a lifestyle and not chasing a dollar figure, I planned more confidently.

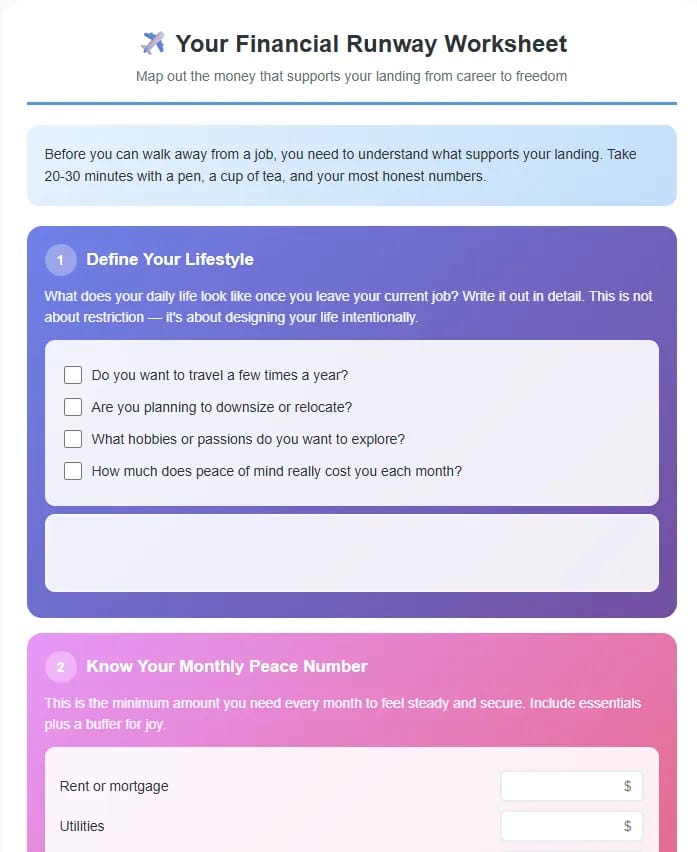

Step 2: Define “Your Number”

I used to think “my number” meant how much I needed to retire forever. Now, I know it’s about cash flow. How much money do you need each month to live comfortably, without anxiety?

Here’s how I broke it down:

Net Worth: I listed what I owned (home equity, savings, retirement accounts, investments) and subtracted what I owed (credit cards, car loan, student loan). Seeing that total gave me perspective. I had a place to start from minus the guilt.

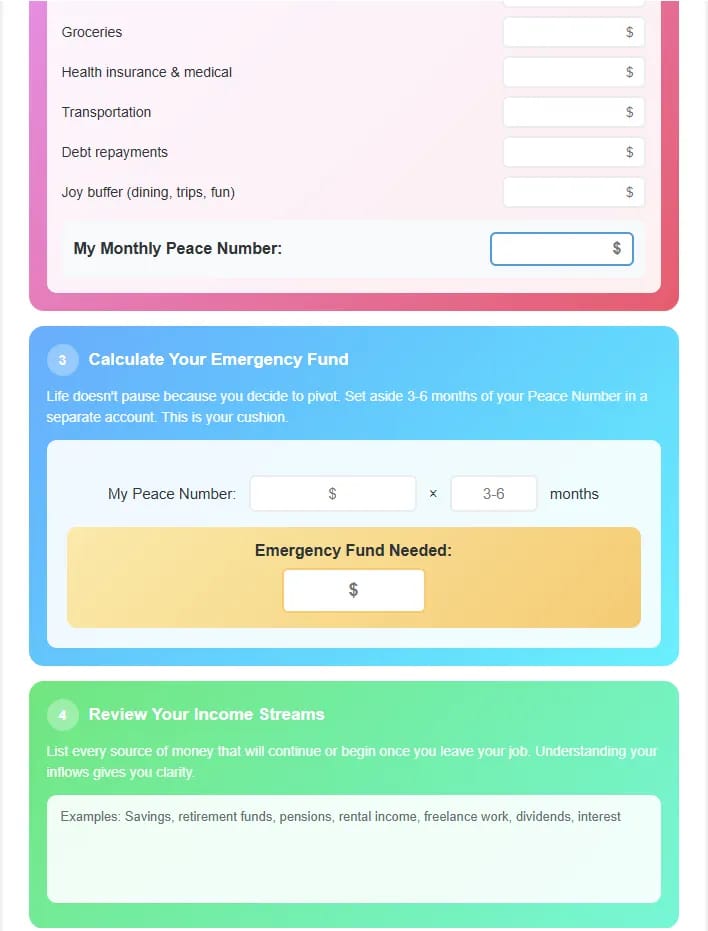

Peace-of-Mind Budget: I figured out the minimum amount of money I needed each month to cover essentials like housing, food, transportation, healthcare, gym fees, investing, an allowance for fun, and so on. This number became my “peace number.”

Emergency Fund: I set aside enough to cover at least five months of living expenses. That cushion gave me breathing room and confidence that if something unexpected happened, I wouldn’t crumble financially.

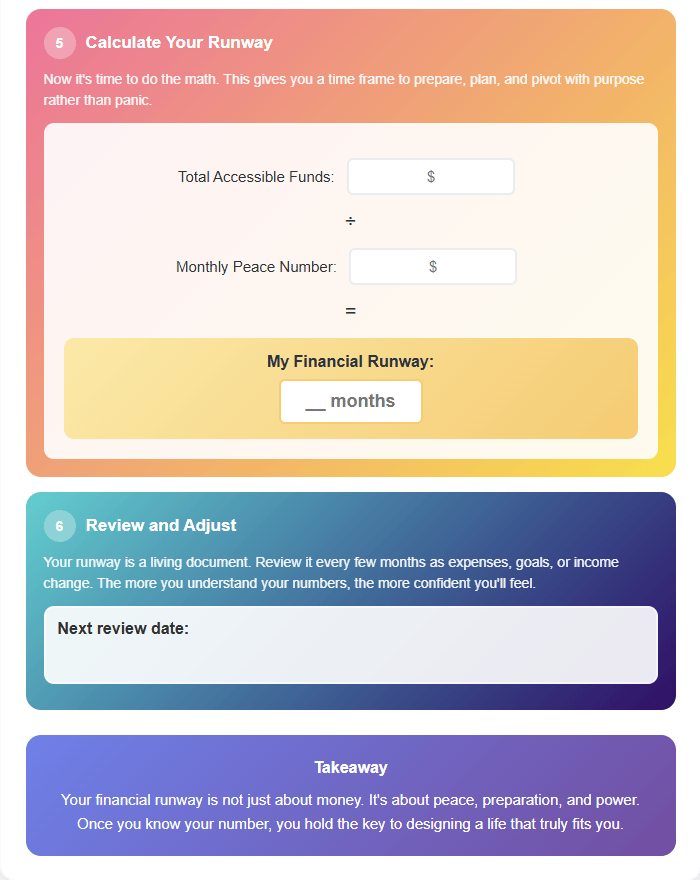

When you add these together, net worth, peace number, and emergency cushion, you get your financial runway. It’s the space between where you are and where you want to go.

Step 3: Track the Flow, Not Just the Savings

This is where most people get stuck. They focus on building a mountain of savings but never think about how their money will move once they stop working full-time. After trial and error, I learnt that the financial freedom everyone talks about all boils down to an understanding of your flow. If your cash flow covers your lifestyle, you’re already closer to independence than you think.

Step 4: Rehearse Your Freedom

Once I had my numbers, I practiced living on them for a few months before leaving my job. I pretended that I was already retired with no side bonuses, no extra overtime, and seeing if I could make it work. It was eye-opening. I found where I was overspending and where I could adjust without feeling deprived. It was humbling, yes, but it also gave me proof that my plan could work.

In this week’s Special Tools and Strategies section, you’ll find the “Financial Runway Worksheet.” It will walk you through the same process I used to plan my exit: calculating your monthly peace number, mapping your resources, and identifying the gaps to fill before you take the leap (retirement or career change or life change).

Remember, you can’t copy someone else’s retirement plan. You have to build your own. One spreadsheet, one honest conversation, and one decision at a time.

Next week, I’ll tell you what happened when the excitement of freedom faded and the emotional weight of walking away hit me harder than expected.

For now, if you haven’t already, take the first step. Figure out your lifestyle, calculate your number, and give yourself the runway to dream responsibly.

Alright, let’s dig in!

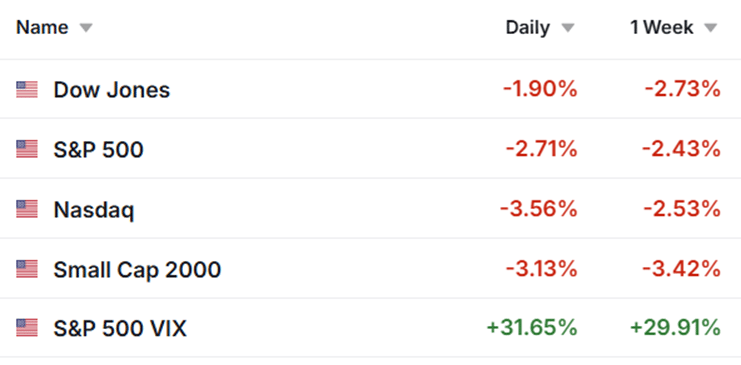

Last week stocks ended lower after a late selloff that was reignited by tariff concerns and memories of past trade war volatility. What began as a quiet, catalyst-light week turned chaotic on Friday when renewed U.S.-China tensions shook investor confidence. President Trump’s threat to impose new duties on Chinese goods sent the S&P 500 and Nasdaq to their steepest single-day drop since April. The decline wiped out earlier gains that were fueled by optimism around fresh AI partnerships and strong early earnings reports.

U.S. Treasuries rallied as investors fled to safety, while the dollar strengthened on global uncertainty. Commodities broadly declined after a ceasefire in Gaza and new trade war headlines shifted capital toward defensive assets. Overseas, markets wrestled with political turmoil in France and Japan’s surprise leadership shake-up.

U.S. Markets Recap (October 05 - October 11, 2025)

Equities:

Major indices traded lower for the first full week of October as renewed trade tensions dominated sentiment. Early optimism faded after President Trump said there was “no reason” to meet with China’s President Xi following new Chinese export controls on rare earth minerals. The CBOE Volatility Index (VIX) spiked above 21, signaling a sharp shift in market mood.

Source: investing.com (after market closed on 10/10/25)

AI optimism provided a temporary boost, with notable corporate news driving isolated gains.

AMD (AMD) surged nearly 24% after announcing a landmark partnership with OpenAI, granting the ChatGPT maker a potential 10% stake in the chipmaker. The deal includes a rollout of six gigawatts of AMD’s Instinct GPUs, starting with 1 GW in late 2026.

Analysts forecast AMD’s revenue to grow from $25.8B (2024) to $68.5B (2028), and earnings per share from $3.31 to $11.62. Of 44 analysts, 28 rate “Strong Buy” and 14 rate “Hold.” The average price target stands at $194.64, with a high forecast of $300 by Barclays.

NVIDIA (NVDA) also gained early in the week after CEO Jensen Huang confirmed strong demand for the company’s Blackwell chips. The U.S. government’s approval of several billion dollars’ worth of chip exports to the UAE added to the positive tone.

Delta Airlines (DAL) and PepsiCo (PEP) jumped on upbeat earnings and improved forward guidance, signaling that early Q3 reports may surprise to the upside.

Fixed Income:

Core bonds rose as the Bloomberg Aggregate Index reversed early weakness. Investors shifted toward safety following the tariff escalation and political unrest abroad.

In France, Prime Minister Sebastien Lecornu resigned less than a month after taking office, forcing the government to miss its budget deadline and raising concerns over fiscal instability. French 10-year yields climbed above Italian equivalents for the first time since 1999.

In Japan, the selection of Sanae Takaichi as leader of the ruling LDP boosted expectations for policy change. Her remarks suggesting government involvement in monetary direction pushed 30-year Japanese government bond yields higher.

With France and Japan both major holders of U.S. Treasuries, rising home-market yields could pressure U.S. rates to remain elevated as global investors demand higher returns for long-term bonds.

The Commodities complex declined overall last week.

Crude oil (WTI) eased as a U.S.-brokered Gaza ceasefire reduced the geopolitical premium embedded in prices. Oversupply fears resurfaced despite a smaller-than-expected OPEC+ output hike.

Gold briefly topped $4,000/oz before retreating on lower geopolitical risk but regained support amid tariff news and political uncertainty.

Silver gained modestly, while copper declined due to U.S.-China tensions.

Currencies:

The U.S. dollar gained broadly on safe-haven flows before easing late last week.

EUR/USD: +0.48%

GBP/USD: +0.41%

USD/JPY: -1.23%

U.S. Economic Recap (October 05 - October 11, 2025)

Tariffs dominated the discussion in the latest Federal Reserve minutes. Policymakers agreed that trade restrictions would keep inflation elevated through 2027, delaying the path back to the 2% target. Fed Governor Miran dissented, advocating for a 50-basis-point cut instead of 25, citing a weakening labour market. Futures markets now price in two additional rate cuts before year-end, followed by a pause in January 2026.

Consumer data pointed to renewed anxiety.

The New York Fed survey showed one-year inflation expectations rising from 3.2% to 3.4%, the largest jump since spring.

Five-year expectations ticked up to 3.0%, suggesting consumers doubt inflation will normalize soon.

The University of Michigan’s October sentiment index fell to 55, its lowest in five months, with 63% of respondents expecting higher unemployment over the next year.

Buying conditions for durable goods hit their weakest level since 2022, citing high prices and new import tariffs.

Global Markets Recap (October 05 - October 11, 2025)

European Markets finished lower as France’s political turmoil deepened. Prime Minister Lecornu’s resignation and failure to form a majority coalition weighed heavily on investor confidence. President Macron’s 48-hour deadline for negotiations failed to calm markets, pushing equities down before a late-week rebound on news that a new Prime Minister would soon be appointed. Defense stocks also fell following the Gaza ceasefire announcement.

Asia Markets delivered a mixed performance:

Japan rallied early on expectations that Sanae Takaichi’s leadership would usher in pro-growth policies but trimmed gains after the ruling coalition fractured.

Hong Kong fell over 3% as tech stocks retreated.

Mainland China slipped modestly, while Taiwan advanced and South Korea gained on reopening Friday.

Crypto Recap (October 05 - October 11, 2025)

Last week was a turbulent one for digital assets.

Bitcoin (BTC): -7.68%

Ethereum (ETH): -13.99%

Last Week’s Top Gainers: COAI, SNX, ZEC, DASH, TAO

A record $19 billion in leveraged positions was liquidated within 24 hours following the new U.S. tariffs on China. Bitcoin fell from above $125,000 to below $113,000, marking one of the most volatile 24-hour periods in crypto history. U.S. spot BTC ETFs still recorded $2.71 billion in inflows, underscoring sustained institutional interest despite short-term panic.

Ethereum mirrored the carnage, sliding nearly 30% from peak to trough before stabilizing. Institutional holdings in ETH ETFs and corporate treasuries now exceed 12.48 million ETH (10.31% of supply), indicating that long-term accumulation continues. Meanwhile, the Ethereum Foundation launched a 47-member Privacy Cluster and the Kohaku wallet SDK roadmap, signaling a stronger focus on native privacy and modular stack development.

Analysts remain split on crypto’s long-term role.

Deutsche Bank projects that Bitcoin and gold may form part of central bank reserves by 2030 as the dollar’s global share drops to 41%.

JPMorgan, however, believes the expansion of stablecoins could strengthen dollar demand, potentially adding $1.4 trillion in liquidity by 2027.

This divergence reflects Bitcoin’s evolution as both a risk asset and an emerging monetary hedge.

Here are other key highlights from last week:

Binance paid $283M following Friday's depegs to cover user losses.

Bitcoin (BTC) Mining firm Marathon (MARA) scooped up 400 BTC after crash.

The internet's most important real estate is being left behind

Polygon launched major payments upgrade that is faster, lighter, & easier.

This is another busy week in the markets!!!

Key U.S. Economic Releases this week:

NFIB Small Business Index (Tuesday)

NY Fed Manufacturing Index (Wednesday)

Philly Fed Manufacturing Index (Thursday)

NAHB Housing Market Index (Thursday)

Note: The ongoing U.S. government shutdown may delay several key data reports, including the Consumer Price Index (CPI), now rescheduled for October 24.

Fed Speakers:

This week’s lineup includes remarks from Chair Powell (Tues. 12:20 PM), Governor Bowman (Tues. 8:45 AM), and multiple appearances from Governor Miran (Wed. and Thurs.). Markets will be watching for any commentary on tariffs, inflation timelines, and rate path adjustments.

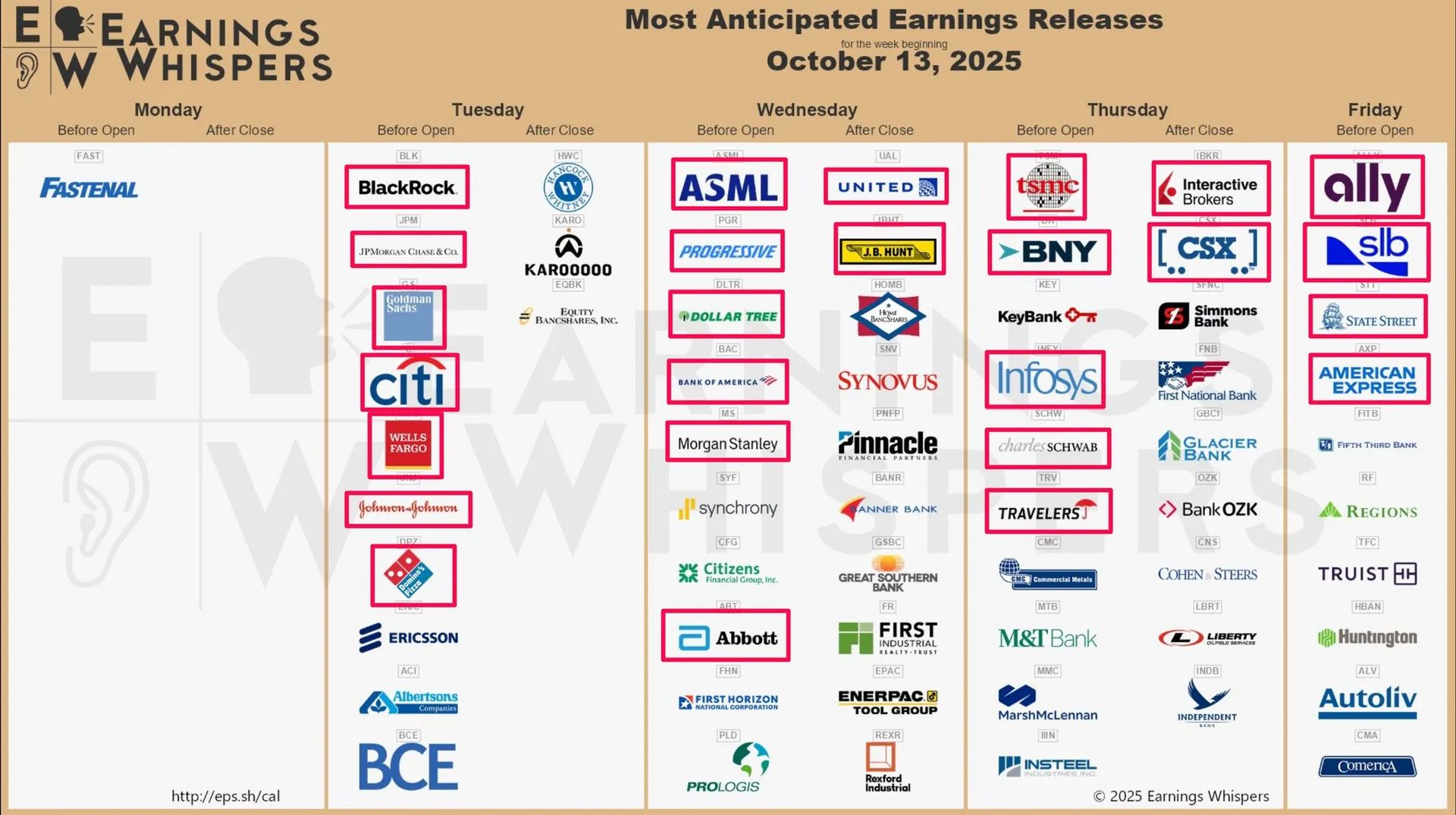

Earnings:

Big banks lead Q3 earnings this week:

Tuesday: JPMorgan, Goldman Sachs, Wells Fargo, Citi

Wednesday: Bank of America, Morgan Stanley

Analysts expect 6% profit growth across major institutions, driven by sustained investment banking and trading strength.

Other key names include ASML and TSMC, which will set the tone for semiconductor earnings.

Notable Earnings Releases are outlined in red in the cart below.

Medium-to-High Impact Global Economic Events This Week:

IMF–World Bank Annual Meetings (Oct 13–18, Washington D.C.): Focus on global debt distress, World Bank reforms, and job creation.

Middle East Peace Accord: World leaders convene in Egypt following a ceasefire between Israel and Hamas.

Ukraine-Russia Conflict: Ongoing energy and infrastructure attacks continue to weigh on European supply chains.

U.S.–China Trade Tensions: Markets remain volatile as both sides harden their stances on tariffs and export controls

Other key global economic events are shown in the chart below.

Tip: Don't Rely on One Retirement Account

If all your retirement money sits in an IRA or 401(k), you're limited by withdrawal rules, penalties, and required minimum distributions. Consider opening a taxable brokerage account as a bridge fund. You can set up automated withdrawals without age restrictions or penalties, giving you flexibility if you want to retire before 59½ or need extra cash between Social Security and your retirement accounts kicking in. This creates a three-bucket strategy: tax-deferred accounts for later, Social Security for stability, and a brokerage account for early retirement flexibility.

Week 10/05/25 - 10/11/25 Recap

Special Tools & Strategies - Your Financial Runway Worksheet

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

.png)